Most governments in advanced economies have been unable to deliver on debt sustainability for the last decades. In some cases increasing spending is not matched by their ability to find additional sources of revenues, in other cases taxes have been reduced without the corresponding reduction in spending. And it will only get worse going forward as worsening demographics will put enormous pressure through the corresponding increase in spending.

As we can see in the US presidential race, solutions are not easy to find. Everyone talks about finding a sustainable path for the government debt but details on how this will be achieved are difficult to find. This is probably more obvious in the case of Mitt Romney and his promise to cut taxes. This is only compatible with debt sustainability if you find enough spending items in the budget to cut, but that is where the difficulty lies. Societies ask governments to provide certain services that are considered to be necessary. Yes, we can make governments more efficient and eliminate some unnecessary bureaucrats but when you look at the numbers, this is not going to be enough – in some cases there is very little margin to reduce spending if you just follow that route.

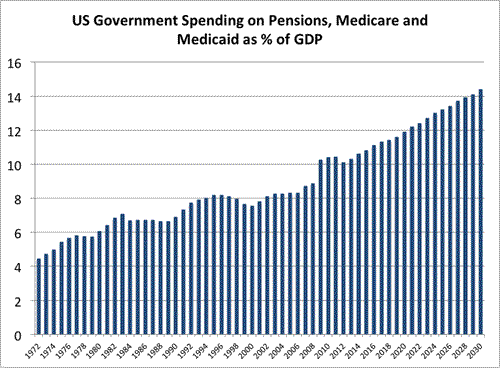

Here is a picture from the US that makes this point as clear as possible. Government spending on pensions and healthcare (medicare and medicaid) from 1972 until today and then extrapolated to 2030 (source: Congressional Budget Office).

(click to enlarge)

What is striking about this picture is not so much the shape but the magnitude of the increase. From 4% of GDP in 1972 to about 10% today and reaching 14% in 2030. This is measure as % of GDP (not % of government spending). In the absence of a reduction in spending in some other budget items, this has to be met by increasing revenues (taxes) by a similar amount.

This looks like an impossible task. But let’s try to look at it from a different angle to see if we find a solution. Forget about governments, imagine a world where all goods are purchased by the private sector (e.g. you pay for your own healthcare). Because of changes in taste, income and technology, we continue spending more on certain sectors (such as healthcare). We have satisfied all our basic needs (food, housing), our income keeps increasing and there is a technology out there that allows us to live healthier and longer so we choose spending more on it. Sectoral changes in the composition of our spending are not rare. How visible is the above trend if we look at consumer expenditures? Do we also see a large increase in healthcare spending in the private sector? And, more interestingly, are there other components that are going down at a similar speed to ensure that budgets are not overstretched?

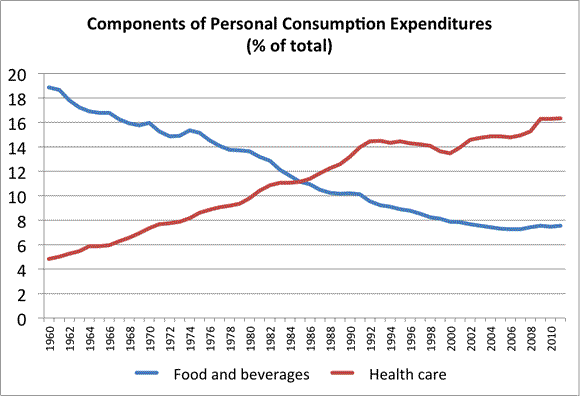

Here is a quick look at Personal Consumption Expenditure by type of good (Source: Bureau of Economic Analysis). I picked the sectors that have moved the fastest and I particularly looked for two moving in opposite directions.

This is what you find: Healthcare is the fastest growing component and has gone from 4% in 1960 to 16% today (this is measured as % of the total expenditures). The component that follows the opposite trend and almost by the same magnitude is Food and Beverages. From 18% down to 8%. So we spend less in food and beverages to be able to afford the increasing cost of going to the doctor more often and enjoying a healthier and longer life.

In some sense we expect governments to do one of these two things:

1. Either they find some spending in their budget that we do not want anymore and they reduce as fast as healthcare and pensions public spending is increasing.

2. Or they do simply pass the bill to the private sector (you will need to pay for those doctors). But if they do so, then the private sector will need to find something else to cut.

What we have seen is that #1 is not obvious. There are not that many things that governments do that we do not want them to do. And #2 is exactly what politicians do not want to do (and we do not want them to do it), to pass the bill to us in the form of higher taxes – and I am ignoring here the question of who exactly gets the bill. So we end up with debt levels that keep increasing and will do so until we find a way to deal with long-term sustainability of government finances that is very different from what we have done in the past.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply