This was another week when everybody but me sees an economic recovery in the works.

Certainly Thursday’s report of a 0.1% decline in U.S. retail trade and food services sales for July was a disappointment. Dan Greenhaus explains why he found the number startling:

The cash for clunkers program was expected to have had quite an effect on retail sales. However motor vehicle and parts rose only 2.4%; expectations had looked for a gain more than double. Sales at auto and other motor vehicle dealers were up just 2.8%, a healthy gain to be certain but far less than many economists expected. The initial impression is that, perhaps, some of the cash for clunkers sales will find their way into the August data.

The auto numbers are indeed surprising, since we know directly from industry counts that the number of autos sold in the U.S. was up 16% in July. I’m wondering if the reason that didn’t show up in the retail sales report may be due to the definitions used by the Commerce Department:

Sales are net, after deductions, of refunds and allowances for merchandise returned by customers. Sales exclude sales taxes collected directly from customers and paid directly to a local, state, or federal tax agency.

Though I haven’t seen a direct statement on this, if sales exclude taxes, they should also exclude subsidies, meaning if someone bought a $20,000 new car with a $3,500 cash-for-clunkers trade-in, Commerce may have counted that as $16,500 in sales. Perhaps the basic message from these numbers is that the government was willing to spend money in July, but nobody else was.

The one solidly positive U.S. economic indicator I’ve seen was the report from the Federal Reserve that U.S. industrial production was up 0.5% in July, the first monthly increase since December 2007. Capacity utilization was also estimated to have risen to 68.5% in July, the first increase for that measure since October 2008. However, Dean Baker is worried that most of the increase in production came from the auto sector. My read on this therefore remains as it was on August 4:

If we’d seen these kinds of numbers in the absence of the cash for clunkers incentives, I would have viewed it as a strong suggestion that the economic recovery has begun. As is, I’m left wondering, and fundamentally not knowing, whether the auto figures signal the shift we’ve all been watching for, or sales stolen from September and October and delivered to July.

The economic recovery may well have already begun in Asia and Europe, and certainly the mechanics are in place for significant improvements in U.S. real GDP even without any changes in the underlying fundamentals. However, I remain persuaded that a real U.S. recovery requires an increase, nor further decreases, in the number of Americans working.

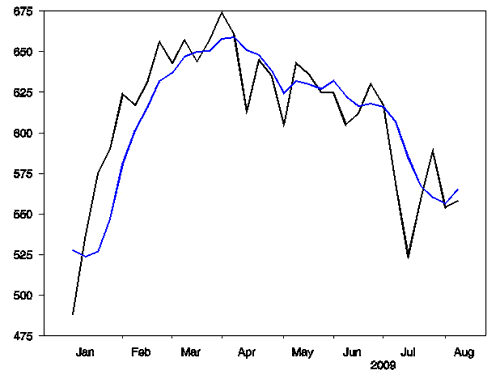

Thursday’s modest bump up in the 4-week average of initial claims for unemployment insurance suggests to me that that goal is a little farther away now than it was a week ago.

Seasonally adjusted weekly new claims for unemployment insurance (black line) and 4-week average (blue line) so far this year.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply