A week ago I cut a EURUSD short position that was well into the money. (Link)I was concerned that “something” might happen that could make a mess. I listed a number of concerns that might have caused a flip-flop, but Mario Draghi talking, was not on my list. Of course, that is precisely what happened.

I’ve read what Mario said a number of times, I think there is no substance to his words.

“The ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”

I’m reminded of an article I wrote more than two years ago titled, Sarkozy Will Get “Stuffed” (link). The occasion was a stupid remark made by then French President Nicholas Sarkozy regarding some new measures that would, once and for all, end the run on the bond markets of Europe:

“We will confront speculators mercilessly. They will know once and for all what lies in store for them.”

This didn’t work out so well for poor old Sarko. The speculators ended up crushing him, and he lost his job. Draghi will suffer the same result. Mario must be saying to himself,

“If only I can just get the Spanish Ten-year back to 6%, all will be well again”

I think he’s nuts. Spain’s problem is its competitiveness. The domestic economy will never recover without a currency devaluation (and debt restructuring). If Mario has his way, Spain will suffer from a decade of recessions with unemployment over 20%. How could he possibly call that outcome a success? On Friday we got some clarification of what exactly Draghi has up his sleeve when he promised, “It will be enough”. From Bloomberg:

DRAGHI’S PROPOSAL SAID TO INCLUDE BOND BUYS, RATE CUT, NEW LTRO

Bond buys? Rate cuts? New LTRO? That’s Draghi’s bazooka? These things have been tried in the past and have failed. These steps might buy the EU a few weeks (or hours?) of market relief, but they have no chance of turning the EU around.

There is still a market-based system that exists in the world of central bank manipulation. In the end, market forces always prevail. The outcome for the Euro will be no different. Draghi thinks he has the power to thwart the markets. He does not have that power. Draghi is either bluffing or lying, that or he is a blind as a bat.

FX Note:

An interesting outcome of the Draghi comments is that the Euro ended the week north of 1.2300 (up 1.5%). Whatever chance the EU may have, it is dependent on a weaker Euro exchange rate. In my book, Mario’s words have set the EU back, not forward. A week ago I swore I would be out of FX until we got into late August. The silliness of the last few trading days changed my mind. I bet all of my recent FX gains on a short EURUSD option strategy. I missed a big blip that got the Euro above 1.2400, and ended up with a fill a bit over 1.2300.

My thinking is that someone in Germany is going to say:

“Sorry Mario, you can’t have our cake and eat it too.”

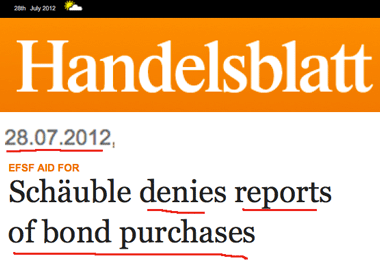

As if on cue, this article appeared in Germany’s Handelsblatt yesterday:

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply