With President Obama pledging that health care reform must be deficit-neutral, new revenue sources will be necessary so that the extension of health insurance to the millions of uninsured will not add to annual federal budget deficits (and, cumulatively, the national debt).

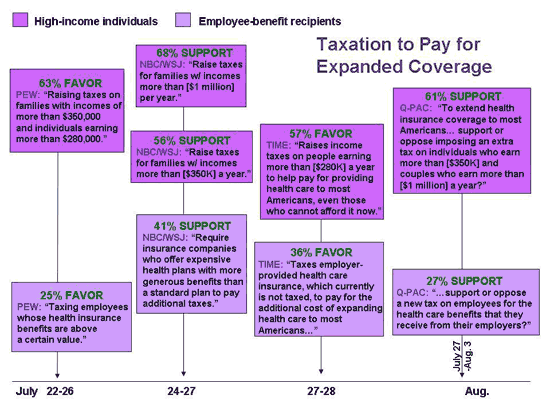

Among the proposals to add revenue, two of them are tax increases on upper-income Americans and treating the health-insurance benefits many Americans receive from their employers as taxable income (generally, the latter proposal has been restricted to employees with particularly generous “gold-plated” health plans). The diagram below (which you can click to enlarge) focuses on the four polling firms that asked about both an upper-income and employee-benefits tax.

Upper-income tax increases have clear majority support, from 56-68 percent. According to an article from earlier this summer, “House Democrats are considering a $544 billion tax on families that earn more than $350,000 a year, but [Speaker Nancy] Pelosi wants to raise the income threshold to $1 million for joint filers.” The NBC/Wall St. Journal poll asked about both of these income levels and Pelosi’s proposal indeed draws additional support; the NBC/WSJ item on setting the threshold for new taxes at a million dollars also draws higher support than other firms’ items on higher-income taxes.

Treating employee health-insurance benefits as taxable income, on the other hand, is not very popular. Even when the survey item alludes to only health-insurance plans above a certain monetary value being taxed (Pew), support is very low. The NBC/WSJ item draws 41% support, but it refers only to insurance companies being subjected to higher taxes (presumably companies’ added tax liabilities would be passed on to beneficiaries).

Just to mention a couple other polls that didn’t ask both the high-income and employee-benefits questions, in late July the CBS/New York Times poll found 65% support for the item, “In order to help pay for health care reform, would you favor or oppose increasing taxes on Americans with high incomes?” Also, back in May, Rasmussen polled on various tax options, including the employee-benefits one.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply