Last week, U.S. Global’s Tadas Misiunas and I spent some time with financial advisors from Florida, providing an update on natural resources investments. Many asked why global resources were significantly lagging the overall S&P 500 Index. Over the past year, there’s been an extreme disparity between the sector and the overall market: As of March 31, 2012, the Morgan Stanley Commodity Related Equity Index had a one-year return of 15 percent while the S&P 500 Index gained more than 8 percent over the same period.

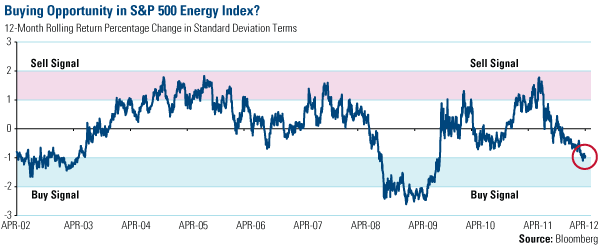

Here’s a different way of showing how energy stocks have lagged. The chart below shows the 12-month rolling return percentage change of the S&P 500 Energy Index. Over the past 12 months, energy stocks have declined so dramatically that it now registers a “one-sigma event” in standard deviation terms. Historically, this has occurred only 18.5 percent of the time in the past 10 years. There were only two episodes when performance was worse on a one-year rolling basis: during the 2002–2003 period and during the global financial crisis in 2008-2009 when the U.S. was in a recession.

I continue to be amazed at the underperformance in natural resources stocks when you look at certain equities in the S&P 500. The most dramatic example is Apple (AAPL). Over the past decade, its stock price has climbed substantially. I recently discussed a Financial Times article that showed a potential investment of $399 in Apple shares in November 2001 would have been worth $26,000 in March 2012.

Today, Apple’s market capitalization has grown to around $550 billion, which is higher than the market cap of all of the utilities companies in the S&P 500 and higher than all of the S&P 500 materials companies.

There’s no doubt Apple has quality products and is a great company—our funds have benefited from holding shares. Apple’s products are quickly becoming as common as a toaster, with a survey by CNBC finding that half of all U.S. households own at least one Apple device! If a household has children, that number jumps to 60 percent.

However, investors seem to be overlooking the fact that Apple’s products are “wants,” not “needs.” Millions of consumers want an iPad and many want a computer, yet, every single person in the world needs global resources. We need companies to grow our food; we need oil, natural gas and coal to fuel our cities. We need to drive to work and school each day, and we need to keep our house warm in the winter and cool in the summer. And so do the other 7 billion people on the planet.

To outperform the S&P 500 over the long term, we believe investors should overweight their portfolio to the global products and services that people need, not want. Currently, energy and materials make up only about 15 percent of the S&P 500, which seems insignificant compared to the tremendous needs from not only the developed markets, but the growing emerging countries.

With the S&P 500 Energy Index in oversold territory, today offers a great buying opportunity to add a natural resources investment like the Global Resources Fund (PSPFX) to your portfolio.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Holdings in the Global Resources Fund as a percentage of net assets as of 3/31/12: Apple, 0.00%.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Thats a valid argument, but realize in some economies, a computer/iphone/ipad is a necessity of doing business. Much like a car. In some cities a car is a merely liability and a luxury, in others, if you don’t have a car you will not work…..