Europe is on its way back into recession. During the second half of 2011 several EU countries already met the most common definition of recession, namely two consecutive quarters of falling output, including Spain, Italy, the Netherlands, Denmark, Ireland, Greece, Cyprus, Czech Republic, Portugal, Slovenia, and the UK. Correspondingly, European unemployment rates began rising again during 2011, more than undoing the modest recovery they enjoyed in 2010.

But while the prospect of a European recession in 2012 is quite bad enough, this understates the scope of the problem. Because not only will this year’s recession directly impact millions of unemployed and soon-to-be unemployed EU workers, as well as (for those more fiscally minded) seriously damaging this year’s government budget balances, it will have lingering effects on Europe’s economies for many years to come.

Hysterisis is the notion that the state of the world today has lingering effects on the future. In the context of labor markets this primarily arises because the state of being unemployed tends to make it harder for workers to find a new job, and the longer someone is unemployed the harder it becomes. Unemployment — especially long term unemployment — therefore has permanent negative effects on an economy even after economic growth has resumed. Unemployment today damages the economy’s potential tomorrow.

This should be of particular concern for European policy makers, because the European labor markets have proven to be particularly slow to recover from recessions.

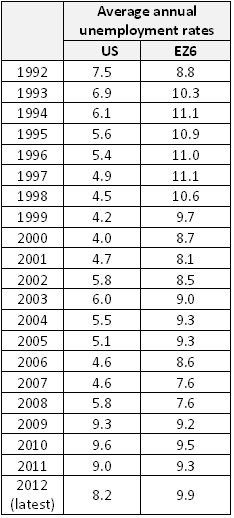

To get a rough sense of this, I calculated the weighted-average annual unemployment rate of what I call the “EZ6” — the six largest eurozone economies, i.e. Germany, France, Italy, Spain, Netherlands, and Belgium — over the past 20 years. If we compare the EZ6 unemployment rate with real GDP growth over those years, we find that every percentage point of real GDP growth reduces the unemployment rate by about 0.33 percentage points. In other words, for every percentage point that the unemployment rate goes up in the EZ6 this year, those economies will need three years of real GDP growth 1.0% above trend to undo the damage.

This is significantly longer than in the US. For the US, every percentage point of real GDP growth causes the unemployment rate to fall by almost 0.5 percentage points, meaning that it takes about two years of growth that is 1.0% above trend to undo a one point rise in the unemployment rate, rather than three.

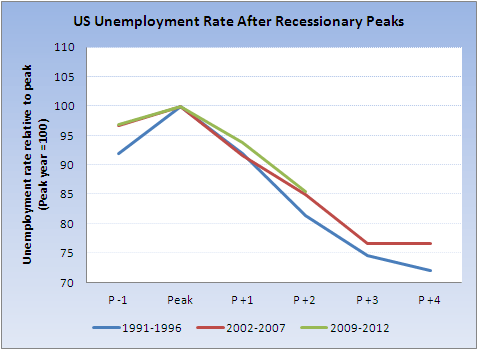

The following chart shows the fall in unemployment rates after the past three recessions in the US. Unemployment rates have been normalized in each case so that the peak rate of unemployment is set equal to 100.

Somewhat surprisingly (at least to me), the current unemployment recovery in the US is roughly on par with the previous two recessions. Granted, those previous two recessions were also characterized by frustratingly slow improvements in the labor markets (so presumably we should still hope to do better), but it’s nice to be able to place our unhappiness with the present labor market recovery in some context.

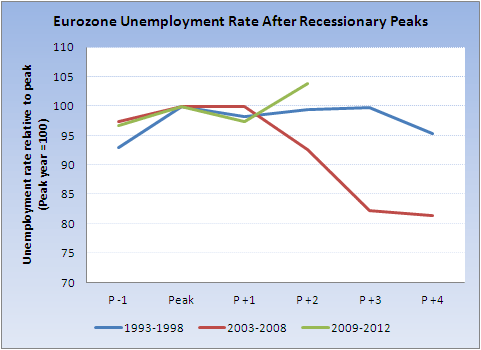

The next picture shows the same thing for the EZ6, and makes clear that unemployment increases in the eurozone tend to be considerably more sticky. Sometimes, it appears, what goes up comes down only very, very slowly. Even during the relatively successful recovery of 2005-2008 the EZ6 unemployment rate only dropped to about 81% of its peak.

To be fair, it’s important to recognize that unemployment rates also tend to rise more slowly in Europe than in the US. In 2009, for example, the unemployment rate in the US rose by 3.5 percentage points, while in the EZ6 the unemployment rate only rose by 1.6 pp. However, this doesn’t take the sting out of the fact that when unemployment rates do rise in the eurozone — as they are doing now — their negative repercussions last considerably longer than in the US.

European policy-makers need to remember this fact. Their misguided fixation on austerity as the solution to the eurozone’s crisis has done a lot to push Europe back into recession. But importantly, the damage and pain caused by this will not just be felt in 2012, but rather for many years to come.

Furthermore, this considerably increases the likelihood that expansionary fiscal policy (i.e. tax cuts and/or more government spending) in Europe would actually pay for itself and reduce government debt burdens in the long run. DeLong and Summers (pdf) recently expounded on this idea and illustrated how fairly reasonable parameter values — at least in today’s economic environment in the US — can result in such an unconventional outcome. But if hysterisis effects can cause expansionary policy to be debt-reducing in the US, this must be all the more true for the eurozone given the sluggishness of its labor markets. Every additional drop of austerity added to the eurozone’s economic brew this year will, more than likely, not only worsen the European Recession of 2012, but will also worsen the eurozone’s long run budget picture.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply