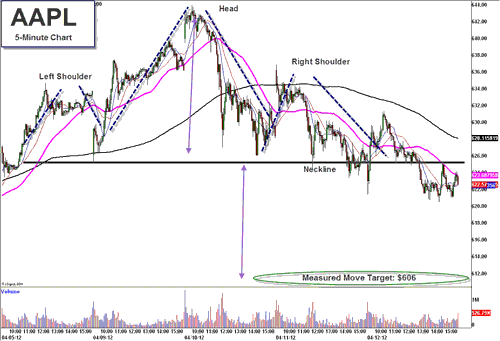

In the last couple of days I was a little concerned about the relative weakness in Apple (AAPL) as the market had a two-day bounce back, which was discussed in my Morning Calls and Daily Notes.. Typically AAPL leads the market and does not show a negative divergence, which put us on an alert to sell some longs and potentially look for some kind of momentum short. Yesterday, while the DOW was up around 180 points, AAPL was dancing around the 10-day MA which is unusual for that stock. I have also outlined a 5-day 5-min chart with a Head and Shoulders topping pattern that was forming with the neckline right around the 10-day MA, which gave a measured move down to the $605 level.

(click to enlarge)

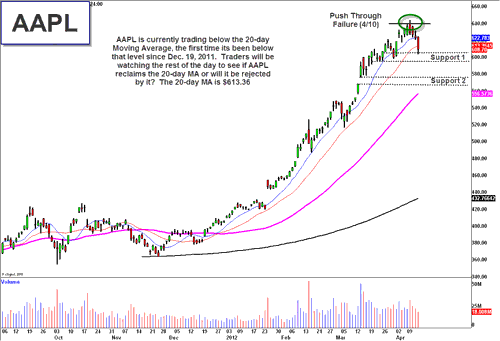

So here we are now, AAPL is trading around $610, already meeting our measured move of the pattern. It has also broken the 20-day MA for the first time since it Dec. 19th 2011. Traders will be watching today to see if it reclaims the 20-day or rejects it. A close below the 20-day would be another bearish signal for the stock market. Next week we will use today’s low as the new reference point. The 50-day MA is far away at this time, standing at $556.57, and the last time we saw the 50-day MA was Dec. 20th, 2011.

(click to enlarge)

AAPL is currently 5% from its highs and could see some form of snapback in the next couple of days, especially after 4-days of selling. It will be key to see how AAPL snaps back to judge the overall weakness or strength of this stock. I hope you were all listening to Evan Lazarus on the radio today as he was all over this trade. Nice Job!

Disclosure: Scott J, Redler is LONG: DNKN, RENN, ZNGA, GLD, CF. SHORT: SPY

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Oh my all those pretty pictures. So sad they mean nothing. If you’d like connect the dots to $650.00 by April 25th.

Chartists focus too much on…. charts. I don’t think I’ve ever experienced AAPL actually moving in a direction that chartists claim it will. It moves off of news more-so than anything on the short term patterns, and fundamentals on the long term patterns.

Of course, Earnings are Tuesday the 17th, so typically AAPL will be trading at a new high going into Earnings. Of course, this isn’t guaranteed, but Earnings WILL be the big driver of AAPL in the near term, not charts.

Get your heads out of the charts. :)