Out of the many signs that the US economic recovery is not as strong as previous ones, the variable that possibly best demonstrates the weakness of the recovery is the stagnant employment to population ratio. This ratio summarizes two labor market variables: the unemployment rate and the participation rate. A declining ratio indicates that out of the available population, we are using fewer resources either because workers cannot find jobs (high unemployment rate) or because they are giving up and leaving the labor force (low participation rate). The current level of the employment to population ratio in the US remains at a very low level (by recent historical standards) and has not increased since the recovery started. This behavior is very different from what we have witnessed in previous recoveries.

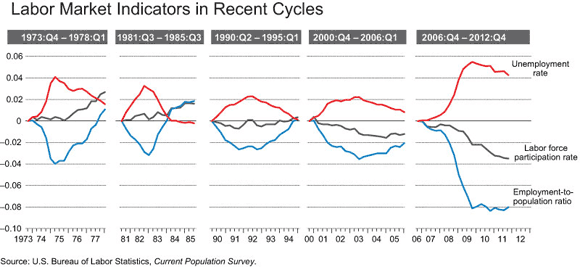

The dynamics of the employment to population rate are not just cyclical. We have seen several interesting trends over the last years which can possibly explain the abnormal behavior during the current crisis. Albanesi, Sahin and Abel provide an in depth analysis of the dynamics of the US labor market during recessions. The authors argue that some of this difference can be explained by the different behavior of he female and labor force participation rates as well as demographic factors. I am borrowing the picture below from their analysis showing how the employment rate is much flatter than in any previous recovery.

Their analysis provides a good amount of detail regarding the US labor market, but how does it compare to other countries?

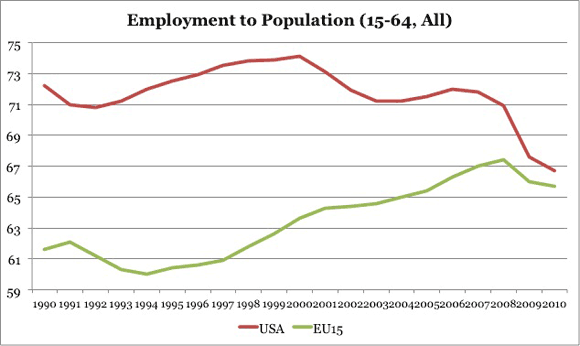

In the charts below I compare the behavior of the US labor market to the European Union labor market (I chose the 15 countries that formed the European Union in 2002 a smaller group that the current 27 members).

The overall employment to population rate (for the population between 15 and 64 years old) in the EU has been converging to that of the US. This convergence started after 1995. In the US we see a stable ratio prior to the 2001 recession followed by an overall declining trend that accelerates during the post 2008 crisis. In Europe the mid 90s show an increasing employment rate that stops post 2008 but not as dramatically as in the US.

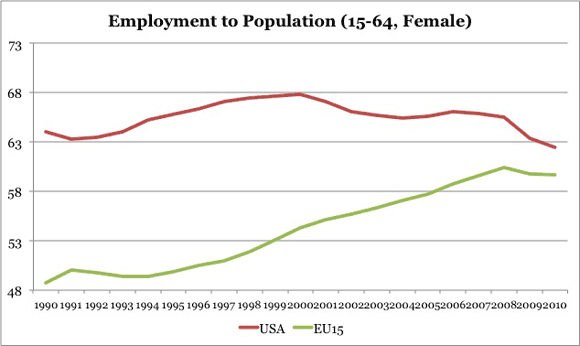

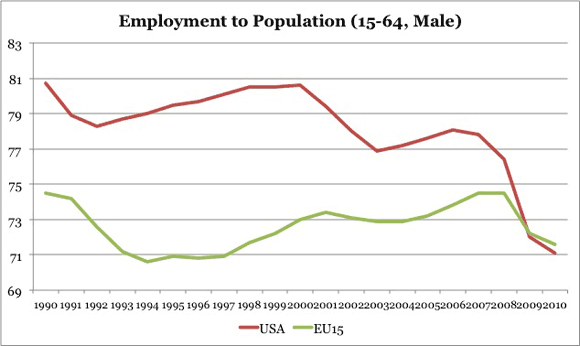

By gender, we see very different patterns although both pointing to convergence of labor markets. In the case of female workers, the US displays a flat or declining ratio (but at a high level), while Europe shows a strong upward trend. In the case of make workers, the EU trend is flat but there is a strong decline in employment rates in the US.

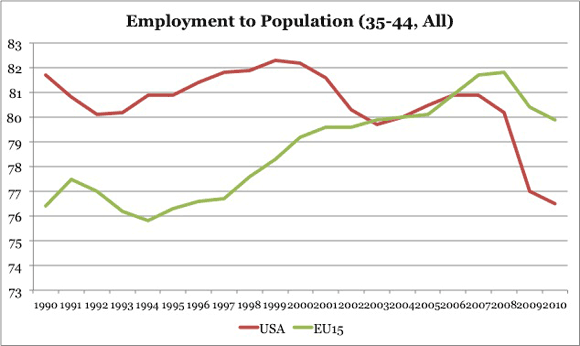

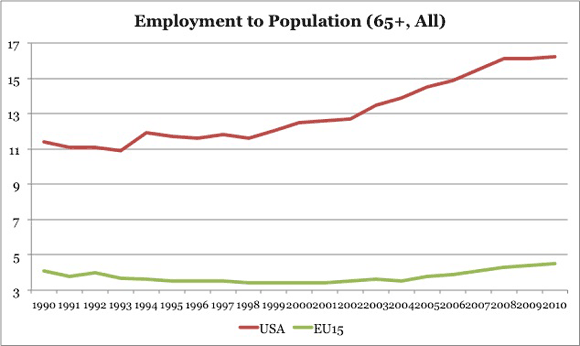

There are many other ways to cut the data, all of them interesting. Below are two charts where I look at a specific age range.

For workers in the 35-44 range (the analysis it would be similar for 45-54), we see strong increases in the EU employment rates that bring the ratio above that of the US. If we look at workers over 65 we see that not only the US has a much higher employment rate but that it has been increasing relative to the EU number that remains low and at a similar level as in 1990.

Overall, the US-EU comparisons of labor markets reveals that Europe has caught up with the US when it comes to employment rates, something that was not expected in the 90s where the US labor market was seen as an example of a dynamic market and the distance between the two kept growing. For some age groups (between 35-44) not only there is convergence but the EU rates are now clearly above those in the US. However, the US maintains the lead in workers close or “over” retirement age, with a gap that has increased over time.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply