Morgan Stanley is making some fairly positive comments on Molycorp (NYSE:MCP) saying falling rare earths prices have started to attract customers again.

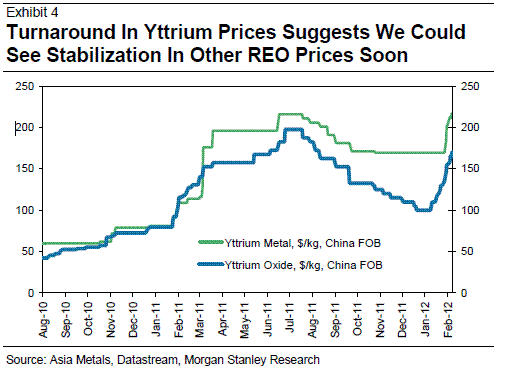

– They think REO prices, down 25% YTD, have reached a level that will drive demand. A recovery in heavy REO prices may already be under way, with yttrium up in February. Heavy REOs should be followed by magnetic REOs (crucial to MCP’s earnings). MCP shares price in REOs at 30% of spot at full capacity.

Firm is reiterating Overweight rating and $81 PT.

The details:

Favorable seasonality from March should help absorb market surplus. REO prices are down 25% YTD. While REO inventory in China and illegal mining could prolong the price decline, we sense an increase in interest from consumers. Japanese REO imports normally pick up in March-May. We expect a seasonal pickup in demand to help stabilize prices by mid-2012. At $55/kg, spot prices are in the range where price-sensitive buyers may start returning, based on our channel checks.

Heavy REOs should lead a price recovery, followed by magnetic REOs (crucial to MCP’s earnings). Export offer prices for yttrium oxide (a heavy REO) have increased on tighter export quotas for heavy REOs. Magnetic REOs could be next to stabilize as their fundamentals are better than for light REOs. One of the magnetics, samarium, recently registered a modest uptick in price. Samarium has a similar end use (magnets) as neodymium and praseodymium, which contribute ~75% of our ‘13e revenues. Even buyers of cerium (a light REO) are reported to be returning to the market, though recent offers at ~$18/kg (vs. a reported spot of $28) suggest it could fall more before stabilizing.

Significantly cutting our estimates; falling 2012 consensus keeps investors sidelined. We are lowering 2012e EPS to $1.00, or 58%, to reflect management’s cost guidance and mark to market for spot prices. Our revised estimate factors in $50/kg average REO price, a 4% YoY cost increase, and 8.9 kT REO production. Other drivers of 2012 earnings are magnetic REOs in sales mix (we estimate 23%) and contribution of Mountain Pass to total volume (we project 77%). At 5x EV/EBITDA and full 40kT capacity, MCP shares reflect REOs at 30% of spot.

Notablecalls: Molycorp (NYSE:MCP) has become a kind of a consensus short of late, evidenced by the 40%+ short interest in the name.

Now we have Morgan Stanley, a Tier-1 firm calling for a possible bounce in REO prices, helped by increased demand. That could cause a squeeze in the name, considering the stock is pricing in REOs at 30% of spot.

I checked with several brokers and Molycop (MCP) was on the “hard-to-borrow” list at almost all of them. Makes me say hmm..

If this gets around, say hello to $27.50-29.00 range in the coming days, regardless if the REO bounce sticks or not.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply