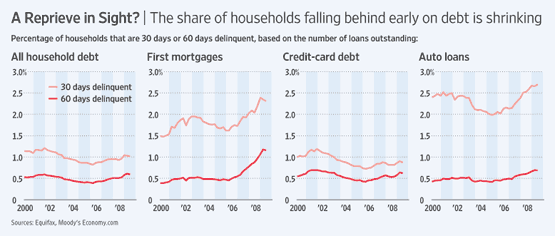

According to credit-reporting firm Equifax, fewer American households are falling behind on their debt payments. The number of mortgage, credit-card and other consumer loan payments that were 30 and 60 days past due declined by nearly 1.1 million to 13.9 million at the end of June, on a seasonally adjusted basis, from three months earlier, the WSJ reported Saturday, citing an analysis of 7.5 million credit files supplied by Atlanta-based titan Equifax.

Nearly two-thirds of the decline came from falling credit-card delinquencies. The reduction in newly delinquent borrowers is a positive sign. Whether the trend will continue ; that’s a debatable argument. Some economists question whether the data reflect a meaningful easing of consumer-credit problems. For Mark Zandi, chief economist of Moody’s Economy.com. the reduction in newly delinquent borrowers is a positive sign for the economy, especially coming at a time when “the job market and housing market are still bad and getting worse. Once those markets stabilize,” said Zandi, “when combined with the tighter underwriting, we will see a dramatic improvement in credit quality.” [WSJ]

Graph: WSJ

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply