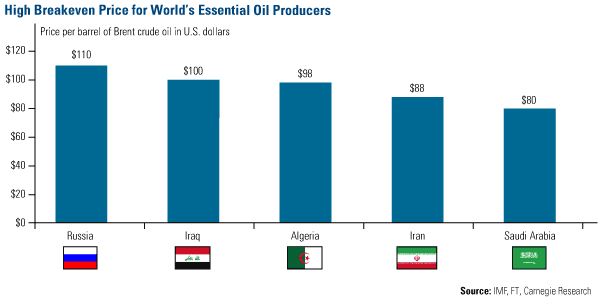

One way to gauge support for the price of oil is to calculate the breakeven price. In other words, what is the dollar amount per barrel that would be required for an oil-producing country to balance its fiscal budget?

Several factors go into this calculation such as the location (and quality) of a country’s reserves, and the spending habits of the federal government.

Analysts at Carnegie Investment Bank recently put together this chart, which illustrates the breakeven price needed for some of the world’s largest oil producers. Combined, these countries are expected to produce 30 percent of the world’s oil in 2011, Carnegie says. Note: these prices are for Brent crude, which have been $10-to-$15 per barrel above West Texas Intermediate prices this year.

Russia, which is currently the world’s largest oil producer, has leaned on the profits of the natural gas and crude oil exports to account for nearly 14 percent of the country’s GDP in 2010. But Russia isn’t the only export-dependent country. Many countries in the Middle East, such as Saudi Arabia and Iran, have used oil profits to ease “Arab Spring” tensions by financing public programs.

However, Carnegie notes that the fiscal budgets of many oil-exporting countries were rising prior to the citizen revolution due to a lack of non-oil revenues, rapid population growth and generous welfare systems. For example, Saudi Arabia, which generates 80 percent of its government revenue from the petroleum sector, has increased government spending roughly 54 percent since 2008. Other countries such as the UAE (up 48 percent), Bahrain (up 53 percent) and Qatar (up 59 percent) have seen government spending increase over the same time period.

Carnegie says the result is, “OPEC countries have stronger incentives to defend higher oil prices, i.e. any drop in the oil price could mean lower OPEC production in order to try to secure higher oil prices.” It also means these countries are “less likely to invest in building additional production capacity.”

This only adds to our argument that we could see oil prices continue at their current levels despite a weaker global economy and softening demand for oil.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply