Ryan Avent is puzzled. He says so:

I have to say, I’m puzzled. Recent developments in the euro zone seem incredibly negative to me. The probability of a reasonably orderly conclusion of the crisis appears to be falling. Yet equities aren’t dropping; indeed, they’re up from early September. Has the roadrunner sprinted off the cliff but not yet looked down? Or am I missing something?

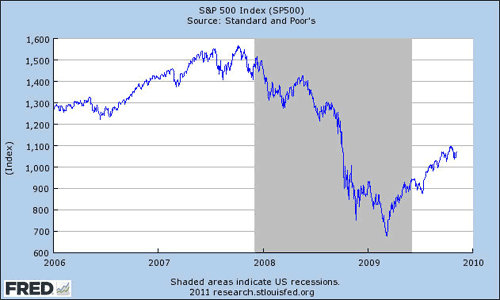

Avent is trying to wrap his mind around equity market behavior. I wish him the best – I hope he gives me a call if he finds a meaningful answer. All I can say is that we have been here before. Recall 2007:

By the middle of 2007 the TED spread was exploding, signaling enormous financial turmoil. Yet equities kept heading upward, fueled by data that was just not that bad coupled with ongoing expectations that a solution was just around the corner. And now we find ourselves in almost the exact same position. Avent is correct, the news out of Europe is abysmal. He is not missing anything. There is no solution, no magic summit at hand. At this point, it is a choice between severe recession and depression. There is no happy ending to this story.

Consider the news from Greece. CR points us to Athens News, which declares the Greek government rudderless. The latest EU demand, that everyone in power sign a commitment to the last bailout proposal, might simply be the straw that broke the camel’s back. The key sentence:

The demand came a day after ND issued a nonpaper saying that the party will support the new government’s policies, only to reverse them when the conservatives come to power.

The implication is that the New Democracy party hopes to pull in the next tranche of aid, then default. CR suggests they just say so, and get the default over with. I have to agree – we all know the latest haircut of 50% – not including official debtholders, of course – will prove to be insufficient, as additional austerity measures erodes the government’s fiscal position.

And that story is growing throughout the Eurozone. Consider this report:

France announced 65 billion euros of tax hikes and budget cuts over five years on Monday, as President Nicolas Sarkozy seeks to protect the country’s creditworthiness in financial markets without killing his chances of re-election in six months time…

…But economists said the government’s growth outlook was still too optimistic, even after cutting the forecast for 2012 to 1 percent from 1.75, meaning the latest measures might not be enough for France to meet its deficit reduction goals.

As the periphery moves to austerity, it weakens the core, and the core turns to additional austerity. Which then weakens the periphery. Slow, but vicious, cycle.

And then we move to Italy. From the FT:

Silvio Berlusconi, Italy’s embattled prime minister, pledged last night that he would resign after parliament passes a new financial stability law that will implement fresh austerity measures demanded by the European Union.

Good luck with that – it has obviously worked so well in the rest of the Eurozone. Meanwhile, the 10 year Italian bond rate rose to 6.77 percent, a whopping 497bp premium to Germany. Many believe that 6 percent is the point of no return, and we are well past that mark. Italian bonds might get some relief from Berlusconi’s departure, but within three to six months they too will be falling short of their fiscal benchmarks, and bond markets will be forced to react.

Meanwhile, the ECB is effectively on the sidelines. Ed Harrison at Credit Writedowns has been providing some excellent commentary, and believes it is only a matter of time before the ECB brings out the big guns and gives Europe what it needs, a lender of last resort. Which makes perfects sense because that is the only way in which the Eurozone does not fall into depression. That said, ECB members are determined to prove him wrong. From Bloomberg:

European Central Bank council member Jens Weidmann said the ECB cannot bail out governments by printing money.

“One of the severest forms of monetary policy being roped in for fiscal purposes is monetary financing, in colloquial terms also known as the financing of public debt via the money printing press,” Weidmann, who heads Germany’s Bundesbank, said in a speech in Berlin today. The prohibition of monetary financing in the euro area “is one of the most important achievements in central banking” and “specifically for Germany, it is also a key lesson from the experience of hyperinflation after World War I,” he said.

In the United States, we live under the legacy of the 1970’s. For Europeans, it is the 1920’s. And with that fateful decade in mind, the resistance of certain Eurozone stakeholders – yes, Germany – remains steadfastly in the path of very aggressive monetary policy.

Bottom Line: Yes, Europe is bad. And getting worse. By the time European policymakers reach an agreement, the goalposts have moved. They are literally looking into the abyss, caught like deer in the headlights. And like the US in 2007, they cannot avoid the abyss. And yet, US equities markets hang on, edging upward in the apparent belief – or delusion – that a European financial crisis will not filter back into the US. I hope that is correct, but suspect it is not. And if it not correct, I don’t anticipate equities will react until it is obvious corporate profits will suffer.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply