BLOOMBERG — “Rare-earth prices are set to extend their decline from records this year as buyers including Toyota Motor Corp. and General Electric Co. scale back using the materials in their cars and windmills.

Prices for cerium and lanthanum, the most abundant rare- earth elements, will drop by 50 percent in 12 months, Christopher Ecclestone, an analyst at Hallgarten & Co. in New York, has forecast. Neodymium and praseodymium, metals used in permanent rare-earth magnets, may fall as much as 15 percent, he said.

Makers of electric cars, wind turbines and oil-refining catalysts have sought to reduce use of the metals after China, which supplies more than 90 percent of the market, said in July 2010 that it would cut exports and clamp down on the industry. That boosted prices, encouraging mining companies to develop new prospects and buyers to find alternatives.

“If you think you can keep raising the prices for those materials and still keep your customers, you’re crazy,” Jack Lifton, co-founder of Technology Metals Research, said in a telephone interview. “The principal customer for rare-earth metals is a global automotive industry using rare-earth permanent magnets. That industry will engineer this stuff out.”

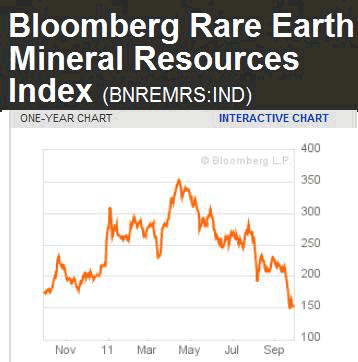

The Bloomberg Rare Earth Mineral Resources Index dropped 41 percent in the last three months (see chart above).”

MP: This is a good example of how the price system transmits valuable information about the relative scarcity of natural resources, how market participants respond immediately and effectively to price changes that signal increased resource scarcity, and how those natural, automatic responses effectively solve the problem of the increased scarcity. In the case of rare-earth elements, the higher prices encouraged producers to: a) find more of the existing materials and b) find alternative materials, and encouraged consumers to: a) find alternatives and b) “engineer the stuff out” of production.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

How many times can these news sources say the exact same thing.