Yesterday it was reported that consumer confidence has plunged recently:

Consumer confidence plunges as hope dims

Expectations at the lowest level in two yearsWASHINGTON (MarketWatch) — Consumer confidence plunged in August as expectations dived, with worsening views on future business conditions, jobs and income, the Conference Board reported Tuesday.

The nonprofit organization said its consumer-confidence index fell to 44.5 in August, the lowest level since April 2009, from a slightly downwardly revised 59.2 in July. It was the sixth-largest one-month decline in the past 21 years. Economists surveyed by MarketWatch had expected an August reading of 51.9.

When news headlines breathlessly announce breaking news about consumer expectations, it’s worth taking a step back and remembering what these surveys actually tell us.

Consumers expectations typically are much more reflective of the past than the future. Put another way, they’re backward looking. And that makes perfect sense, since if you don’t really know how to reliably forecast the future (and let’s be honest, none of us are particularly good at that) then it’s usually a very reasonable strategy to assume that the future, at least in the near term, will look a lot like the recent past.

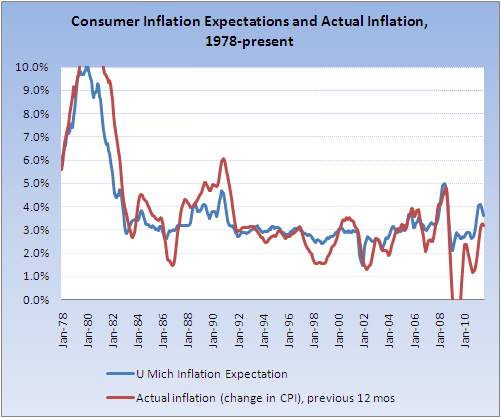

To see how this works regarding these consumer surveys, I pulled the data on consumer inflation expectations and overall consumer sentiment since 1978, and compared it with actual inflation and consumer spending. The first chart illustrates that consumer inflation expectations (measured by the University of Michigan’s monthly survey) match up almost perfectly with actual inflation — over the previous 12 months. Inflation expectations do not match future inflation nearly so well. (If you can imagine shifting the red line to the left by 12 months, you can see what I mean.)

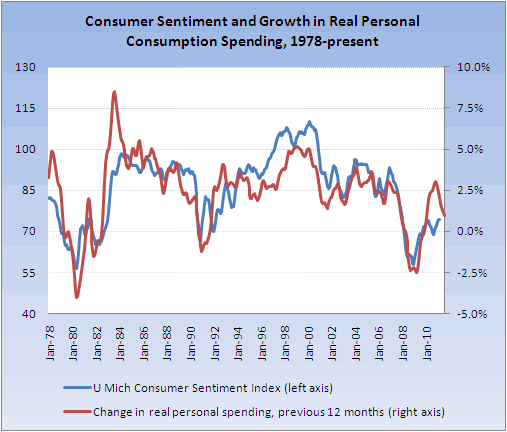

The next chart shows “consumer sentiment” (the name used in the University of Michigan’s monthly survey) plotted against the 12-month change in real consumer spending — again over the previous 12 months. The series match extremely well, but would not match nearly so well if we tried to compare sentiment with future spending changes instead.

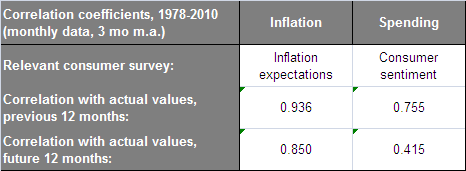

To be slightly more rigorous, the following table shows correlation coefficients between consumer expectations, the past, and the future. The first column shows the correlation between consumer inflation expectations, inflation over the previous 12 months, and inflation over the subsequent 12 months. The second column shows the correlation between consumer sentiment, changes in real consumer spending over the previous 12 months, and spending growth over the subsequent 12 months. A zero would indicate no correlation, while a score of 1.00 would indicate perfect correlation.

Consumer expectations regarding inflation are almost perfectly correlated (the correlation coefficient = 0.94) with actual inflation over the previous 12 months, but significantly less so with future inflation. And on the spending side, consumer sentiment is also much more correlated with the change in real spending that took place over the past 12 months (coef = 0.76) than over the coming 12 months (coef = 0.42). So for both inflation and spending, the consumer survey data tells us much more about the past than the future. Something that’s important to keep in mind when trying to read the economic tea leaves.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply