Eurobonds are being touted as the silver bullet to resolve the Eurozone crisis. This column argues that the Eurobonds proposal fails on legal, political, and economic grounds. It says that, whatever the variant, Eurobonds only make sense in a political union—and given the vast differences in national political systems and their quality of governance, any political union created on paper will not work in practice.

The term “Eurobond” is usually taken to mean a bond which has a “joint and several” guarantee by all member states of the Eurozone (see for instance Manasse 2010 and Suarez 2011). The “joint and several” guarantee implies that if the issuing country cannot service its “Eurobond” debt the creditors can demand payment from all other Eurozone countries. This would imply that in extremis the creditors could demand that Finland or Estonia pay up for the (Eurobond) debt run up by, say, Greece or Italy if the other large Eurozone members are either unwilling or unable to pay.

This contribution deals only with the idea that member states should be able to issue Eurobonds to finance their deficits and convert at least part of their outstanding debt. This is, of course, a totally different proposition from the idea that a common institution should be able to finance some task of common interest (see Gros and Micossi 2008).

Will investors buy Eurobonds?

Proponents of Eurobonds assert that they could be sold at a very low yield, close to that of the benchmark German “Bunds”. The thinking is that because the aggregate debt and deficit levels of the Eurozone compare favourably with those of the US, investors would lend at similar interest rates.

But this is a proposition that has not been (and unfortunately cannot be) tested and is not a foregone conclusion, especially if the Eurobonds are to cover a large part of the debt outstanding.

- Investors have noted that many arrangements to deal with the Eurozone debt crisis have been overturned by politicians and thus might not fully trust the “joint and several” guarantee.

They might also have a different opinion of the incentive effects which would result from Eurobonds.

- Market participants might expect that the introduction of Eurobonds will lead to a faster aggregate increase in debt.

- Investors might also just have a different view of sovereign credit risks in the Eurozone given its much higher level of bank debt (2.5 % of GDP compared to “only” 1.2% in the US).

It is interesting to note that opponents of Eurobonds tend to much more pessimistic regarding the interest rate they would carry. For example, Ifo (2011), assumes that the interest rate on Eurobonds would be equal to the (weighted) average of the yield on outstanding government debt in the Eurozone, which at present is almost 200 basis points higher than the yield on German government debt.

Another argument turns on the liquidity that such bonds would have. Of course, Eurobonds would become a highly liquid asset with a volume of available debt comparable to US Treasury bonds. However, the yield differentials between large and small AAA-rated issuers within the Eurozone (eg Germany versus Austria) are in the order of 30-50 basis points. The improvement in liquidity would thus at most constitute a minor benefit.

What problem are Eurobonds supposed to solve?

The purpose of introducing Eurobonds now is of course not to solve some long-run problem but to deal with the present crisis by giving governments of countries which are currently paying high risk premia access to cheaper funding.

- For opponents of Eurobonds, differences in risk premia are justified by differences in national fiscal policy and constitute a useful market signal, forcing governments to adjust.

- For proponents of Eurobonds, the differences may include high risk premia that may well be the result of panic.

Any country with a moderately high debt level might be driven into insolvency – even if this debt were perfectly sustainable at low interest rates – because when markets discount the debt of the government, the economy will tank and the debt service burden will increase.

Economists call this multiple equilibria. If investors believe that Italy is fundamentally solvent they will buy Italian government bonds at an interest rate of below, say, 5%. In this case debt service will be bearable and Italian banks will be able to refinance themselves without problems in the interbank market. But if many investors have doubts about the solvency of the country interest rates will shoot up and the nation’s banks will be shut out of the interbank market. The economy will then tank, reducing government revenues at exactly the time the government faces higher debt service costs (see Gros 2011 on the importance of the bank-sovereign nexus).

These doubts about the solvency of a country can clearly be self-fulfilling and lead to a quick downwards spiral in financial markets as the panic of this summer has shown. A number of recent VoxEU contributions have dealt with this issues, most recently de Grauwe (2011). See also Kopf (2011).

But how important is this phenomenon of multiple equilibria?

In early 2010, when Greece started to face difficulties selling its debt on the market many also argued that this was just a case of self-fulfilling market panic. It turned out, however, that the doubters of 2010 were right on Greece. Despite a massive dose of financial aid the country has not been able to get its budget under control. One should thus not jump to the conclusion that all increases in risk spreads constitute unjustified speculative attacks. But it is difficult to escape the impression that at present this mechanism might be driving markets.

The dangers of introducing political union without democratic legitimacy

“No taxation without representation” is a fundamental principle of democracy, but this is not compatible with joint and several liability for other Eurozone countries’ debt unless Europe (or rather the Eurozone) becomes a political union. Holding taxpayers in thrifty countries fully and unconditionally liable for spending decisions taken in other countries would most likely turn into a poison pill for EMU. Political resistance against EMU would rise in the stronger countries, eventually leading to a probable break up of EMU.

Furthermore, if the issuance of Eurobonds were limited to a part of national debt (say only 40-60% of GDP as proposed), highly indebted countries would immediately be forced into a debt restructuring as they could no longer find buyers for the part only guaranteed nationally. This is why the system of blue/red bonds proposed by Delpla, and Weizsäcker (2010) – The Blue Bond Proposal – cannot work if the countries concerned have a debt overhang (on the key issue of seniority see Gros 2010).

Legal problems

The legal objections to Eurobonds are well known. Any joint-and-several-liability contract would contravene the no bail-out clause of the Lisbon Treaty (Art. 125). Thus, a Treaty revision requiring ratification by all EU27 would be needed. The fate of the Lisbon Treaty, which was rejected when put to a referendum in France and the Netherlands, should be a warning. In addition, the German Constitutional Court would most probably consider Eurobonds without a political union unconstitutional and could order the German government to leave the Eurozone or withdraw its unconditional guarantee for Eurobonds.

Putting the cart before the horse? Create political union to justify Eurobonds?

Proponents of Eurobonds assert that the necessary elements of “political union” could be created, if necessary by changing the EU Treaties. It is clear that at the minimum supranational surveillance by the Commission, the Council (Eurozone) and the Parliament would need to be strengthened to an extent that would almost certainly interfere with constitutional principles in each member state regarding the budget autonomy of parliaments. Stronger involvement of the European Parliament is no substitute for this given the (at least widely perceived) “democratic deficit” of this institution, and the fact that it represents the EU27, not the Eurozone.

Peer surveillance in the Council did not work well in the past, and may not work much better even in a strengthened framework of the stability and growth pact as it is planned in any case. Sanctions (ie no access to EU budget funds, penalty payments, and so on) cannot be designed in an appropriate way because they are not time consistent: when a real problem arises the country is not punished, but receives help.

The joint decision-making mode of the body which would oversee national fiscal policy (most likely the so-called Eurogroup) would presumably need some sort of qualified majority voting. But how could one then impede a majority of fiscally lax countries to allow themselves higher deficits? This already happened in 2003/4. In the end, issuing Eurobonds requires the establishment of a United States of Europe on fiscal policy under which citizens of all member countries agree in advance that their tax payments might be needed to shore up other countries and that their benefit levels might be reduced because other countries paid too much to their own citizens.

However, even then one has to doubt that the best designed mechanisms can maintain incentives at the member state level to pursue fiscal solidity and good economic performance in the Eurozone. The evolving debt crisis has shown that countries only move under the scrutiny of the markets and rising refinancing costs—with Italy providing the latest evidence.

Is political union enough?

Those who propose a political union to make Eurobonds viable assume that some Treaty changes and high-level political agreements would be enough to ensure that member countries implement all decisions taken at the European (or rather Eurozone) level. However, this is not a foregone conclusion as the experience with the fiscal adjustment of Greece has shown. Even the most determined government was not able to implement the austerity measures it knew were necessary.

There are profound differences among member states in the degree to which their political systems and administrations work in reality. The World Bank provides a useful databank of “governance indicators” which allows us to compare countries on the quality of their administrations and the extent to which the rule of law is actually adhered to. These are key elements if a Eurozone political union is to work. However, even a cursory glance at these indicators reveals that the differences are so large that a political union is unlikely to work.

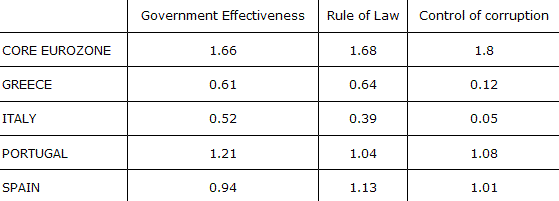

Table 1 shows the three most relevant of the governance indicators, namely “government effectiveness”, “rule of law” and “control of corruption”. A minimum common standard on all three is needed to ensure that common decisions on the deficit each country is allowed to run are also implemented in a way that tax payers in the stronger countries can rest assured that the necessary enforcement mechanisms will actually work.

However, the data show that there is a large difference between the core countries and the “Club Med” (Greece, Italy, Portugal, and Spain). Especially Greece and Italy perform particularly poorly even if compared to Portugal and Spain, whose standards are still clearly below the core euro average. On almost any measure the observations for both Greece and Italy are more than two standard deviations below the Eurozone average.

Table 1. Eurozone governance indicators: core versus Club Med or Southern Periphery)

Notes: “Government effectiveness” captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies. “Rule of law” captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence. “Control of corruption” captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests.

Source: WGI 2009, World Bank

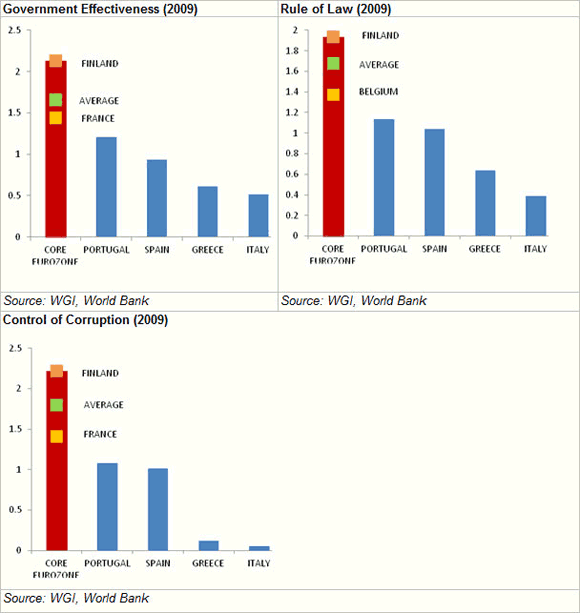

The figure below provides a visual confirmation of the difference between the core and the Southern Eurozone member countries.

Figure 1.

These differences in the quality of governance, more than any technical problems, are probably the reason why the electorate in Northern Europe is sceptical about Eurobonds. With these fundamental differences in the way different member countries work it would in practice be impossible to conduct a unified fiscal policy even if the post of a Eurozone finance minister were created.

Conclusion

Whatever the variant, Eurobonds only make sense in a political union – and even then only when debt levels are low.1 When starting debt levels are so high that the markets suspect a debt overhang, Eurobonds would amount to a large transfer of risk and generate strong expectations that future accumulations of debt will be treated in the same way.

Political support for Eurobonds seems to be growing even in member states such as Germany (the social democrats and the Greens have indicated their support) but only because the idea sounds good at first glance. Once the fiscal implications of a specific proposal are discussed, political support may vanish very soon. The odds of the German Bundestag underwriting with a constitutional majority implicitly €6,700 billion in outstanding Eurozone public debt when the German debt is “only” about € 2,000 billion are small.

The differences in national political systems and their quality of governance are so large that any political union that might be created on paper would not work in practice.

References

•Ifo (2011), “What will Eurobonds cost?”, Press release, 17 August.

•De Grauwe, Paul (2011), “The European Central Bank as a lender of last resort”, VoxEU.org, 18 August.

•Delpa, Jacques and Jakob von Weizsäcker (2011), “The Blue Bond Proposal”, Breugel.org, 11 May.

•Gros, Daniel (2010), “The seniority conundrum: Bail out countries but bail in private, short-term creditors?”, VoxEU.org, 5 December.

•Gros, Daniel (2011), “August 2011: The euro crisis reaches the core”, VoxEU.org, 11 August.

•Gros, Daniel and Stefano Micossi (2008), “Crisis management tools for the euro-area”, VoxEU.org, 30 September.

•Kopf, Christian (2011), “Restoring financial stability in the euro area”, CEPS Policy Briefs.

•Manasse, Paolo (2010), “My name is Bond, Euro Bond”, VoxEU.org, 16 December.

•Suarez, Javier (2011), “A three-pillar solution to the Eurozone crisis”, VoxEU.org, 15 August.

__________________

1 The Federal government of the newly-created US assumed the debt of the founding states because that debt had been incurred fighting for a common cause. This is certainly not the case in Europe today.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply