Grounds for optimism about the economy have been scarce, so you might suggest I’m scraping the bottom of the barrel here. Not true. This is BIG!

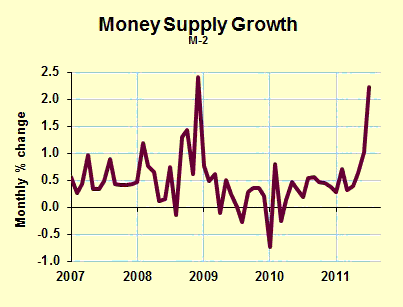

We finally have the money supply growing as it should. The Federal Reserve’s second round of big quantitative easing (QE2 it’s called) didn’t seem to have much effect at first. The Fed increased the banking system’s reserves, but they ended up as excess reserves held by banks. However, I held that if the Fed keeps at it long enough, the reserves would get translated into money supply. Now that has happened.

(Data in the chart are monthly through July 2011. The first two August weekly reports also look strong.)

This money supply growth was accompanied by loan growth, believe it or not. Commercial and Industrial loans by banks began growing at a strong pace in March, and growth continues today. Consumer lending turned up in April and has risen without fail every month since. Real estate lending is still declining, but not as fast as it previously declined. Roll these categories up with the others (ag, miscellaneous) and with have four months of total bank loan growth, with a surge in July.

There’s a phenomenon that Keynes hypothesized coudl happen: a liquidity trap. At some point, investors prefer cash (or cash equivilants) over bonds, and no amount of monetary easing will help the economy. Keynes wrote the he knew of no such instance ever happening, but some advocates for fiscal policy have argued that America is now in a liquidity trap. Up until the increase in bank lending, they had an argument. It was, however, a brief and fleeting argument.

The increase in the money supply and in bank lending bode very well for the economy. The last jump in the money supply was associated with the first quantitative easing in the wake of the Lehman Brothers bankruptcy. One year later the economy recorded its best growth rates since 2006. Then the Fed stopped growing bank reserves, fearful that inflation was around the corner. I blogged at the time that the Fed was engaging in Quantitative Tightening, and I urged the Fed to reverse course. It eventually did, but we have been paying the price of their tardiness.

How long until the money supply increase pushes the economy upward? I often use a rule of thumb of 12 months for the time lag between monetary policy and the economy, though Milton Friedman warned us that the time lags are long and variable. Right now I believe the time lag will be shorter, more like six to nine months. That’s grounds for some optimism in fourth quarter 2011, with even more optimism for the first half of 2012.

Double-dip recession? Looking less likely now, but it’s never a bad time to do contingency planning just in case.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply