About a year ago, I wrote about The Shocking Cost of Regulation and the unintended consequences new rules can have on our business system without proper cost-benefit analysis being done. A year later, it’s clear the swarm of red tape is choking companies and impeding growth.

U.S. businesses continue to deal with the unintended consequences of these regulations. According to Wayne Crews of the Competitive Enterprise Institute, there’s currently more than 4,000 new regulations in the pipeline and a record 81,405 pages of new rules were created in the Federal Register during 2010. As the economy continues to sputter, many thought-leaders’ voices have grown louder in protest against increased regulations.

In its semi-annual update of regulations, conservative think-tank The Heritage Foundation summarized how many more rules and regulations have gone into effect over the past few years, with “a higher number and larger cost of regulations” coming under the current administration than ever seen before. In the first half of 2011 alone, $38 billion in new costs were added, “more than any comparable period on record,” says The Heritage Foundation.

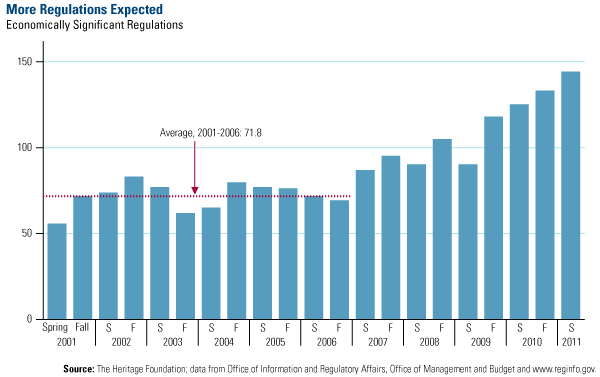

The terrorist attacks, the Enron/Worldcom scandals, the housing/banking crisis and the overhaul of the health care system have led to a considerable jump in regulations over the past decade. From 2001-2006, the number of economically significant regulations—those that cost $100 million or more—averaged 72 per year. Since then, the number of pending regulations doubled.

As I often say, it’s not the political party, it’s the political policies. Prior to President Obama taking office, President Bush put $60 billion in additional annual regulatory costs in place, says The Heritage Foundation.

Alabama Congressman Spencer Bachus, chairman of the House Financial Services Committee, said this onslaught of regulations—most recently Dodd-Frank—burdens the private sector by creating an “atmosphere of uncertainty” where businesses can’t put “ideas and capital to work.”

A 2010 report developed by the Small Business Administration pegged the cost of federal regulations at $1.75 trillion, nearly 12 percent of America’s GDP. This cost is more than $8,000 per employee and up from only about 4 percent of GDP in 1950.

Small businesses—which have historically created seven out of every 10 jobs, are especially hurt by these higher costs of regulation. Companies with fewer than 20 employees bear a disproportionate share of the federal regulatory burden with total costs per employee exceeding $21,000—36 percent more per employee than larger companies, according to data from the Small Business Administration.

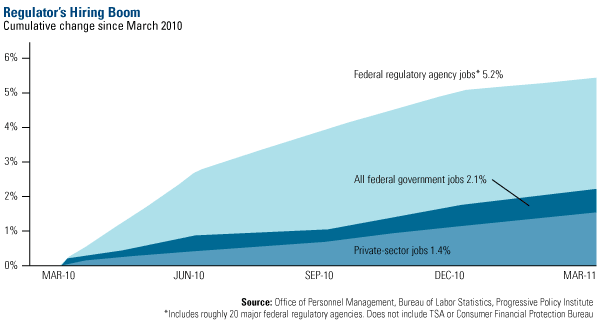

Unlike in the private sector, federal regulatory agency jobs have been growing at a much faster pace to enforce this onslaught of new regulations. Investor’s Business Daily compared the significant growth of jobs that have taken place in the federal regulatory agencies versus the lack of job growth in the private sector. Since March 2010, the cumulative change in federal jobs–which includes the Environmental Protection Agency (EPA), the Federal Communications Commission (FCC) and the Food and Drug Administration (FDA)–was just over 5 percent. The cumulative change in private-sector jobs remains significantly lower at a little more than 1 percent.

These federal numbers don’t include the Transportation Security Administration, which employs around 45,000 airport screeners, or the 5,000 federal workers needed for the Consumer Financial Protection Bureau to enforce regulations put in place by Dodd-Frank.

IBD highlighted startling statistics, “If the federal government’s regulatory operation were a business, it would be one of the 50 biggest in the country in terms of revenues, and the third largest in terms of employees, with more people working for it than McDonald’s, Ford, Disney and Boeing combined.”

To make sound decisions these days as a voter, taxpayer and investor, Americans need to gather and dissect all the economic data, the political environment, the international landscape and the opinions of businesses and thought-leaders. These regulations will continue to be enacted unless government leaders are persuaded to act differently.

Our team will continue to go where we see the best policies for growth, where jobs are created and where policies are more focused on social investing than social welfare.

None of U.S. Global Investors Funds held any of the securities mentioned as of 6/30/11.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Contrary to what Frank Holmes and his friends at the Heritage Foundation like to believe, regulations are not an enemy to businesses. Government rules play a major role in all our lives. They are necessary to protect the most vulnerable among us – the young, the old – those who cannot protect themselves. They shield us from companies that are willing to pollute, to cheat, or to skimp on safety in the name of profit. These rules are one of the foundations of a civilized society.

The fact is, now is exactly the wrong moment to be talking about fewer regulations. The BP oil disaster, the Massey mine explosion, the myriad consumer product and food safety recalls, and the financial meltdown of 2007 (which nearly caused a second Great Depression and sent 8 million Americans to the unemployment line), are stark reminders of the crucial role regulations play in our society.

Amazingly, Holems talks about the cost of regulations without mentioning the benefits. When you spend three bucks on a cup of coffee, yes it costs you $3 – but you still have a cup of coffee. Public safeguards are no different.

Controls on Big Business have enormous benefits. They save lives and reduce illness. Less pollution, for instance, means fewer cases of asthma and lung disease. Having safer toys on store shelves means fewer children dying after choking on small parts.

The latest Office of Management and Budget (OMB) report shows that between 2001 and 2010, the benefits of major regulations reviewed substantially exceeded their costs. It put the total annual benefits “between $132 billion and $655 billion, while the estimated annual costs are in the aggregate between $44 billion and $62 billion.” That estimate puts benefits at 2 to 15 times more than the cost!

He cites a Heritage report that claims new safeguards against polluters, financial malfeasance and reform of the nation’s health care system will “further weaken an anemic economy and job creation.” However, a recent study by the Economic Policy Institute shows evidence that refutes the claim.

In “Regulation, Employment, and the Economy: Fears of job loss are overblown” authors Isaac Shapiro and John Irons review studies that compare the benefits of regulations to their costs, investigate whether regulations negatively impact the economy, and assess the studies that the federal government uses when formulating specific regulations. The available evidence, as discussed in their paper, shows that public protections “do not tend to significantly impede job creation.”

In assessing the impacts of regulations on the economy, the authors note that in addition to some regulations being designed to specifically aid the economy and particular industries, regulations “can lead to investments that create jobs, improve worker health and thus productivity, and spur important technological innovations, among other positive effects on the economy and employment.”

Holmes reaches for the latest numerical talking point – that the Federal Register is an “an all-time high of 81,405 pages” – conveniently ignoring the fact more pages are added due to the requirement of agencies to publish their responses to the public comments they receive. They also required to publish the data that underlies the agency’s scientific studies. More transparency is going to mean more pages in the registry.

Lastly, Holmes cites the phony figure of $1.75 trillion as an annual cost on the economy due to regulations comes from what is called the Crain and Crain study after its authors, Nicole V. and W. Mark Crain. It was commissioned by the Small Business Administration (SBA) NOT for the purpose of figuring out how much federal rules cost the economy, but to give the SBA a better handle on the impact of regulation on small businesses, compared to large businesses.

The number has been utterly debunked by several organizations, including the nonpartisan Economic Policy Institute and the Congressional Research Service.

Crain and Crain acknowledged their study’s limitations. In an email to the Congressional Research Service, they stated that their report is “not meant to be a decision-making tool for lawmakers or federal regulatory agencies to use in choosing the ‘right’ level of regulation. In no place in any of the reports do we imply that our reports should be used for this purpose.”

Despite previous cautions from the study authors themselves about its use in a policy debate, the figure has taken on a life of its own and has been repeated incessantly by corporate spokespeople, lawmakers, and special interest lobbyists.

Many familiar with the regulatory process have known about the study’s defects. Testifying at a recent Senate hearing of the Homeland Security and Governmental Affairs Committee, Cass Sunstein, administrator of the Office of Information and Regulatory Affairs, said the outrageous dollar figure “should be considered nothing more than urban legend.” Austan Goolsbee, the former Chairman of the Council of Economic Advisers, called the figure “utterly erroneous.”

Members of Congress, proponents of Big Business and others who cite the phony $1.75 trillion cost figure need to cease. It is overstated and misleading, and lawmakers should not use it as the basis for policymaking.

Rich Robinson

Press Officer,

Public Citizen