Quasi-monetarists and Keynesians both warned the ECB that it was making a mistake by raising interest rates in response to commodity inflation, even as NGDP expectations were falling. Indeed, we claimed they were making precisely the same mistake as they made in July 2008, when the ECB raised rates in response to high oil prices, even while NGDP growth remained weak.

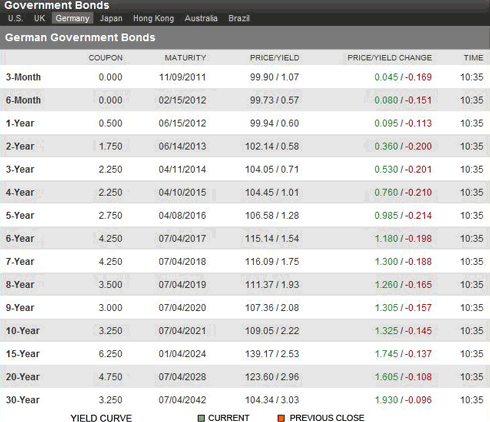

It now looks like we were right; the ECB goofed and will soon have to reverse its policy. Yields on German debt are plunging to ultra-low levels, particularly at the short end of the yield curve. Three month bills yield 1.07%, while three year yields are only 0.71%. Unless I have misread the data (I’m not used to following the German bond market), the markets are predicting a reversal of ECB policy in the near future. (They recently raised their target rate to 1.5%.)

BTW, Kantoos is the best source for information on the ECB and Germany.

Here’s today’s market data:

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply