Many economists are racing to declare a ‘manufacturing revival.’ The latest to join the bandwagon is Paul Krugman. In his latest column, Krugman writes (my emphasis added)

Manufacturing is one of the bright spots of a generally disappointing recovery…..Crucially, the manufacturing trade deficit seems to be coming down. At this point, it’s only about half as large as a share of G.D.P. as it was at the peak of the housing bubble, and further improvements are in the pipeline…one piece of good news is that Americans are, once again, starting to actually make things.

Oh, how I wish Paul was right. Unfortunately, I still don’t see it in the trade numbers. In fact, the real trade deficits in capital and consumer goods are both nearing all-time (negative) records. Meanwhile, the real trade deficit for industrial supplies and materials has improved in large part because of an enormous surge in real exports of energy products, including coal, fuel oil, and other petroleum products (yes you read that right) and a sharp decline in imports of building materials. I don’t find either of these convincing proof of a resurgence of manufacturing.

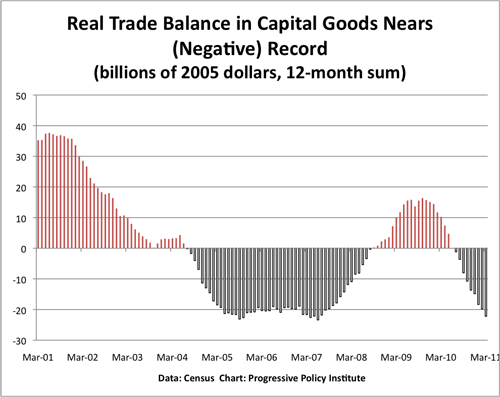

As you might expect, time for some charts. Here’s a chart of the real trade balance in capital goods in billions of 2005 dollars, calculated on a 12-month basis.

Capital goods include computers, telecom gear, machinery, aircraft, medical equipment–the heart of U.S. advanced manufacturing. Within a couple of months, if current trends continue, the capital goods trade deficit will be at a record level. What’s more, there’s no sign of any great domestic capital spending boom that could suck in imports.

And not to digress, these figures probably substantially underestimate the deterioration of the capital goods trade balance because of the import price bias effect , where the government statisticians do not correctly adjust for rapid changes in sourcing from high-cost countries such as the U.S. and Japan to low-cost countries such as China and Mexico (for a good reference see the new paper “Offshoring Bias in U.S. Manufacturing” by Susan Houseman, Christopher Kurz, Paul Lengermann, and Benjamin Mandel in the latest issue of the Journal of Economic Perspectives) .

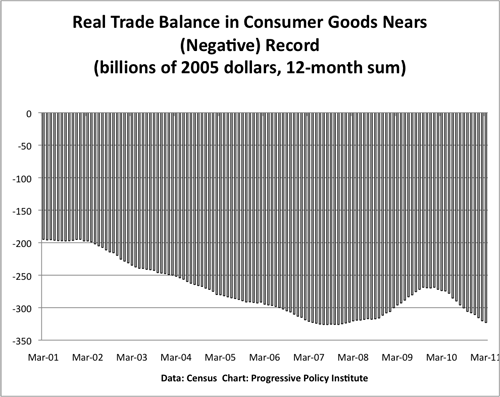

Now let’s turn to consumer goods. Here’s the chart of the real trade balance in consumer goods, in 2005 dollars.

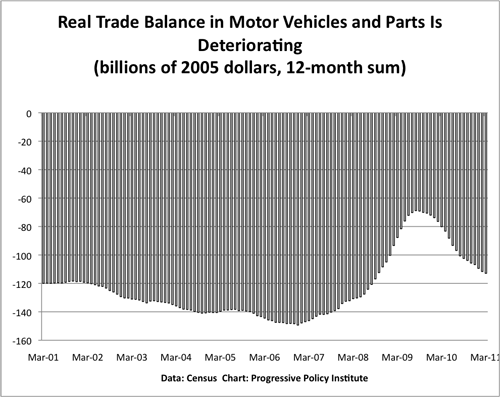

No sign of any real improvement here either, I’m afraid. The trade balance retreated a bit during the recession, but since then has surged back. Once again, there’s no sign of a sustainable improvement in the trade balance, the situation with motor vehicles is a bit more ambiguous. As the chart below shows, clearly there has been some gains in the motor vehicles and parts trade balance. However, it has started deteriorating again.

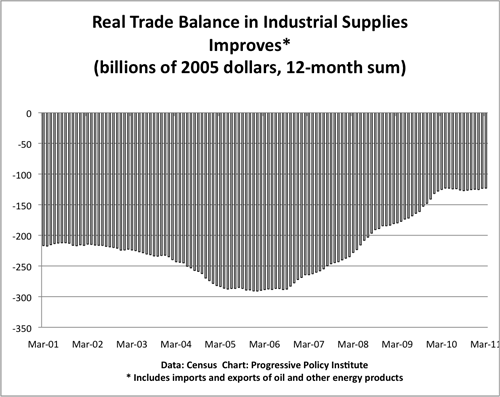

Finally, we come to the one area, industrial supplies and materials, where there has been a clear improvement in the real trade balance. Industrial supplies and materials includes fuel imports and exports; steel and other metals; building materials; chemicals; and a grab bag of other things including newsprint, audio tapes, and hair.

Since 2006, there has been roughly a $150 billion improvement in the industrial supplies and materials trade deficit, measured in 2005 dollars (I say roughly because this is one case where the chain-weighted procedures used to construct the figures gives quirky answers that aren’t additive. So when I give the following numbers, please please don’t divide them into $150 billion to get a share of the improvement). Part of that is a decline in real imports of crude oil, which fell by roughly $30 billion (measured from 2006 to the 12 months ending in March 2011). But another $30 billion, more or less, came from an increase in real exports of petroleum products such as fuel oil and lubricants. I’m not sure whether a gain in exports of fuel oil really tells us much about the fortunes of manufacturing overall.

Another contributor to the improved trade balance is a decline in the imports of building materials. Once again, not a sign of strength.

So I see no sign in the trade data of a great manufacturing revival. The topline improvement in the real trade deficit has mostly come from industrial materials and supplies, and within that from a swing in the energy sector imports and exports.

Let me finish with a quote from a piece that Paul Krugman wrote back in 1994. In that piece, he scoffed at worries that foreign competition was hurting U.S. manufacturing. He argued that

A growing body of evidence contradicts the popular view that international competition is central to U.S. economic problems. In fact, international factors have played a surprisingly small role in the country’s economic difficulties…. recent analyses indicate that growing international trade does not bear significant responsibility even for the declining real wages of less educated U.S. workers.

I wonder if he still believes that today.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply