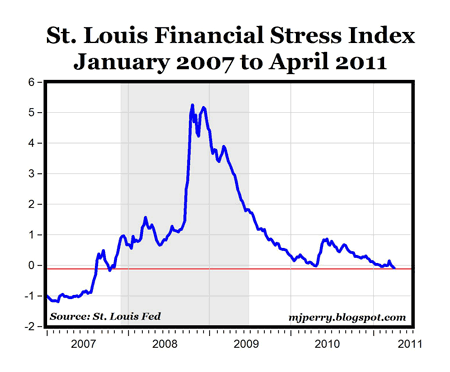

The St. Louis Federal Reserve updated its Financial Stress Index yesterday for the week ending April 8, see chart above (data here). This index measure of the amount of financial stress affecting the markets (explanation here) based on 18 individual variables including seven different interest rates, six interest rate yield spreads, and five measures of market volatility. According to the St. Louis Fed, each of the 18 component variables in the Financial Stress Index captures some aspect of financial stress in the markets, and the Financial Stress Index incorporates the 18 variables into a single, composite index measure that tracks the amount of overall financial stress in the markets.

The chart above shows that the St. Louis Fed Financial Stress Index has now returned to the pre-recession, pre-financial crisis levels that prevailed back in the fall of 2007. The reading for last week of -0.085 was the lowest stress index value since the second week of October 2007, and provides evidence that U.S. financial markets have made a complete recovery from the financial crisis in the fall of 2008 that drove the Stress Index to record high levels above 5.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply