JMP Securities is downgrading Apple (AAPL) to Market Perform from Market Outperform while reducing estimates.

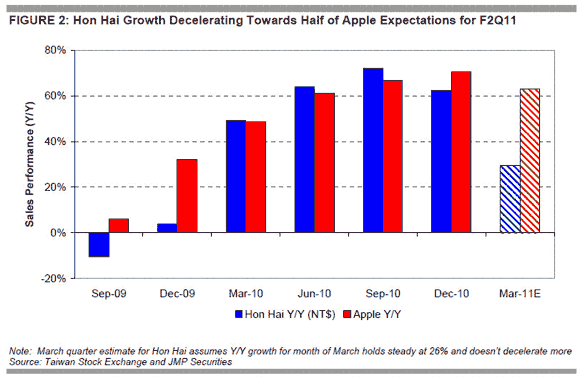

According to the firm the downgrade comes to reflect risk associated with the notable deceleration in its primary manufacturing partner Hon Hai (Foxconn) that was emerging even prior to the amplified uncertainty created by developments in Japan. Hon Hai sales growth decelerated from 84% y/y in the month of December to 37% in January and then again to 26% in February, or levels that are tracking well below the >70% y/y sales growth consensus is looking for in the March quarter and >50% in June. Consequently JMP ise trimming their F2Q11 revenues estimates from $23B to $22B (Street $23.1B; guidance $22B) and GAAP EPS from $5.49 to $5.10 (Street $5.27, guidance $4.90) and CY12 GAAP EPS estimate from $27.50 to $27.00 (Street $27.63). Analyst notes they don’t know the source of the Hon Hai deceleration, but possible causes could include simply in-line iPhone sales due to more significant Android competition, weakness in computing products as tablet demand grows, and/or product transition risk around the iPad 2. While they see Apple’s five-year track record of upside surprises (averaging 23%) and YTD outperformance (AAPL +7.1% vs S&P 500 +1.9%) as exposing the stock to near-term downside risk towards its $300 200d MA, longer term they see current valuation levels at ~13x JMP CY12 GAAP EPS of $27.00 as appropriate relative to firm’s low-teens coverage mean.

– JMP’s more cautious stance is heavily predicated Hon Hai sales deceleration rather than any longer-term fundamental concerns with Apple technology or technology roadmaps. Apple and Hon Hai sales growth was tightly coupled throughout 2010, and given Apple’s scale we view it as unlikely that a correlation isn’t still in effect as Hon Hai slows.

– Investor reaction to large cap tech misses have been vicious recently, and they sense a large degree of complacently has been built up over the course of five years worth of upside surprises that have averaged 23%. Recent Street commentary appears biased towards the momentum continuing, with most numbers moving higher around the CDMA iPhone and iPad 2 launches where clear demand trends have yet emerge.

– The firm notes their downgrade is also factoring in iPhone and Japan developments that they view as compounding near-term risk. At the iPad 2 launch, Apple updated WW iPhone sales to over 100M units, implying only in line QTD performance relative to JMP’s 15.2M target (Street 14.66). Apple derives 6% of sales from Japan, as well as key components such as HDDs and NAND flash.

Notablecalls: Lots of shock value here guys. Everyone knows iPad 2 is sold out everywhere, so it has to be the iPhone that is getting hit. If you think about it, it does make some sense given the recent popularity of Android.

Hon Hai reports monthly revenue #’s, here’s the March 15 one that JMP seems to be refering to. In the release they are touting ‘strong shipments of Apple Inc.`s iPad’. So it’s definitely new info.

http://news.cens.com/cens/html/en/news/news_inner_35651.html

Another possible explanation for the slowdown is tied to Chinese New Year, a 15 day holiday during which many workers are allowed to visit their families.

Given the fact iPhone is a far larger revenue generator than iPad, the downgrade warrants attention. As JMP notes, the market is not in a forgiving mood when it comes to missing estimates. They are highlighting $300 level as possible support for the stock which serves to create some anxiety among holders.

Should trade down today once the details of the downgrade start circulating.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

this might be the dumbest downgrade I’ve ever seen. Correlation is not causation.

I don’t buy it. Verizon now accounts for 12% of all iPhones in the U.S. That means they sold a lot more iPhones recently. You have the iPad 2 sold out everywhere. I can’t find one anywhere and now I’m waiting 4-5 weeks for my online order. iPad 2 has handily crushed the competition and will likey dominate the tablet space for at least the next year. We have iPhone 5 this summer and if the past is any teacher, Apple will not disappoint. Android is a threat for sure but there is plenty of room in the smartphone space right now for two major players. I personally know a number of people who bought an Android phone because it was a cheap smartphone but had technical issues and are now switching to iphone. There are just too many catalysts for this company in 2011. This downgrade might be a good time to buy on weakness. I am long Apple.

Why do I think that JMP Securities has a short position on AAPL….