The public side of CES was very incremental. Nosing around the floor can sometimes unveil that which is hidden. I spent some time with a very well-connected character in mobile and he laid out the case that Oracle will have to enter the smartphone race, and may be in the best position to challenge Apple (AAPL) and Android.

The public side of CES was very incremental. Nosing around the floor can sometimes unveil that which is hidden. I spent some time with a very well-connected character in mobile and he laid out the case that Oracle will have to enter the smartphone race, and may be in the best position to challenge Apple (AAPL) and Android.

When Hewlett-Packard (HPQ) bought Palm I commented on their logic: rather than be a box supplier for Windows or Android, they believe they need to have architectural control. Palm’s new WebOS is the most developed alternative to Apple and Android, and gave HP the best starting point. They intend to eschew the mobile handset space (at first) and race ahead in tablets. WebOS is easy to program in for web designers, giving HP a possible developer community to leverage. (Apple’s iPhone leveraged the Mac base, and now has a whole new base; and Android leveraged Java). How well they do will now depend on execution and great apps.

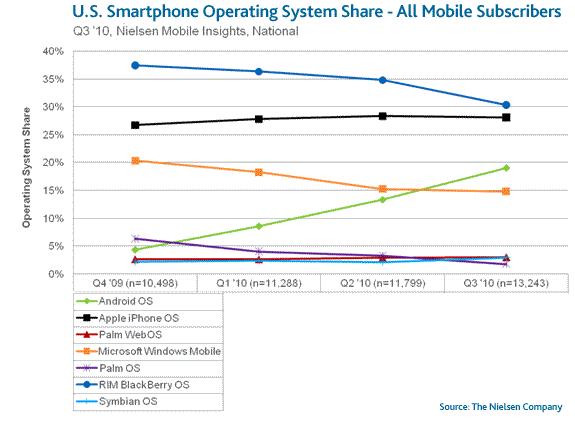

HP seems a bit slow to get out of the starting gates, however, which opens up room for another challenger. Nokia’s (NOK) Symbian seems out of it. RIM’s (RIMM) Blackberry is making their play right now with their new touch line, and it still has a strong following, as you can see from this recent Nielsen market survey:

What remains is a huge Java phone installed base, estimated at 3B feature phones, all of which rely on Java. That base dwarfs the smartphone market. Sun (now Oracle) is the prime licensor of Java, and Java gets into handsets via ‘stack’ suppliers like Aplix and Esmertec (now Myriad). The world remains firmly Java even as the high-end is going Apple or Android.

Oracle (ORCL) bought Sun and now is in a series of battles to maintain royalties for Java. Esmertic (Myriad) has defected and sued Oracle, claiming excessive royalties; Android modified its Java engine and claims not to owe to Sun. Oracle has sued Google (GOOG) and counterclaimed against Myriad.

Rather than play defense, their next move is to go on offense and launch a Java-based smartphone OS (or embedded java stack that the handset makers can add on top of their proprietary OSes). They have a 3B user market to convert, scads of handset makers to sign up (all left a little high-and-dry by the onslaught of Apple), and a huge Java developer base to keep in the fold and out of the clutches of Android. My source says they are already making moves:

From the directions that Oracle is taking (and deeply investing in) it is clear that they are making a large client move with embedded Java. They have made it clear to the JCP executive committee that JSE 7 will be their technical competition for Android. They are setting up to support the eco-system and willing to make the moves needed to recapture and grow the Java market share. They will be pushing JSE 7 changes into OpenJDK that they have partnered with IBM on. … This will exceed the openness of Android, but they will still need to meet the service value of Android.

Watch and see whether Oracle goes a step further into a branded Java smartphone community with an apps store, mimicking Android. Investors take note that an apps store for Java already exists in a company called GetJar, which might be snarfed up by Oracle as their strategy gains substance. Game on!

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply