It has been a freaky season in Oz. First, snow fell on December 19, almost giving them a White Christmas – and December is the start of their summer. Next, a flurry of bad retail reports is putting a lump of coal into their stockings. Third, a prominent analyst recommends shorting Australia.

It has been a freaky season in Oz. First, snow fell on December 19, almost giving them a White Christmas – and December is the start of their summer. Next, a flurry of bad retail reports is putting a lump of coal into their stockings. Third, a prominent analyst recommends shorting Australia.

How did this come about? Did the luck of the Lucky Country run out?

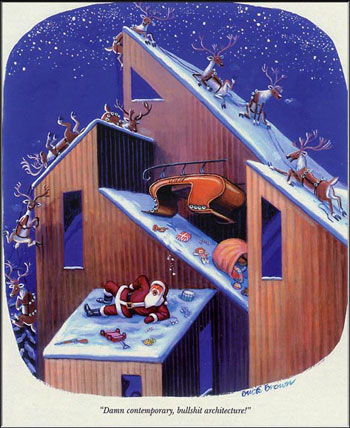

Mish explores the implications of a retail sales slump heading into the holidays, the slowest Christmas in 20 years. Blame is tossed around from online sales to rising utility bills. Electricity costs indeed have been rising all around the world, with blame going to an excessive push towards expensive renewables (wind, solar) over cheap coal and natural gas. The New York Times ran a piece that ran like Rudolph across the blogosphere entitled Coal-Rich Australia Grapples With a Price on Carbon and China’s Money, posing the dilemma Down Under: how to extract more from coal exports without driving up domestic energy costs. Advocates for a Green Christmas are raising energy prices in a country blessed with cheap coal.

Regardless of blame, Australia has been subsidizing real estate much as the US, and now appears to be facing the Day of Reckoning. A retail slump will likely throw the over-build retail sector into the same wave of bankruptcies and empty buildings that hit the US two years ago. In some parts of OZ, residential property is already appearing to be busting. It has been a long time in the coming, with premature predictions of a bust last summer from Jeremy Grantham, and a noteworthy bet by Steven Keen in 2008.

The play may be to short the $AUD. It closed above parity yesterday and is holding above today with markets largely closed. The logic is that the Great Re-Liquification of global stimulus, easy credit and Bernanke’s QE is coming to an end. Austerity rules Europe, China is raising rates to squelch internal inflation, and the Tea Partiers are coming to Town in Washington. The Tax deal may be the last gasp of stimulus for a while, and the new Congress should be tight-fisted.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply