It is not often in economics one can get a realtime test of two different theories, but we have one right now with how Iceland and Ireland have handled their debt crisis. Pierre du Plessis comments on a report from BCA Research that highlights the stark difference in policy to remedy their debt debacles.

Simply put, Iceland bit the bullet & repudiated the debt, plus devalued the Kroner, while Ireland kicked the can down the road & took on even more debt. Both were forced to pursue fiscal austerity, but Ireland stayed with the Euro and could not devalue their currency. How is it working out?

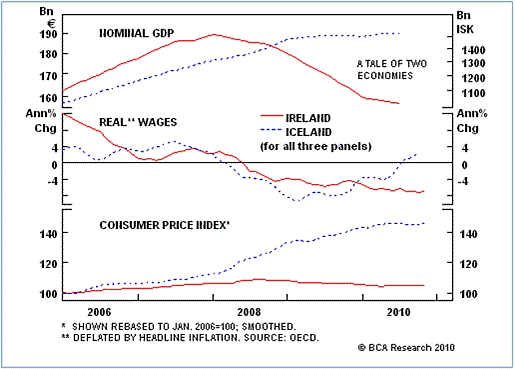

Iceland is growing GDP and real wages, and Ireland is dropping in both GDP and wages:

Put in stark terms, Iceland decided to protect its people rather than the global banks:

Iceland takes some very severe one-time pain as the country pays for excesses, but will emerge with a clean slate and limited liabilities for the taxpayer, while the bondholders of debt (in this case Iceland’s banks) take the hit.

This is in contrast to what other nations have been doing, which is along the lines of the decisions in Ireland over the past 3 years – that is (a) first shift the debt from the banks from the private sector to the public, and more recently (b) accept bailout funds – that eventually need to be paid back – to keep the whole thing from collapsing…. but to make the global banking oligarchy fat and happy as they suffer no losses.

Ambrose Evans-Prtchard of the UK Telegraph comments how this presents a “risky temptation” to the rest of the PIIGS, to drop the Euro and repudiate the debt in order to protect their citizens from the penury of paying back the global banks. There is an odd moral justice here. When the PIIGS joined the Euro, they got a one-time benefit of lower borrowing rates and higher national wealth, which they squandered with massive borrowing to pad their welfare states rather than invest in future production. Now will they leave, take a one-time hit, and restructure their economies?

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply