According to analysts from JPM, homes in the upper crust will lose more value than those in the lower strata. This is exactly what I’ve been forecasting based upon the fact that the Baby Boom generation is moving beyond their peak earning/ spending years and are now becoming empty nesters like me.

The Boomers ran up the price of luxury homes and built FAR TOO MANY of them. The size of the population behind them is not near as large and thus will produce a huge hangover of big, expensive houses that most people are ill equipped to pay for much less maintain and heat or cool.

While 60% sounds reasonable to me, 2012 may be too quick. The demographic trend does not bottom until 2016 and the next wave up, the Echo Boomers, will not come on strong until they reach their peak earning/ spending years (age 48.5) in the year 2022 (Damning Demographics). My best case scenario for housing is a bottom around 2012 with flat to very slow price increases until the mid to late 20teens…

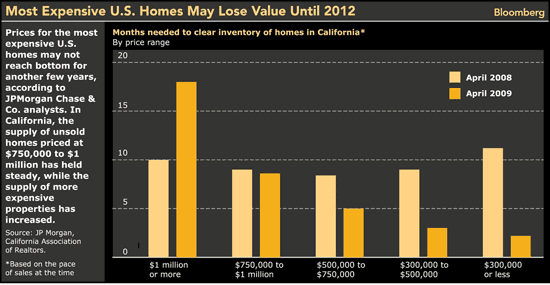

The Bloomberg article below did not contain the Chart of the Day mentioned so here it is… I believe there is a glut of “shadow inventory” waiting to come on the market still. Many people would like to sell but have been waiting in false hopes for the market to turn, thus inventory conditions are probably worse than this chart depicts:

Millionaire Homes’ May Lose Value Until 2012: Chart of the Day

By Jody ShennJune 16 (Bloomberg) — Prices for the most expensive U.S. homes may not reach bottom for another few years, according to JPMorgan Chase & Co. analysts.

The CHART OF THE DAY shows the supply of unsold homes by price in California, data that the mortgage-bond analysts including John Sim and Matthew Jozoff used in a June 12 report to illustrate the weakening market for the most-expensive residential properties. The supply of homes priced $750,000 to $1 million held steady while the supply of more expensive properties increased.

“Tighter lending standards and the lack of cheap financing for these borrowers continue to be key issues,” the New York- based analysts wrote, referring to “jumbo” mortgages. That’s after so-called interest-only and option adjustable-rate loans were a “major driver” of soaring values, they said… Read the whole thing »

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply