Amtech Systems (ASYS) recently posted record quarterly results. The company is getting flooded with new orders and thanks to excellent management; it is able to meet the demand.

Shares are trading with attractive valuations and this Zacks #1 Rank (Strong Buy) stocks up well against its peers.

Company Description

Amtech Systems makes equipment for semiconductors and solar cell makers.

Huge Surprise

On Nov 15 Amtech Systems announced record-setting quarterly revenue, which came in at $45.4 million. The top line has roughly tripled in the past year.

Net income was up 38%, to $5.4 million. Earnings per share rose 16 cents, to 58 cents, since last quarter. The Zacks consensus was only 34 cents, giving Amtech Systems its third consecutive surprise.

The CEO commented on the record bookings as the company is seeing strength in solar orders and expanding its customer base. He also said that Amtech Systems expects another record year in 2011.

Consensus Jumps

Following the news covering analysts quickly raised their estimates. The Zacks Consensus Estimate for fiscal 2011 i sup 25 cents, to $1.58.

Next year’s projections are up 18 cents on average, to $2.18. Amtech Systems earned $1.08 in fiscal 2010, so current estimates are projecting annual growth rates of 47% and 38%.

Valuations & Comparisons

Shares of ASYS are trading at just 11 times this year’s estimates. Factor in those growth rates and you have a PEG of 0.2, a steal. The price to sales ratio comes in around 1.3 times. Each of these valuations is better than the industry average.

Amtech Systems operates with a net profit margin of 8.0%, easily beating the industry average of 5.6%. The company’s return on equity of 13.2% is double the norm for its peers.

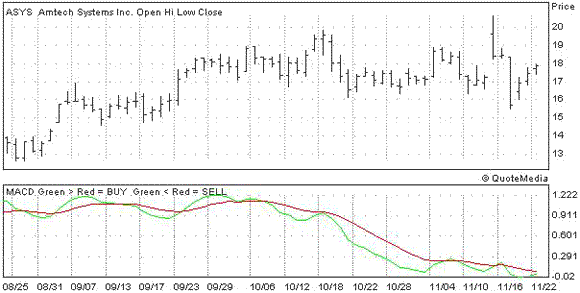

The Chart

The stock spiked on the earnings release, but when several in the solar industry were downgraded a couple days later, shares took a hit. Given the excellent results last year, the strong momentum moving forward and the favorable valuations, this is a great time to buy on the dip.

AMTEC SYSTEMS (ASYS): Free Stock Analysis Report

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply