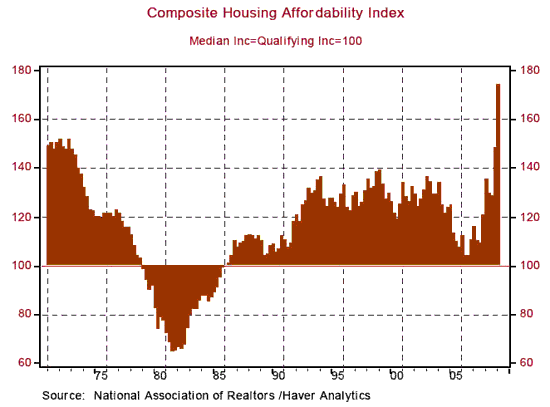

One of the positive aspects of a crashing housing market is that as the sector breaks its support levels on the way down, the housing affordability index gains by steadily breaking rez and printing higher-highs. Consequently, buying a home becomes more affordable. According to Paul Kasriel of Northern Trust, housing affordability is higher than it has been since the mid 1960s.

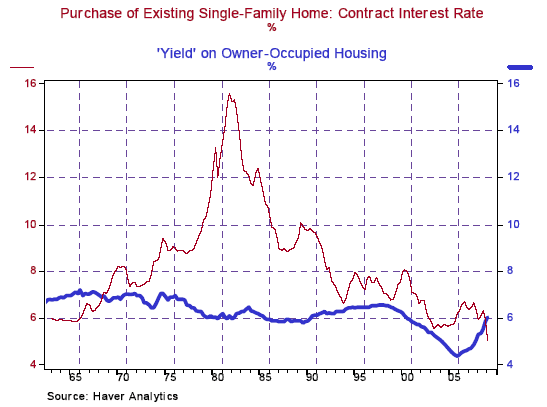

From Northern Trust: [I]n terms of the level of mortgage rates, the sale price of houses and the income of families, the affordability of home purchase of late is higher than it has been in about 40 years (see Chart 1). With Thursday’s release of flow-of-funds data by the Fed, I can demonstrate yet another factor suggesting the current attractiveness of a home purchase – the implicit yield on owner-occupied housing in relation to the cost of financing a house purchase. I calculate the implicit yield on owner-occupied housing by dividing the “space rent on stationary owner-occupied housing” (from unpublished GDP data pertaining to personal consumption expenditures) into the market value of household real estate (from the household balance sheet data in the Fed’s flow-of-funds accounts). Then I compare this implicit yield on owner-occupied housing with the level of mortgage rates pertaining to the sales of existing single-family homes. Chart 2 shows a history of this calculated implicit yield on housing and the financing or mortgage rate.

In the first quarter of 2009, the implicit yield on owner-occupied housing was 6.02%; the contract mortgage rate was 5.07%. The data in Chart 2 show that it is rare for the implicit yield on housing to be above the cost of financing a house. In fact, from the late 1960s until now, the implicit yield on housing has always been below the mortgage rate…In sum, the higher relative implicit yield on owner-occupied housing is yet one more positive element arguing in favor of the bottoming of housing demand.

We should also keep in mind that the continuing gains in the housing-affordability measure also reflect the influence of low-cost foreclosed homes.

Emphasis added

Graphs: Northern Trust

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply