Things look slightly cheerier than they did a month ago. But that’s not saying much.

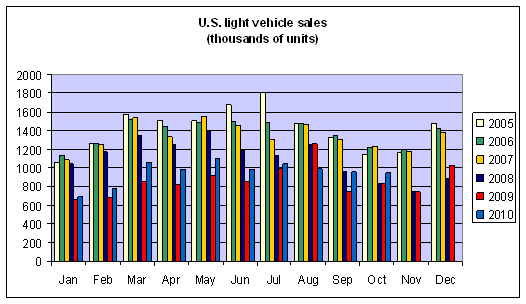

U.S. auto sales for October were up 13% from a year ago, and about the same level as September.

Data source: Wardsauto.com

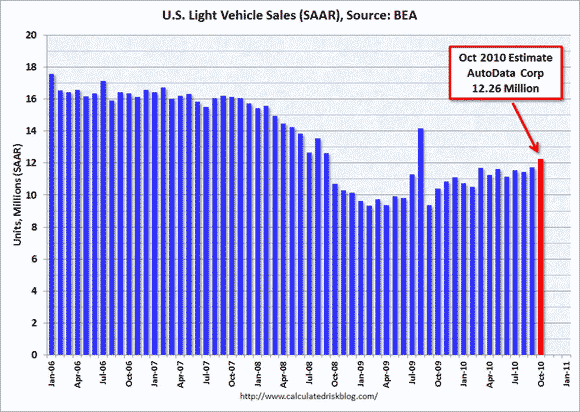

You might take that as reasonably good news, since October’s usually a bit softer than September. Seasonally adjusted auto sales seem to have been edging modestly higher for a while now, and motor vehicles production contributed 0.42 percentage points to the nation’s 2.0% Q3 real GDP growth rate (see BEA Table 1.2.2).

Source: Calculated Risk

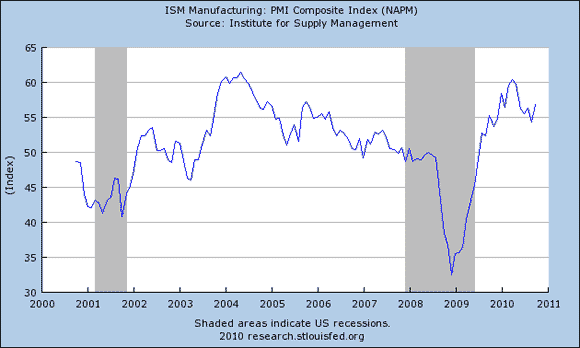

The ISM manufacturing PMI climbed to 56.9 for October. Any reading above 50 signifies improving conditions, and all year long this index has been suggesting good gains for manufacturing. ISM nonmanufacturing PMI was also up.

Source: FRED

Marcelle Chauvet’s recession indicator index, which had spiked up to 25% last month, is now back down to a more comforting 12%.

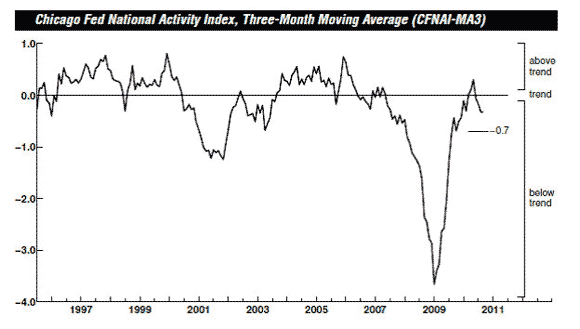

But before you start to party, remember that the Chicago Fed National Activity Index is another pretty good indicator of broader economic conditions. Its 3-month average for September came in at -0.33, suggesting that overall growth remains weak.

Source: Federal Reserve Bank of Chicago

The Bureau of Labor Statistics reported on Friday that nonfarm payroll employment increased by 151,000 workers on a seasonally adjusted basis in October. That’s so much better than what we’ve been seeing that, like the first 20oF day after a tough winter, it makes me want to cheer. But on the other hand (you knew there’d be another hand, didn’t you?) it’s still way below what we need in order to make any progress on the unemployment rate. And separate measures were less sanguine. Payrolls processed by ADP only implied a seasonally adjusted gain of 43,000 private-sector jobs for October, while civilian employment according to the volatile BLS survey of households was down 330,000 for October.

Overall, I continue to see an economy that is growing, perhaps by a little more than suggested by last month’s numbers. But the slowness of that growth continues to be disappointing.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply