Par Pharmaceutical (PAR) estimates are inching higher as the company nears its next quarterly report. In addition to a solid earnings history, the company’s strong pipeline has analysts optimistic about the future.

Growth rates are looking good for the Zacks #1 Rank (Strong Buy) but shares are still trading with attractive P/E ratios.

Company Description

Par Pharmaceutical develops, makes and sells generic drugs and some other proprietary pharmaceuticals.

Estimates Rising into Report

One of the best indicators of a strong upcoming quarterly report is rising estimates just ahead of the number. Par is set to announce results on Nov 3 and analysts are upping estimates.

In the past month we have received 3 upward revisions for both this year and next year. The Zacks Consensus Estimate for 2010 is up 4 cents, to $2.50.

Projections for next year are averaging $3.03, up 6 cents. Growth in 2010 is essentially flat, coming in 1 cent behind 2009, but the forecasted growth rate for 2010 is now over 21%.

First to Market

Some of those revisions are due to the new deal to ship a generic version of hydrocodone polistirex and chlorpheniramine polistirex, for cough and upper respiratory relief. This will bolster and already healthy offering of pharmaceuticals.

Good History

Par Pharmaceutical also has a solid earnings history. The company has posted 7 consecutive earnings surprise, with the latest coming on Aug 4. Earnings per share came in at 71 cents, crushing the consensus estimate of just 58 cents.

Revenues were down about 37% during the period; due to new competition in metoprolol, but 3 new launches help offset that hit.

Valuations

Shares of PRX are trading at just 13 times forward estimates and less than 11 times 2011 estimates. Both of these levels are ahead of the industry average. Additionally, the price to sales is barely over 1.0, also better than its peers.

The price to book near 2.0 is in line with similar companies.

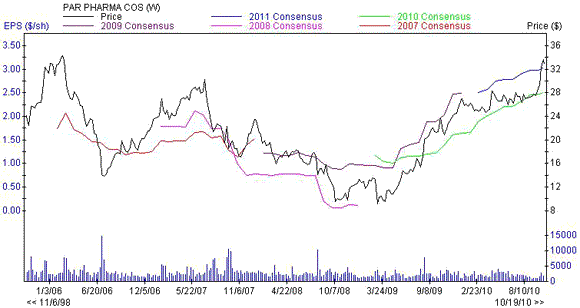

The Chart

Estimate trends for PRX are great. Next year’s estimates are at the highest level in the past 5 years. And while the 2010 forecasts did dip, they rose throughout the year and 2011 is well ahead of 2009’s levels.

PAR PHARMA COS (PRX): Free Stock Analysis Report

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply