ZAGG, Inc. (ZAGG) saw its share price soar after the company raised its outlook for the most recent quarter. The news followed up an earnings surprise in August and both factored into a rush of upward estimate revisions from analysts.

The company is a Zacks #1 Rank (Strong Buy) and, given the growth trajectory, shares are trading at a nice value as well.

Company Description

ZAGG makes protective plastic coverings for consumer electronics. The company’s products are designed for laptops, cell phones, iPods, GPS systems and other similar devices and are sold through most popular electronic retailers.

Topped Estimates

On Aug 10 ZAGG reported second quarter results that included a 64% spike in revenue since last year, to $15.1 million. The company cited new distribution channels and new products for the iPad and iPhone for the share increase.

Net income came in at $1.9 million, or 8 cents per share. This as a 5 cent sequential increase and 2 cents ahead of the Zacks Consensus Estimate.

Consensus Rising

Since the earnings release the Zacks Consensus Estimates have been on the rise. Forecasts for 2010 are up 6 cents, to 31 cents in the past 3 months. Analysts are expecting ZAGG to earn 36 cents a share in 2011, also up 6 cents in the past few months.

The company brought in 18 cents in 2009, which means the projected growth rates are currently 74% and 15%, respectively.

On Oct 14 ZAGG raised its revenue outlook, which helped spur another round of upward revisions as well. The company is now looking for revenue in the most recent quarter to top $22 million, about $8 million more than analysts were expecting.

ZAGG raised its full-year estimate as well. Annual revenue is now expected to jump 70%, to $65 million.

Valuation and Comparison

Shares of ZAGG may give some conservative investors sticker shock, with a forward P/E just over 24 times. But, the given the expected growth the price is actually a discount. The PEG ratio is coming in at just over 0.8 times.

ZAGG operates with a net profit margin of 8.6%, well ahead of the industry average which is 3.1%. The company boasts a 30.9% return on equity, compared to the 7.4% its peers are averaging.

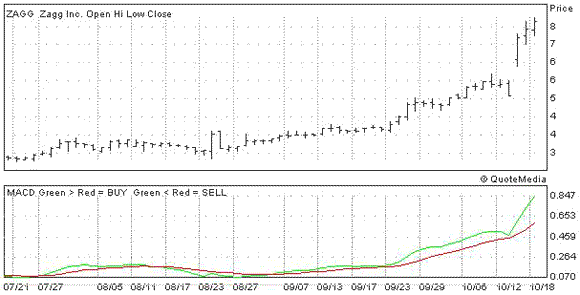

The Chart

Investors pushed shares higher on the earnings surprise, but the biggest movement came on the increased estimates from the company. Shares jumped to all-time highs on the news.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply