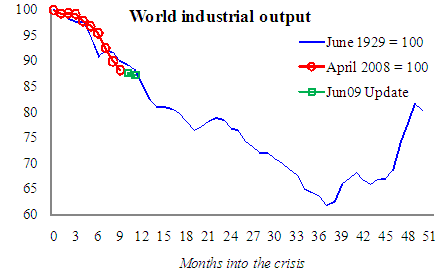

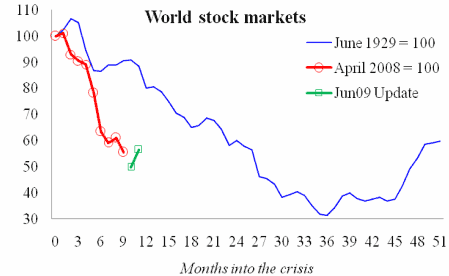

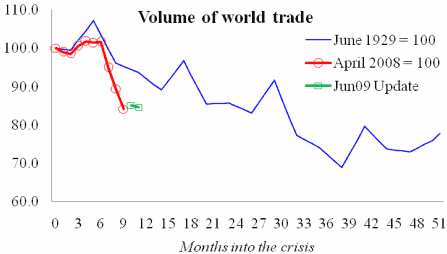

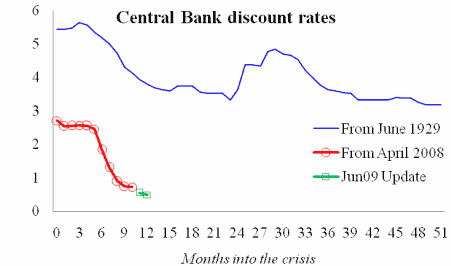

This is an update of the authors’ 6 April 2009 column comparing today’s global crisis to the Great Depression. World industrial production, trade, and stock markets are diving faster now than during 1929-30. Fortunately, the policy response to date is much better. The update shows that trade and stock markets have shown some improvement without reversing the overall conclusion — today’s crisis is at least as bad as the Great Depression.

Editor’s note: The authors will update the charts as new data emerges; this updated column is the first, presenting monthly data up to April 2009. (The updates and much more will eventually appear in a paper the authors are writing for Economic Policy.)

New findings:

» World industrial production continues to track closely the 1930s fall, with no clear signs of ‘green shoots’.

» World stock markets have rebounded a bit since March, and world trade has stabilised, but these are still following paths far below the ones they followed in the Great Depression.

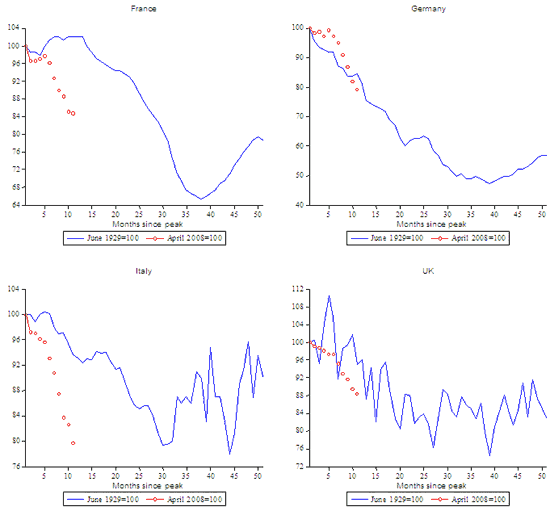

» There are new charts for individual nations’ industrial output. The big-4 EU nations divide north-south; today’s German and British industrial output are closely tracking their rate of fall in the 1930s, while Italy and France are doing much worse.

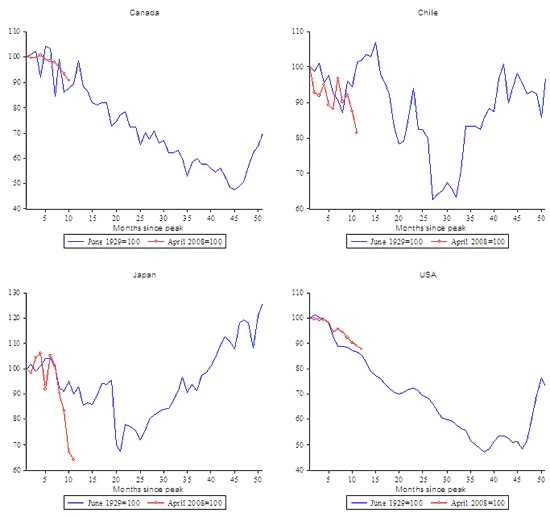

» The North Americans (US & Canada) continue to see their industrial output fall approximately in line with what happened in the 1929 crisis, with no clear signs of a turn around.

» Japan’s industrial output in February was 25 percentage points lower than at the equivalent stage in the Great Depression. There was however a sharp rebound in March.

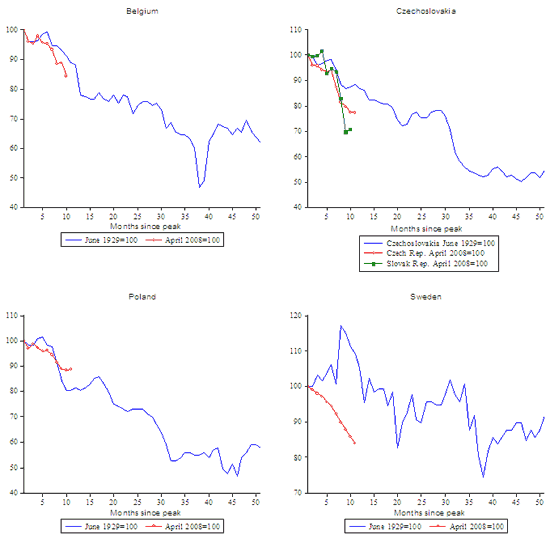

The facts for Chile, Belgium, Czechoslovakia, Poland and Sweden are displayed below; note the rebound in Eastern Europe.

Updated Figure 1. World Industrial Output, Now vs Then (updated)

Updated Figure 2. World Stock Markets, Now vs Then (updated)

Updated Figure 3. The Volume of World Trade, Now vs Then (updated)

Updated Figure 4. Central Bank Discount Rates, Now vs Then (7 country average)

New Figure 5. Industrial output, four big Europeans, then and now

New Figure 6. Industrial output, four Non-Europeans, then and now

New Figure 7: Industrial output, four small Europeans, then and now

A Tale of Two Depressions (Part I) (published 6 April 2009)

References

Eichengreen, B. and K.H. O’Rourke. 2009. “A Tale of Two Depressions.” In progress.

Bernanke, B.S. 2000. Bernanke, B.S. and I. Mihov. 2000. “Deflation and Monetary Contraction in the Great Depression: An Analysis by Simple Ratios.” In B.S. Bernanke, Essays on the Great Depression. Princeton: Princeton University Press.

Bordo, M.D., B. Eichengreen, D. Klingebiel and M.S. Martinez-Peria. 2001. “Is the Crisis Problem Growing More Severe?” Economic Policy32: 51-82.

Paul Krugman, “The Great Recession versus the Great Depression,” Conscience of a Liberal (20 March 2009).

Doug Short, “Four Bad Bears, ”DShort: Financial Lifecycle Planning” (20 March 2009).

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply