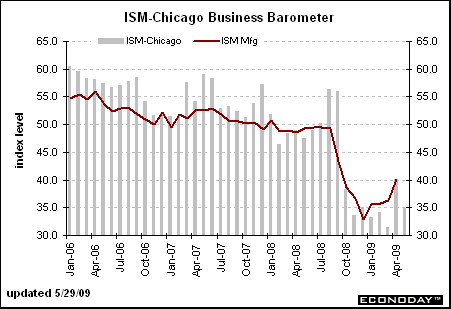

The Purchasing Index shows significant weakness with the index falling from a reading of 40.1 to 34.9. The consensus expectation was for IMPROVEMENT to 42! Any reading below 50 shows CONTRACTION and 34.9 shows extreme contraction.

Here are the details of the report from Econoday.

Highlights:

A “W” recession is what the Chicago purchasers report is pointing to as the headline index came in at a much weaker-than-expected 34.9, a reading well below 50 to indicate significant month-to-month contraction in business activity. New orders, always the key index, fell nearly 5 points to 37.3. Backlog orders fell nearly 11 points to a very depressed 26.3. Businesses, facing declining orders, continue to draw down inventories as much as possible with the index at 31.5. Job cuts are deeper than ever with the employment index down nearly 7 points to 25.0. Despite increases in energy and commodity prices, purchasers continue to report significant month-to-month declines in input prices with the index at 29.8. This report has a thin sample and a sample that includes both manufacturers and non-manufacturers. But its results are clear and do point to disappointing reversals in next week’s national purchaser reports from the ISM. Stocks fell back in immediate reaction to today’s report.

Market Consensus Before Announcement:

The Chicago PMI Business Barometer in April jumped nearly 10 points to 40.1. While the latest reading was still sub-50 and indicating contraction, it at least showed that the rate of decline has eased. Looking ahead, we may see further but incremental improvement as April’s new orders index jumped more than 11 points to 42.1

Backlog orders falling does not indicate future growth, that’s for certain. Sorry, but I just fail to see any of the supposed greenshoots that everyone is so enamored with. I see printing, buying our own debt, buying up failed businesses (but not yours), and false profits in the financial space.

A slowing of the freefall? Perhaps, but that’s just a function of math… Once something has fallen 50% or more, the RATE of fall MUST decelerate… no surprise there. Look at the chart above, you will see an index that was literally cut in half, from 60 to 30. Is it going to get cut in half again and fall to 15? Low odds of that, especially in a straight line. No, the real question is what is going to move our economy forward from here? Is it printing? Does that equal economic growth? How about financials who simply mark up their toxic loan and derivative portfolios? Does that equal growth? Does buying up GM, and handing out cash to financials in exchange for their toxic assets generate orders or create economic prosperity? Of course not… If we wish to return to a truly prosperous economy it will take the people to rise up and put an end the insanity…

Graph: Econoday

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply