Is it just Macro Man, or are we living in a world of five-minute macro?

It seems as if tradeable macro themes get as much traction these days as someone wearing ballet shoes on an ice rink. If you don’t like the theme of the minute, hey! Just wait. Another one will be along shortly.

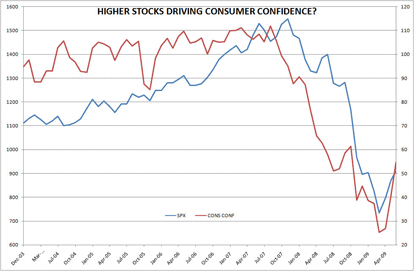

Such was the case yesterday, where the bother about Kim Jong-Il (was yesterday’s Team America reference too subtle?) vanished as soon as you could say “higher consumer confidence.” Yesterday’s 54.9 reading on the Conference Board measure was clearly a positive surprise, so it’s understandable that equities and risky stuff might rally. Yet the vast bulk of the improvement was down to the expectations component, which itself was probably driven by the recent run-up in equities. So we’re buying equities on the basis of a number that was driven higher by the fact that we’ve bought equities over the past month. Uh, OK.

Another “five minute macro” theme was the death of the dollar and the Chinese withdrawl from funding the deficit. Yesterday’s two-year auction had indirect bidders (read: foreign central banks) take down more than half the print, the highest proportion in five years.

Before we consign the funding fear theme to the dustbin of history, however, let’s see how the rest of the week’s auctions go, and whether Uncle Sam and label the market with (yet more) duration.

Indeed, there is a rising drumbeat of what you might call the “Goldfinger” theme (loving gold and expecting Mr. Bond to die.) Price action in bunds, which have rolled over and broken their 200 day MA, has been mirrored in numerous other markets.

Of course, as linked above, Macro Man wrote a similar post about bonds little more than a year ago. A cursory glance at the charts therein will reveal that prices were a hell of a lot lower then, and that “key breaks” were not sustained.

So the world of five-minute macro is a hardly new, and simply represents a relatively noisy period of back-and-fill price action. Macro Man can only hope that the trend of five-minute macro steers well clear of economic datapoints like these.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply