Sigh. If only Macro Man had been able to hire Costanza over the weekend.

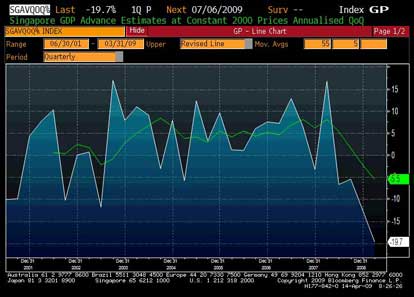

For if he had, then ol’ George would have told him that the clear response to a country reporting a -19.7% saar GDP figure in Q1 and adjusting its exchange rate peg lower would be to buy as much of that currency as you could get your hands on.

In all the years that Macro Man’s been in the market, he can’t ever remember a GDP print as low as -19.7. That’s the economic equivalent of getting hit with one of those Hollywood movie asteroids, the eruption of Krakatoa, a 9 Richter-scale earthquake, and the Great Fire of London….at the same time!

And so it’s happened in Singapore. As a reaction to the shock hitting the economy, the MAS re-centered the SGD band at the level prevailing last night: a modest step lower in the SGD. However, they didn’t widen the band, and perhaps more importantly warned about “undue” weakness in the SGD.

Now, from Macro Man’s perspective, when you’re hangin’ a minus twenty on GDP (-11.5% y/y), the only “undue” weakness in your currency is if it dispensed in lieu of Charmin in public lavatories. Anything short of that falls within the bounds of reason. Still, with the market rather short of SGD, we were treated to another Costanza-like reaction of the SGD screaming higher on a shocking growth figure and a SGD band re-centering.

Meanwhile, back in the US, Goldman Sachs (GS) recorded super earnings in the first part of the current fiscal year, announcing Q1 earnings of $3.39 per share, well above the consensus expectation of $1.64. Except that they didn’t. Buried in the small print, it appears that as the Easter Bunny was delivering candy and eggs to children all over the world, he also desposited a small turd in the GS income statement. In December, which magically falls outside the aegis of any reporting period (falling through the cracks, as it were, in the transition from investment bank to bank holding company) , the firm lost $2.15 per share. Add that to the Q1 earnings figure, and you get a result that is comfortably lower than consensus.

More telling was the GS announcement of their intention to sell shares to the public. While Macro Man occasionally takes Goldman to task, he will happily concede that, individually and collectively, they are some of the smartest guys on the street. And when a smart guy offers to sell you something in an industry that has more than doubled in value over the past month….well, judge for yourself what the appropriate response is.

All of this has left Macro Man wistful, slightly bitter, and more than a little jealous. His carefully-laid plan to reach a P/L summit this month has ended with his portfolio nursing a broken leg back in base camp. Adding insult to injury, he doesn’t work for an institution where he has the option of valuing his book using a model derived from those titans of modern finance, Andersen, Grimm and Grimm.

Perhaps its the accumulated fatigue of the last month’s trading, or perhaps its the literal tiredness from getting Costanza’ed in the wee hours of the night by the market and the MAS. But your humble scribe is suffering from a deficit of both conviction and performance, and could use a few more data points.

In the meantime, it’s back to the drawing board for Macro Man. He really needs to find a market where they’ve never heard of Seinfeld.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply