As part of the EU/IMF plan to resolve Greece’s debt crisis and to make its economy more competitive, the government announced a couple of weeks ago plans to revamp labor relations laws and social security entitlements. The minimum monthly wage for new entrants into the labor market will be decreased from 700 euros to 560 euros, and workers will be required to have 40 years of employment to receive a full pension (which has also been subject to significant reductions). And companies would face far fewer restrictions with regard to layoffs and layofff compensations–which have been cut in half. The strategy is obvious: Greece wants to win the race to the bottom in the Eurozone, that is, to win competitive advantage by having the region’s lowest and meanest living standards. That, of course, will now be an even tougher race to win, with the recent entry of Estonia into the Eurozone.

Even in the best of times, this would be a dangerous strategy. Given that all members of the Eurozone have removed trade and capital barriers and adopted a common currency, there is no possibility of gaining advantage through the normal methods of currency devaluation or by tacking tariffs onto imports. This means that trade surpluses can be achieved only by lowering costs and increasing labor productivity. Costs are cut by slashing wages and benefits; productivity is increased by working employees harder—downsizing the labor force, longer hours, shorter vacations, and postponed retirement. But every nation will adopt the same strategy. Matters are made worse by the deep global crisis. Markets for exports are depressed and tourism is down. Meanwhile, governments are cutting spending—especially in those areas that could actually help increase productivity and enhance competitiveness: public infrastructure investment and education. Lower wages and retail sales, and a smaller workforce result in collapsing government tax revenue—fueling a vicious cycle of spending cuts but falling tax revenue so that budget deficits cannot be reduced.

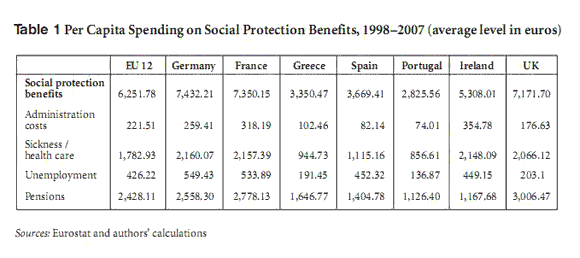

To be sure, Greece has had its problems. Its labor costs have grown significantly over the past decade, much faster than those of Germany and other Eurozone nations. But the notion that workers in Greece have been enjoying the fruits of an overly generous welfare state is belied by the facts. (See here) In reality, the Greeks have one of the lowest per capita incomes in Europe (€21,100), much lower than the Eurozone 12 (€27,600) or the German level (€29,400). Further, the Greek social safety nets might seem generous by US standards but are modest by European standards. On average, for 1998-2007 Greece spent only €3530 per capita on social protection benefits–slightly less than Spain’s spending and only €700 more than Portugal’s, which has one of the lowest levels in all of the Eurozone. By contrast, Germany and France spent more than double the Greek level, while the original Eurozone 12 level averaged €6251.78. Even Ireland, which has one of the most neoliberal economies in the euro area, spent more on social protection than the supposedly profligate Greeks.

Greece is also supposed to suffer from inefficiency and cronyism in its government—so its administrative costs should be higher than those of more disciplined governments such as the German and French. But this is obviously not the case as the table below demonstrates. Even spending on pensions, which is the main target of the neoliberals, is lower than in other European countries.

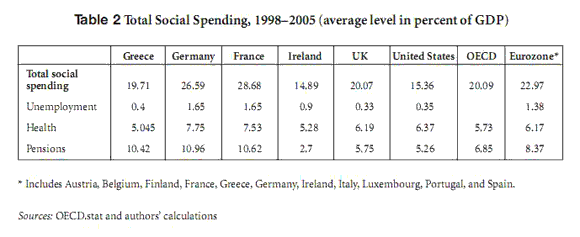

Table 2 shows total social spending of select Eurozone countries as a per cent of GDP. Through 2005, Greece’s spending lagged behind that of all euro countries except for Ireland, and was below the OECD average. Note also that in spite of all the commentary on early retirement in Greece, its spending on old age programs was in line with the spending in Germany and France.

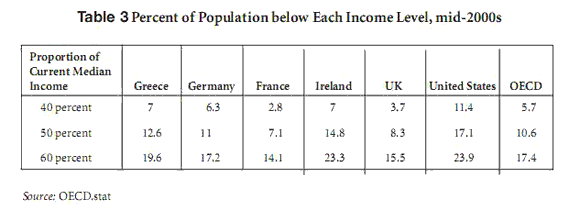

Greece has one of the most unequal distributions of income in Europe, and a very high level of poverty, as the following table shows. Again, the evidence is not consistent with the picture presented in the media of an overly generous welfare state.

The proposed cuts will simply widen the gap between living standards in Greece versus those in the wealthiest Eurozone nations.

This is a race to the bottom that can only be won by the biggest loser. It is bizarre that the EU and the IMF are promoting such a contest since it is completely inconsistent with the longer-run strategy of convergence across Euroland. Indeed, it will ultimately destroy the union.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Thank you for this post. It is showing data not announced through other media sources.

The IMF is only interested in profiteering at the expense of the weaker countries like Portugal and Greece. Its not controlling the economy of the eurozone countries, market conditions are, and no one wants overpriced inferior products, that every sector of eurozone manufacturers produce in not needed multitude, in an overvalued Euro currency.

The next stage of this manufactured block is liquidation of the weakest, followed by more currency printing, the currency increasing, ending with depression and devaluation. The risk cannot be averted because others have crossed that bridge and were first to revalue their currency.

What happens now is that eurozone countries have price hikes on everything, effectively making the entire Euro currency countries uncompetitive to its export markets and its own consumers who import lower priced better quality products.

These price increases will determine the pressure on the Euro and the consumer who has less to spend and the spiral is downhill for both. It was and is way overvalue as stated in October 2010, and now all other currencies are in the race to devalue at the expense of the irrevocably fixed Euro. The result a double dip recession and inflation out of control.