Five years ago, nearly every natural resource investor knew two things to be true. First, South Africa was the world’s largest producer of gold and second, that the U.S. used more energy than anyone else in the world. Titles both countries had held for a century.

Now, both of those truisms are false.

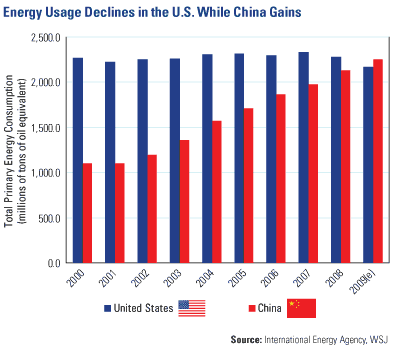

The International Energy Agency (IEA) reported this week that China overtook the U.S. in energy consumption last year, outpacing the U.S. by 4 percent (2.252 billion tons vs. 2.170 billion tons). The IEA measures energy usage in tons of oil equivalent which includes all crude oil, nuclear power, coal, natural gas and renewable sources.

The International Energy Agency (IEA) reported this week that China overtook the U.S. in energy consumption last year, outpacing the U.S. by 4 percent (2.252 billion tons vs. 2.170 billion tons). The IEA measures energy usage in tons of oil equivalent which includes all crude oil, nuclear power, coal, natural gas and renewable sources.

The IEA’s chief economist said the announcement begins “a new age in the industry of energy.”

While most, if not all, had predicted China would become the world’s largest energy user, many didn’t think it was going to happen for another five years. China’s rise to the top can largely be attributed to a decline in energy usage in the U.S. China’s 2009 energy usage was below that of the U.S. from 2004-2008, before the financial crisis.

In fact, just ten years ago China’s energy consumption was less than half that of the U.S., according to the Wall Street Journal. The U.S. remains the biggest energy consumer on a per capita basis, the IEA economist said, consuming three times more per citizen than China. The U.S. also consumes more than twice the amount of oil that China does in a day.

But like most things with China, that statistic won’t last long. The IEA reported in last year’s World Energy Outlook that China and India will represent more than half of all incremental demand increases by 2030.

Well aware of the global politics of energy, the Chinese government was quick to dismiss the story as an overestimation by the IEA. Probably not the last time we’ll see modesty from Beijing as the country continues to put “world’s largest” in front of more and more resources.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply