But I fear that Roger Lowenstein and his assessment on how long it will take the U.S. economy to return to normal may be right. The crux of his analysis is that household balance sheets were decimated in this recession and to fix them will take years. As part of this slow process households are deleveraging and saving more. Though needed, these structural adjustments imply sluggish growth. And if this process takes years as indicated by Lowenstein then we are looking at sluggish growth for some time. Here is Lowenstein:

Eschewing trips to the mall, Americans are paying off credit-card balances and home-equity lines. Despite low rates, mortgage demand has plummeted.

Some people have no choice but to pare their debts (indeed, some are being foreclosed on). For others, call it morning-after sobriety or late-blooming prudence. Losing income tends to bring on a case of the nerves, and half of American workers have suffered a job loss or a cut in hours or wages over the past 30 months. And, need we add, people’s stock portfolios are not what they were.

The economic term is “deleveraging”; it means that, as opposed to the normal state of affairs, in which, each quarter, people borrow more money and banks issue more loans, credit in the economy is shrinking. Remarkably, this deleveraging has been going on for nearly two years.

To return to the status quo of before the housing boom — say, back to debt to income ratios prevailing in 2000 — it would take five more years of deleveraging at the current rate. Deleveraging cycles are rare, notes David Rosenberg, an economist with the Toronto firm Gluskin Sheff, but five to seven years is typically what they take.

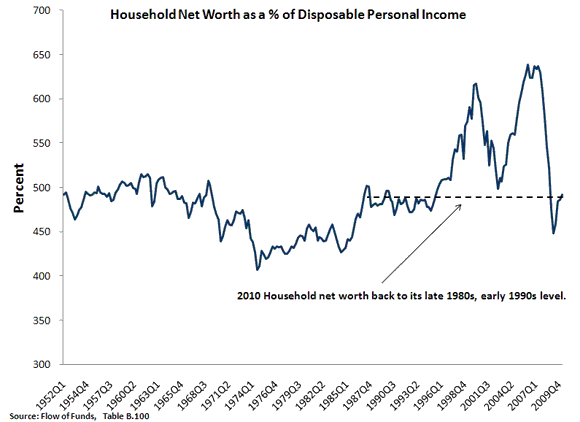

I really hope this assessment is wrong. Looking to the data, though, on household balance sheets does seem to lend itself to Lowenstein’s dour assetment. Below is household net worth (i.e. assets minus liabilities) as a percent of disposable income up through 2010:Q1. The data comes from the Flow of Funds table B.100.

Household net worth is close to what it was in the late 1980s, early 1990s. Obviously, most of the fall in household net worth has come from a decline in asset values. Liabilities have not change much. This is very evident in if one looks specifically at residential real-estate assets versus residential mortgage debt. Truly this is the revenge of the balance sheets.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply