Tesla Motors (TSLA) became the first American automaker to go public since 1956 today as shares began trading under the ticker TSLA on the Nasdaq. With its most expensive car selling for more than $100k, Tesla is looking to strike a chord with wealthy yet environmentally conscious car buyers. Later this year, Chevrolet hopes its Volt (a price tag about half the size of the Tesla Roadster) will become the first electric car for the masses.

Building this industry from the ground up isn’t an easy task. There were more than 260 million registered vehicles in the United States last year and only a small percentage of those are fueled by alternative energies.

The transportation sector consumed 27.92 quadrillion British thermal units (Btus) of energy in 2008, roughly 28 percent of all energy consumed in the U.S. Of that, petroleum products accounted for nearly 95 percent. Electricity and natural gas combined accounted for less than 3 percent.

The transportation sector consumed 27.92 quadrillion British thermal units (Btus) of energy in 2008, roughly 28 percent of all energy consumed in the U.S. Of that, petroleum products accounted for nearly 95 percent. Electricity and natural gas combined accounted for less than 3 percent.

This story isn’t new. Petroleum products accounted for 95 percent, 97 percent and 96 percent of energy usage by the transportation sector in 1965, 1985 and 2005, respectively.

While Tesla, Chevrolet and others battle it out in the electric car market, tycoons like T. Boone Pickens have been outspoken proponents of natural gas vehicles (NGVs).

Currently the U.S. only represents a smidgen of the global NGV market. Of the more than 10 million NGVs around the world, only 110,000 drive on America’s roadways. Many of these are in cities that have converted their municipal fleets of buses and trucks to liquefied natural gas (LNG).

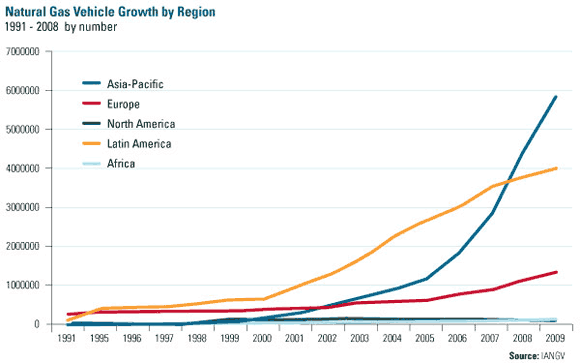

As you can see from the chart, the U.S. trails China, Colombia and Argentina in the NGV market. More than half of the total vehicle population of Pakistan (52 percent) is NGVs, making it the world’s largest market.

Overall, the global NGV market has grown by more than 20 percent a year since 2000, according to the International Association for Natural Gas Vehicles (IANGV). In the past four years alone, the Asia-Pacific Region has increased its number of NGVs from just over 1 million to almost 6 million.

Some have argued that in order to increase the usage of NGVs in the U.S., there needs to be massive investment in fueling stations and infrastructure but that’s not necessarily true. There were 1,300 refueling stations servicing the 110,000 NGV vehicles as of 2007—roughly one station for every 85 vehicles, according to IANGV statistics.

That’s a substantially better ratio than the world’s leading NGV markets. In Pakistan, there is one fueling station for every 750 NGVs. In Iran it’s one for every 1631 vehicles. In India it’s one for every 1670.

In the near term, it’s unlikely either electric cars or NGVs will grab substantial market share in the U.S. auto business but after 2008’s sky-high gas prices and BP’s Gulf disaster, the American public may finally be ready for an alternative.

None of U.S. Global Investors family of funds held any of the securities mentioned in this article as of March 31, 2010.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply