Some dish detergent and hot water is all it takes to clean up a pelican that is being smothered by spilled crude. Nobody knows how to clean up the Obama administration’s energy policy, which is likewise floundering in goo.

Some dish detergent and hot water is all it takes to clean up a pelican that is being smothered by spilled crude. Nobody knows how to clean up the Obama administration’s energy policy, which is likewise floundering in goo.

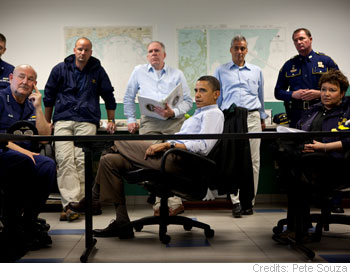

The president is back on the Gulf Coast this week to show everyone how involved he is in managing the problem, and how very, very angry he is about the ongoing spill. We are supposed to see that he is doing something about it.

He is doing a lot of things. The problem is that the things he is doing, taken together, don’t make any sense.

Obama has called on Congress to roll back “billions of dollars of tax breaks to oil companies so we can prioritize investments in clean energy research and development.” Legislative leaders are practically tripping over one another to comply so they, too, can show how tough they can be on that dirty oil industry. Make things expensive enough or legally and financially risky enough, and we can get the oil industry to do its drilling elsewhere.

If Obama actually wants to end offshore drilling, his proposals might be coherent. But, less than a month before the Deepwater Horizon blowout, the president actually called for expanding offshore drilling. In waters off northern Alaska, 130 million acres would have been opened for exploration. The plan also would have opened 167 million acres of ocean along the Atlantic coastline, putting an end to the long-standing moratorium that remained intact through Texas oilman George W. Bush’s eight years as president.

Obama’s offshore drilling plan is now, officially, toast. At the end of May the administration announced that it was putting all applications for exploratory drilling in the Arctic on hold until 2011 and extending a moratorium on permits to drill new deepwater wells for six months. The government also has called an indeterminate time-out on drilling in shallow coastal waters because, at the moment, nobody knows what the president wants to do about shallow-water drilling.

So we’ll need to look for oil someplace else for the time being. But Obama is also against increasing oil imports. “Without a major change in our energy policy, our dependence on oil means that we will continue to send billions of dollars of our hard-earned wealth to other countries every month, including countries in dangerous and unstable regions,” he said.

If the president doesn’t want to get oil here and he doesn’t want to get it there, the only alternative is to increase energy production from other fuel sources. In his Jan. 27 State of the Union address, Obama expressed hope for “a new generation of safe, clean nuclear power plants.” In February his Department of Energy proposed $36 billion in new federal loan guarantees for nuclear power. “It’s ironic, but Obama could end up being the biggest pro-nuclear power president since Dwight Eisenhower,” said Henry Sokolski, executive director of the Nonproliferation Policy Education Center.

But, while Obama may be in favor of building more nuclear power plants, he is against doing anything to find a way to store the hazardous waste those plants will produce. By nixing funding earlier this year for the Yucca Mountain repository program in Nevada, Obama pleased Senate Majority Leader Harry M. Reid (D-Nev.) and scored himself some points in a swing state, but he also eliminated this country’s only real plan for dealing with its nuclear waste.

A Department of Energy statement on the termination on the Yucca Mountain project included the comment, “The President…has made it clear that the Nation needs a better solution than the proposed Yucca Mountain repository.” So far, Obama has given no indication as to what that solution might be.

I suppose, given his lack of prior executive experience, it is no surprise that this president has trouble making decisions. He probably is tempted to call for a commission to determine national energy policy, but he has played that political card so often that he would risk inducing actual laughter.

The president’s most effective recent approach is the “beat on BP” strategy that he is scheduled to present to the nation tonight in his first televised address from the Oval Office. Though the details remain to be seen, the president apparently wants BP (BP) to turn over a sizable chunk of its cash to someone independent of the company (though not necessarily independent of Obama’s government) to dole out to the spill’s real and alleged economic victims. I very much doubt the administration’s claims that it has the legal power to enforce this demand, but it may not matter. BP just might be willing to go along anyway, especially if it can find a way to cap its financial exposure at some ultimately manageable level.

Otherwise, Obama’s current energy plan is a rhetorical mishmash of verbiage about green development and carbon caps which says almost nothing useful about how we are going to fuel our vehicles, heat our homes and power our gadgets. If we could turn the president’s hot air into motor fuel or electricity we would be in good shape, but that isn’t in the cards.

Despite his lack of a plan, Obama vows to somehow produce energy legislation this year. We can only hope that the addition of Scott Brown’s Republican vote in the Senate will prevent the president and his party from afflicting us with an energy “policy” that has no idea where it wants to go or how it wants to get there.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

I agree with most of your article, except for Obama's "afflicting us with an energy “policy” that has no idea where it wants to go or how it wants to get there." Obama and his comrades actually know very well where his "energy policy” will take us.

Obama's "green energy tax" (Cap and trade) represents huge taxes and cost increases, which will hurt mostly the poor and the middle class. Cap and trade will give dictatorial powers to Obama and will further enrich his billionaire friends (Gore, Soros, Goldman Sachs, Obama’s Chicago Climate Exchange friends, GE, the United Nations, etc.) — all at our expense and at the expense of our children and grandchildren.

Obama and his comrades know how bad their "green energy tax" (cap and trade) would be for us, but they want to force us to swallow it because they expect to further empower and enrich themselves at our expense.

Numerous economic studies support a leaked memo from the Obama administration that said restricting carbon dioxide emissions will have a severe negative impact on the U.S. economy.

Applying the U.S. Energy Information Administration’s economic forecasting model, Science Applications International Corporation reports reducing U.S. carbon dioxide emissions 70 percent by 2050 could kill 4 million U.S. jobs, cause gasoline and electricity prices to more than double, and reduce household income by more than $7,000 each and every year. http://www.heartland.org/publications/environment…

IMPEACH Obama before it's too late!