Ever since the ClimateGate scandal broke, I have been asked “how do we play this?” With the chaotic failure of Copenhagen, this is a more pressing question, as bets are being shuffled in cleantech with the new change of assumptions. At a high level the primary investment implications are to move out of sectors that require government subsidies or carbon taxes, and into sectors with economic competitiveness. This is not to say we won’t see attempts to pass cap & trade or carbon taxes, but they seem likely to give way to a different spin on cleantech, that of saving imported oil or saving green jobs not saving the planet.

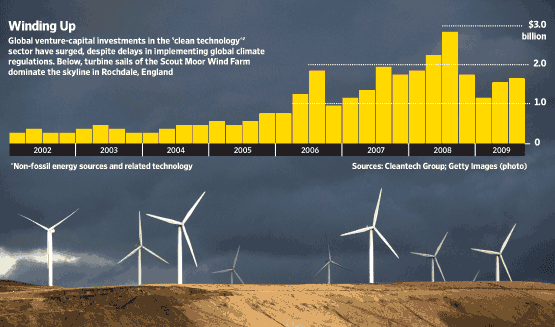

Also, the exuberance for CleanTech investing has abated even as touters try to obscure this. Check out this chart, and note how it says cleantech investing has “surged” even as the chart shows a 50% drop this year. The WSJ ran a post-Copenhagen piece about cleantech firms having to “reset” their strategies. They also agree with my thesis posted Dec7 of a change in the rationale to “economic development or reducing dependence on Mideast oil, [rather] than at threats posed by global warming.”

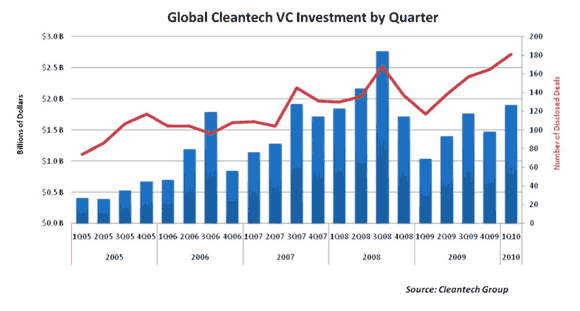

Yet this tone of caution does not mean there aren’t good areas for investment in CleanTech. It also doesn’t mean that CleanTech is going away. Unlike last time around, in the ’80s, which was driven by big corporate projects, this time around it is being driven (in part) by the venture capital community. The diversity and energy of venture investors is impressive. As a consequence, even though the Dollar volume of CleanTech is still down from the peak in 2008, the number of CleanTech deals is now back to high levels. See chart from GreenBeat:

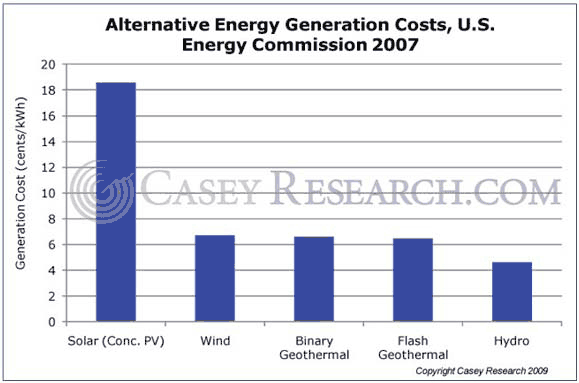

With this in mind, we need to start where green technologies are or will soon be price competitive. Casey Research has a really useful newsletter on point, and here is on of their charts:

Let’s walk through major CleanTech sectors with this chart in mind.

Carbon Trading

This one is easy: stay away, stay far away. This will be the first casualty of the failure at Copenhagen. Even as the masses assembled, Denmark was marked with a huge scandal over fraud in carbon markets. The Danish scams were in the Billions of Kroner. Australia’s Cap & Trade bill failed on the eve of the confab. Now, after the confab, the scams are being found more broadly, across Europe. Organized crime may have skimmed an astounding 5B Euros ($7.4B).

This one is easy: stay away, stay far away. This will be the first casualty of the failure at Copenhagen. Even as the masses assembled, Denmark was marked with a huge scandal over fraud in carbon markets. The Danish scams were in the Billions of Kroner. Australia’s Cap & Trade bill failed on the eve of the confab. Now, after the confab, the scams are being found more broadly, across Europe. Organized crime may have skimmed an astounding 5B Euros ($7.4B).

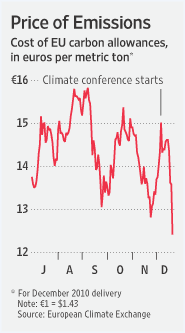

This chart from the WSJ shows how carbon allowances have plunged post Copenhagen. To make carbon-free technologies like solar competitive, these allowances need to be above E60/tonne. It has fallen in half from a recent high of E25 to below E12.50. Quite a drag, says the Silicon Valley cleantech press.

Since Copenhagen, it has gotten worse. In March 2010, the Chicago Climate Exchange has been going through record lows of 10c per tonne. Two carbon exchanges in Europe had to suspend trading when a new scandal emerged: some certificates of emission reduction had been illegally reused.

Geothermal

The authors of the Casey Energy Report make a great case for geothermal. Right now geothermal is used near hotspots of surface geothermal activity. The core insight is that future technology can turn almost any area into a geothermal hotspot, providing a 24/7 energy source which has very low incremental costs once set up. No need to worry over the sun shining or the wind blowing. There is a public play here, recommended by David Fessler:

This is an area with plenty of potential, particularly in the western United States. When it comes to profitable, large-scale geothermal and recovered power producers, Ormat Technologies (NYSE: ORA) is pretty much the “Lone Ranger,” but many smaller operations will likely fire up geothermal plants in 2010.

The biggest setback to geothermal was a Swiss project which triggered an earthquake. There is the well-funded (pun intended) AltaRock project just north of SF, near the San Andreas fault. Local geologists seem a bit sanguine about this. Hmmm. Does deep drilling and pushing pressurized water down cause earthquakes? Why no earthquakes then in oil country, where they drill deeper and also push pressurized water and Co2 down to break rock (a process called fracking)? Because the very structures which trap pools of oil also bury geothermal effects, and make make geothermal diseconomical; it works best where the geothermal activity is near the surface – and those are usually areas of tectonic activity. Earthquake zones.

Deep geothermal promises unlimited energy anywhere. The industry believes of course that the micro-earthquakes from geothermal deep wells are not a worry. The implication is that instead of going for the low-hanging fruit of surface geothermal, we should drill geothermal outside of the tectonic areas, and trade-off the higher cost for safer unlimited power.

Maybe they are right, but the early projects are stumbling. Those in SF need not worry – after the Basel project was suspended, AltaRock abandoned The Geysers area and instead focused on deep drilling and fracking. Unfortunately, they only got down 4400 feet (of 12,000) before the holes they were drilling collapsed, due to a tricky type of rock layer. Another deep drilling company, Geodynamics of Australia, has been delayed in its Cooper Basin project due to human error, not nature. And so it goes across the board.

One way to play geothermal (besides Ormat, mentioned above) is to invest in rollup plays, such as Ram Power (TSX: RPG) and Magma Energy (TSX: MXY). The rollup of smaller geo players makes financing easier, since the larger company can pursue multiple projects, and like an oil wildcatter, still win even if some fail. Also, larger firms find it easier to get contracts with utilities. Ram has a project in Nicaragua broken into phases, where if the first works, the second will be easier to finance. The remaining small microcap players are relying on DoE grants to get started.

On the private side, a company to watch is Vulcan Power, which just raised $108M to develop 300 MW in Nevada, and send it over the DSierra’s into California. Vulcan has the coveted power purchase agreements (PPAs) from SoCal Edison (LA), PG&E (SF) and a Nevada utility. A broader set of eight geothermal investment candidates is discussed here.

Wind

Wind can augment base power and average down electricity costs. A recent study in Europe showed a €3-23 drop per megawatt-hour due to using wind instead of going out into the spot market for swing power. At low demand times, coal could be kept off; and a peak times gas need not be turned on. The marginal cost of wind is low, making it a promising base energy source. The problems come in getting the turbines financed and connected to the grid.

Wind can augment base power and average down electricity costs. A recent study in Europe showed a €3-23 drop per megawatt-hour due to using wind instead of going out into the spot market for swing power. At low demand times, coal could be kept off; and a peak times gas need not be turned on. The marginal cost of wind is low, making it a promising base energy source. The problems come in getting the turbines financed and connected to the grid.

T. Boone Pickens made a play for wind in Texas, then very visibly backed out of it. Wind would work well offshore of New England, but has been blocked by the Kennedy’s, among others, for ruining their views. (After Teddy’s death, it got approved, but still faces additional obstacles to getting built.) Theoretically, a spine of wind down the Great Plains would make sense, given the wind there. Windmills could become a cash crop.

Part of what deterred T. Boone as well, besides not being able to shake down governments for subsidies nor investors for funding, was the need to connect the windmills to the grid. In vast areas where wind would work, the grid is inadequate, non-existent, or caught in political wrangling. Hard to make wind a cash crop if the grid won’t connect to it! Watch for approvals of new powerlines to renewable areas to inform as to where to focus investments, such as just happened in SoCal.

A microcosm of the wind market is the Bonneville Power Authority, which runs hydro on the mighty Columbia River and wind in the breezy Columbia Gorge. The actual output in practice is far less than expected. This calls into question the cost estimates of wind. The BPA has found that at peak wind, they would overwhelm the transmission lines, and have to cut off turbines; and further have had to dump water over the dam without getting power from it due to the way nature works (the water flows even as the wind blows).

If you want to play this, David Fessler has a wind recommendation:

Wind installations will continue during 2010, but well off the record pace of 2008. Nearly 300,000 megawatts of wind farms are waiting for grid enhancements and upgrades. Vestas (Nasdaq: VWDRY.PK) is the world’s largest wind turbine manufacturer, with over 39,000 turbines installed around the world.

Back to the theory of a spine of wind down the Great Plains. Yogi Berra once quipped:

In theory, theory and practice are the same. In practice, they are not.

In theory, wind power makes sense. In practice, it doesn’t. Before investing in wind, read the ghosts of wind farms past. Wind lasts until subsidies are pulled, and then rusts away. Many of the turbines in the three primary wind spots in California are broken or turned off. The blades may slowly turn, giving the illusion of operation, but for many of the windmills, no power comes out. Farms in Hawaii from the first wave of subsidized wind are rusting away, unused and unusable. Now wind farms in Europe from the second wave are at grave risk:

European wind developers are fleeing the EU’s expiring wind subsidies, shuttering factories, laying off workers, and leaving billions of Euros of sovereign debt and a continent-wide financial crisis in their wake.

While the recent problems of Greece and the other PIIGS may have out a damper on Euro wind subsidies, China is still going gangbusters. Last year wind increased 30%, but with the Euro troubles this will slow dramatically in 2010. China was about 1/3 the increase last year, and that should continue until their bubble bursts – which may already be happening. China has begun tightening their over-heated growth, which should also lower the growth in wind.

Another red flag was raised in Minnesota recently, where their wind turbines froze. This problem may not be fixable, turning another expensive ($3.3B) wind farm into a rusting eyesore and monument to the failure of central planning & subsidies. No nuclear, coal or gas plant gets turned off like this. Those plants work at 85% or higher of stated capacity, whereas wind stumbles in at 33% when new, and lower and lower as they age and break.

The wind area is littered with puff pieces, such as this one from a normally decent CleanTech blog site, or the WSJ puff piece and chart that start this post. These sorts of analyses should be looked at skeptically by an investor. They extrapolate from the recent past to paint a picture of a green future without looking inside the trends and what had been driving them. Extrapolating growth in 2009 with heavy green subsidies as part of global stimulus is risky as this subsidies are drying up, especially in Europe and now China.

Still not seeing which way the wind is blowing? Here is a list of ways to invest in wind.

Solar

The solar sector is 3x more expensive other mainline energy sources, making it a bad bet for base energy production. Potentially solar can run down a cost curve, but it is having a terrible time getting out of the starting gate. I have an indirect interest in BrightSource, a solar-thermal engineering firm. Solar-thermal uses mirrors in the desert to drive a heat pump to spin a turbine. The team behind BrightSource was the pioneering team in the ’80s behind solar-thermal in that wave of energy consciousness, and near the end had 90% market share. Yet steadily the subsidies were pulled as oil continued to get cheaper and cheaper, and the lights were turned out on their first company. Their new company hit a serious bump in the road this summer, when their plans to build a huge planet in the Mojave Desert were stymied by the local eco crowd (NIMBY!) as well by Senator Diane Feinstein (DiFi).

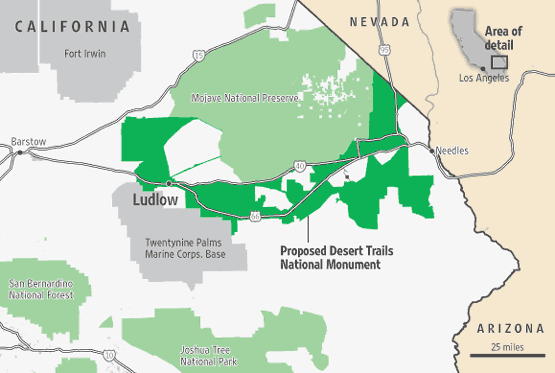

The WSJ reported that DiFi is pushing for a huge National Monument to cover much of the Mojave. (See map.) She must have thought the timing right, given the positive reception to the recent PBS series The National Parks: America’s Best Idea, by Ken Burns. She would protect over a million acres. California has required utilities to invest in solar, and they would need 128,000 acres for that; but almost a million acres of projects have been proposed (which is down from a initial 2.5 million acres). Projects are being cancelled; the NYT says DiFi’s move has further scuttled 13 big solar plants and wind farms planned for the region. The bill does try to speed up approval, but the local NIMBY crowd will still have to be dealt with. The WSJ dryly notes that:

The Mojave is particularly attractive because it not only offers nearly uninterrupted days of bright sunshine in a sparsely populated area, but lies near a major electric-transmission corridor from California to Nevada.

I suppose there is always Arizona next door, but this puts a huge damper on utility-scale solar.

Another obstacle is the race to get the facilities started before the end of 2010 in order to qualify for Stimulus money worth 30% of the cost. Despite a lot of attention on this issue and an increase in personnel to handle permits, the process seems excessively slow and burdensome, if not a bit random at times, and solar projects to build an astounding 11 gigawatts of electricity are at risk of missing the deadline.

Possibly the solution lies in photovoltaic cells (PVs). The SciAm article A Solar Grand Plan (you can download it here) paints a compelling picture of mass PV farms across the Desert Southwest, joining that theoretical spine of wind down the Plains. It is difficult to see how it is more than science fiction, unfortunately. It requires some engineering breakthroughs, such as mass storage of energy in caves/mines using compressed air, and superconducting DC lines that stretch from the Desert Southwest to populated centers across the country. More daunting is the need for 30,000 sq miles (20 million acres) to be covered with PV cells along with concrete, power lines, roads, and the support for a massive construction project. To give that perspective, that is the size of land between SF and LA, from the ocean to the mountains. Hard to see how that swathe can be available somewhere, and more than that can be built upon. That is a lot of Mojave Deserts, and we just lost that one. We might be able to find some of that area available in Arizona, but the system needs water to construct and water to maintain (PVs get dusty).

Still, it appears that distributed PV cells (small panels on homes and businesses) have a market, because the savings at the retail end of the utility price curve are enough at the margin to cover the 3x higher cost. Currently the Chinese are dumping PVs into the US, reusing excess semiconductor capacity. This is depressing domestic production but incenting domestic uses.

A lot of money has been put behind thin-film PVs, which should be markedly cheaper than silicon PVs. A number of thin-film ventures are coming online in 2010. (Disclosure: I have an indirect interest in Miasole, one of the thin- film ventures). Perhaps the cheap Chinese PVs will make a market for thin-film to fill.

Thin film is also a candidate for large utility-scale solar fields. Chevron has just launched Project Brightfield to test PVs from 19 companies at an old refinery near Bakersfield, CA. Six winners were thin-film (including Miasole). Typical of the time scale of utility-scale projects, Chevron expects to test for three years, at which time it *might* pick a winner. This combination of long sales cycles and winner-take-all makes these projects more akin to pharma than IT investing.

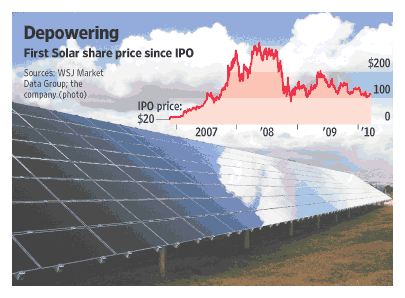

Caution is warranted in solar, as the initial exuberance has fallen to hard economic and logistical realities. The whole sector has performed poorly, even with the rise of the Hope Rally off the Mar 2009 bottom. This may lead to consolidation and shakeout, per David Fessler’s comments on this sector:

This is one sector that should continue to see consolidation in 2010. With an excess of silicon wafer capacity and new low-cost thin-film designs just now coming into production, expect the transition from silicon-based panels to thin film to continue in 2010. And despite the negative press, one of the ultimate winners in this space will be First Solar (Nasdaq: FSLR).

Here is a bit more on First Solar, from Toby Shute, who posts on solar regularly in SeekingAlpha:

The thin-film kingpin came back the next day with guidance for 2010, plus news of a major capacity expansion. The forecast was notable in that it went beyond the usual sales and margin figures, and it included free cash flow guidance. Free cash flow is a rare commodity in this capital-consuming industry. With such a robust financial profile, it’s no surprise that First Solar is comfortable expanding its current capacity by nearly 50%

In a coming shakeout, seizing share by expanding capacity can make sense, yet the story above about the loss of most of the Mojave for utility-scale solar puts a huge risk into First Solar. GreenBeat has this story:

It turns out First Solar has dropped four large-scale solar plant projects in California alone, according to a report from investment firm Wedbush Securities. In each of these cases, the company’s plans were denied by the Bureau of Land Management. At the same time, it was revealed that one of its 150-megawatt projects slated for 2,100 acres in Colorado has now also been cancelled.

The central message behind First Solar’s recent success was that utility-scale solar plants would soon be a reality. [Now] it looks like First Solar is having more trouble than it bargained for, boding even more poorly for others striving toward the same goals. In short, utility-scale solar could still be a ways away.

Solyndra, a thin-film maker competing with First Solar, is poised to go IPO. An analysis of their filing, however, shows they are way behind First Solar in their PV cell costs: they sell for $3.42/watt but cost $6.29/watt to make. Ouch. Apparently their PVs are easier to install, and that saves their buyers as much as $2-4/watt, dropping the effective cost to $2.79-4.79. But this doesn’t appear competitive:

Compare this to First Solar (FSLR). First Solar’s average manufacturing cost per watt declined by $0.23 per watt, or 21.3%, from $1.08 in the three months ended September 27, 2008 to $0.85 in the three months ended September 26, 2009.

Or compare it to a silicon solar vendor like Trony Solar (TRO). Trony Solar’s average manufacturing cost was $1.15 per watt for the fiscal year ending June 30 this year, the company said in its SEC filing. From June to September, the company lowered the cost to $1.09 per watt.

Solyndra must also compete head-on with the plunging price of flat plate panels from BP Solar (BP), Suntech (STP), Mitsubishi, etc. while lowering their cost almost an order of magnitude from about $6 per Watt to under $1 per Watt.

While First Solar still looks relatively attractive, whether they are a buy on an absolute basis is unclear at best. First, the collapse of utility-scale projects must be taken into account. Second, they seem poorly poitioned to go into residential; Solyndra targets rooftops with a unique cylindrical design. Third, as a stock, First Solar is hurting as solar subsidies subside. Key point:

While First Solar still looks relatively attractive, whether they are a buy on an absolute basis is unclear at best. First, the collapse of utility-scale projects must be taken into account. Second, they seem poorly poitioned to go into residential; Solyndra targets rooftops with a unique cylindrical design. Third, as a stock, First Solar is hurting as solar subsidies subside. Key point:

Solar power relies almost completely on subsidies, and those are being slashed in Germany, where First Solar made 65% of its sales last year.

The stock is down 40% and is likely to continue dropping. Its core business is suffering due to cheap solar panels coming in from China and the difficulties of transitioning to a systems provider for solar farms. The WSJ thinks the stock could drop another third.

More generally, the PV side of solar seems to be destined to high capital costs for PV fabs, like chip plants, and commoditized pricing, as has afflicted the DRAM market, or the PC market. If you decide to invest in PVs, educate yourself on the DRAM story, and look for PV makers who have a way to differentiate in marketing, services or some other element of value. Here are one commentator’s nine suggestions to save solar from the DRAM fate.

Hydro

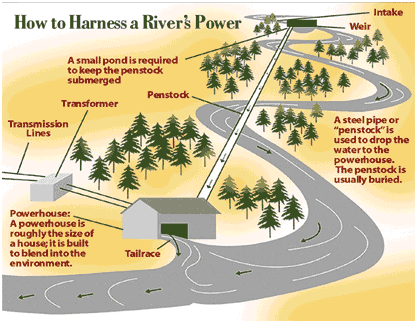

The original green technology is having a rebirth: hydroelectric. The greens have been on a mission to tear down the big dams and free the wild rivers, and now an environmentally-friendly solution is being scaled up: run-of-the-river hydro. Instead of damming the river, run-of-the-river creates a “penstock” water run downhill into a small hydro generator, and then back into the river. No fish are interfered with, and white-water rafting continues apace.

This projects are smaller scale and need proper siting, and unlike dams they do not store water; but unlike wind they can run continuously and provide a cheap base power load. While smaller than big dams, the premier US run-of-the-river project generates 2,6230 MW, which can support 2.4M homes.

Natural Gas

Nat gas seems to be the transitional fuel from oil to renewables like geothermal. We have had recent large discoveries, and gas has become cheaper than oil. In the longer run, nat gas may become the foundation of the so-called hydrogen economy, where it can be used to fill up hydrogen fuel cells (the CH4 in gas is converted to H). This is several years away from commercial development.

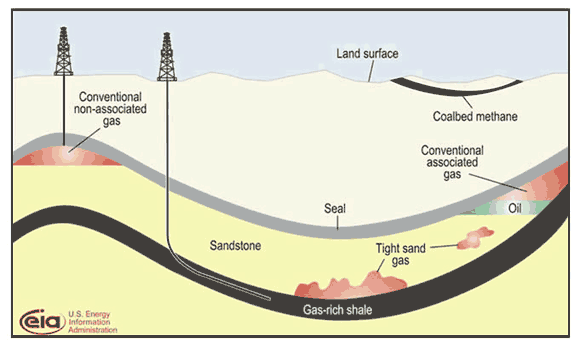

The breakthrough which has led to cheaper gas is fracking, a technique combining horizontal drilling and pressurized water to break up shale. Here is a simplified depiction:

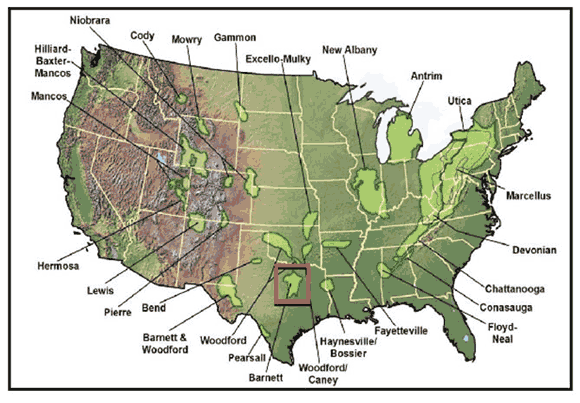

Fracking has led to some huge natural gas finds in the US, enough to potentially power the US for the next century. Besides the obvious places in TX, AK and LA, the Bakken formation in the Dakotas (also called Gammon) has huge potential, and the Marcellus formation under WV and PA is a super-giant, and appears to have the second largest reserves globally. You can read more in this downloadable PDF.

There are many ways to play gas. Some ideas include ETFs like FCG or DIG. (Please note that I am not endorsing these, just passing them on.)

There is a lot of backroom political wrangling over nat gas. Some fracking gas companies have been caught dumping the waste water rather than cleaning it up. The externalities of mining/drilling need to be baked into the cost, and the sites cleaned up, not dumped on the innocent downstream. This sort of cheating has caused a reaction, to regulate fracking or even stop the drilling.

Nat gas has a number of wonderful properties, including easy distribution and relatively clean burning (especially when compared with coal or oil). It solves a huge problem in rotating the fleet from gasoline to electric vehicles:

- it can power large trucks in a much cleaner fashion than diesel, and trucks have the wrong weight ratio to be electrified

- It can (potentially) power electric cars by being converted to hydrogen and filling a fuel cell, extending the range and removing the need for a gasoline engine range extender

It would be a supreme irony if we finally found the transitional fuel to move off imported oil just as political winds shifted against it, continuing our dependence as we chase unproven renewable methods of energy production.

Before you go into this area, be sure to keep an eye on influence peddlers in Washington. Or hire your own!

Nuclear

Quick comment on nukes: there are a bunch of future models being designed. The most interesting uses Thorium as a fuel. A long-term play is to look into Thorium. Thorium makes a better fuel than uranium: much safer. more abundant, less waste, and no proliferation potential. India and China in particular are all over it. The US considered and rejected Thorium reactors in the ’60s precisely because it had so little waste; they wanted to use the uranium waste (plutonium) for bombs.

Another play is to invest in compact nukes – small self-contained reactors that can power a large factory or a city. We have run nuclear-powered subs and carriers for 50 years, safely; so why not use those design ideas commercially? Small modular reactors (SMRs) are being built. Th Energy Secretary, Stephen Chu, recently sang the praises of SMRs. One way to play, suggessted by the prior link, is to check out McDermott Intl (NYSE: MDR).

It turns out there are also five fission and three fusion start-ups, including for fission Hyperion, NuScale and TerraPower, plus for fusion General Fusion, Tri Alpha and Helion. Also, some of the large nuke builders like GE, Toshiba, Hitachi and Areva are looking at this. The reactors are small, some small enough to fit on a kitchen table. They are self-contained and can be thought of as nuclear batteries. They can be built in a factory, shipped to a site, and plunked in the ground. When they run low, they get pulled and replaced, and processed back at the factory.

Sounds pretty compelling. What’s the catch? Bob Metcalfe, the inventor of Ethernet and a prominent venture capitalist, touted this idea in the WSJ, but said he wasn’t investing himself. As he puts it:

As venture capitalists, we at Polaris might have invested in one or two of these fission-energy start-ups. Alas, we had to pass. The problem with their business plans weren’t their designs, but the high costs and astronomical risks of designing nuclear reactors for certification in Washington.

The start-ups estimate that it will cost each of them roughly $100 million and five years to get their small reactor designs certified by the Nuclear Regulatory Commission. About $50 million of each $100 million would go to the commission itself.

The problem with nukes is political, and reflects a common pattern when a new technology comes in: we first treat the new as different, and only later learn it really wasn’t that different. Yet the damage is done and hard to unwind.

My favorite example of this is the Fairness Doctrine in broadcasting. Under the First Amendment, no one would think of restricting the number of newspapers or limiting their editorial control. Yet when radio and later TV came in, this is precisely what happened. The rationale was that spectrum was limited, and so would be the voices; but ask yourself, are there more newspapers in your town, or radio & TV outlets?

We lucked out in the US with the Internet, and I give Al Gore credit not for inventing it but for keeping the government’s hooks away from it.

We got very unlucky in the US over nukes. First, the Atomic Energy Commission was heavy-handed and excessively subsidized the industry, so a reaction was predictable. Second, a silly Hollywood movie, The China Syndrome, came out almost simultaneously with an incident at Three Mile Island. Fear trumpeted logic. No nukes in the US since then. Nukes are not really that much more difficult to manage than other toxic chemical plants, yet are seen as much riskier, and are buried in regulations, approval and litigation.

The good news is even with the noose around their neck, nukes appear to be able to compete economically as base energy sources. SciAm has a good online site to learn more about nukes.

Also, one of these mini-nuke deals, TerraPower, is backed by Bill Gates and seems the closest to commercial production. You can watch a talk on it or download the presentation.

While pushing for nukes may be good energy policy, it seems a tricky area for investors, too subject to the whims and fancies of craven politicians and emotive pressure from relatively uneducated voters. Maybe Metcalfe’s “nuclear batteries” will be approved and then worth investing in. I would wait for that.

If you feel compelled to find a play, those new nukes that are added to existing facilities, as extra reactors, are much more likely to be approved and operational in an investment time frame than new sitings.

Electric Vehicles

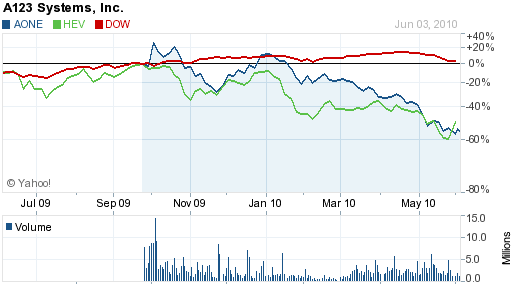

A lot of action here, although little yet public. The nano-scale Lithium battery maker A123 went public this Fall, and is worth watching. Tesla Motors should go out in 2010 (disclosure: I have an indirect interest in Tesla). It should get a good reception, given it is the first one out. Fisker with its Karma plug-in should follow.

This may be a market where it is better to catch the early IPOs than wait. A lot of electrics will be coming out in the period from 2010-2012, including the Chevy Volt. The current hybrids are expected to give way to plug-in electrics of various designs. The primary battle is between all electrics like the Tesla and electrics with range-extenders (motors or fuel cells) like the Volt or the Karma. Toyota has a huge lead with the Prius, and recently announced a plug-in lithium-ion car with a motor range extender. Consequently the competition should get pretty fierce.

An interesting longer-term play is to invest in Lithium. All the future batteries are using lithium-ion technology. It is also stressed by laptop/netbook and mobile-phone demand. The coming tablet computers will further increase demand for lithium. The focus of lithium investing right now is Bolivia, the Saudi Arab of Li. As the electric car industry picks up scale, a number of other materials will also be affected, such as aluminum for lighter cars; a good list is here.

An interesting longer-term play is to invest in Lithium. All the future batteries are using lithium-ion technology. It is also stressed by laptop/netbook and mobile-phone demand. The coming tablet computers will further increase demand for lithium. The focus of lithium investing right now is Bolivia, the Saudi Arab of Li. As the electric car industry picks up scale, a number of other materials will also be affected, such as aluminum for lighter cars; a good list is here.

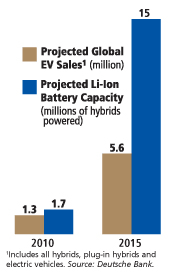

Besides investing directly in lithium, one could invest in lithium battery companies such as A123. A contrarian perspective on lithium calculates that the lithium future has been fully baked into the valuation of A123 (AONE) and competitors, and that traditional lead-acid batteries are undervalued. Also, recent reports suggest a car battery glut is coming as early as 2012, but likely by 2014-17. Perhaps, but never under-estimate the value of a good old fashioned bubble, in this case an electric car bubble, which has not yet warmed up. Forbes predicts over-investment in batteries due to government subsidy and the expectations of an artifically-created market. The gap in their chart is largely due to the mix of electric cars: will they be all-electric like the Tesla, or largely only partially-electric like the Karma or Volt? Right now, who knows?

Again, my suggestion is play the early IPOs in this space, if you can, but be ready to flip out of them quickly. Consider the trajectory of A123: steadily down since IPO (see chart). The problem is that the premium for electrics is well more than the extra cost of gas: a new Nissan Leaf at $25K is $15K more than the comparable Versa at $10K. That pays for a lot of gas, specifically 5k gallons at $3/per, or 150K Versa miles.

As a personal note, four of the five cars in my family (including kids who have flown the coop) are hybrids. I think they drive better – a smoother and quieter ride. While the GW alarmism will abate, and carbon-trading flop, the transition to electric vehicles will continue. Yet it may be more prudent to invest in companies making current cars more efficient (such as Woodward Governer, Timken or Magna Intl) and wait for the electric future to manifest.

Efficiency

Another whole category is energy management, ranging from the Smart Grid for utilities, to energy metering for businesses and homes, and down to systems to lower energy usage in devices. Again, few companies yet public, but a plethora being invested in via venture capital and the Dept of Energy. This is a space to watch.

Other pundits are weighing in on the implications of Copenhagen for investors. Greentech Media agrees that the focus should shift away from grandiose climate legislation towards subsidies for ‘green jobs’ and especially to energy efficiency. The investment plays here may stretch outside of VC into PE and public companies:

Many VCs will look for IT-based ways to try to play the wave: Home energy monitoring, LED-based lighting, etc. are already popular sectors and will become more so. But I think VCs will be left out of most of the emerging wave of energy efficiency adoption, because it will be mostly service-based, and tapping into the biggest pools of incentives will require working with utilities and governments. Non-VC investors may be the most critical source of capital for energy efficiency. And I also expect a fair amount of mid-market private equity activity in the sector as well.

A word of caution on investing in areas with “green jobs”. Much of the green jobs push will be for core manufacturing, often combined with temporary construction jobs (building solar plants, putting solar cells on buildings, etc.) Examples that would drive green jobs are PV cells and batteries for electric cares. Yet, we already have a glut in PV cells and a possible glut in Lithium-Ion batteries that may disappoint investments in core manufacturing. The rush to produce capacity, which until last year was funded with cheap capital, has gotten way ahead of demand for the end-use products built on top, such as electric cars or utility-scale solar.

One final note of caution that applies even to energy efficiency deals: avoid investing in areas with heavy government subsidy, whether from the Stimulus bill or from Dept of Energy programs. In particular, Smart Grid ventures may be over-invested in. If you feel compelled to play the Smart Grid, two big payers are Cisco Systems (CSCO) and Honeywell (HON). A recent and fairly comprehensive overview of the area found some niches of promise and others seeming too early. Smart meters has gotten a lot of focus, and now some backlash. Home management networks has also gotten a lot of interest, but little consumer pick-up.

In areas without heavy government subsidy, energy efficiency deals will be more attractive since the ROI from saving cost is the gift that keeps on giving.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Can you address whether Lord Christopher Monckton lied to Congress while under oath recently?

A Minnesota professor, John Abraham, has allegedly refuted each of Lord Christopher Monckton’s skepticisms.

The professor’s presentation is available on PCs:

http://www.stthomas.edu/engineering/jpabraham/