Yesterday proved to be eventful, to say the least, as the Bank of England formally adopted QE, announcing that they could purchase up to £100 billion Gilts and £50 billion private-sector bonds as a new way of prosecuting monetary policy. It’s hard to believe that it was only three months ago that the Bank “saw the light” about the state of the UK economy and the global financial system? You can’t say that they haven’t made up for lost time!

Amusingly, readers of the FT can find commentary that the Bank has either done too much (Martin Wolf) or not enough (Willem Buiter.) When everyone disagrees with you, that’s usually a sign that you’ve done the right thing. Certainly the Gilt market likes it; 10 year yields have plummeted 50 bps since the announcement.

In Europe, meanwhile, the ECB also seems to have had a Damascene moment. How else to explain the revision to the staff forecasts, which now expect EMU GDP to fall 2.7% this year and for CPI to go negative by mid-year. Not that that is “deflation”, however….more of an “extreme disinflation”, peut-etre? Either way, rates look like going to 1% or below by June.

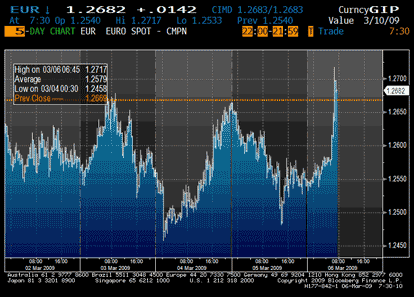

Today, of course, sees the release of employment data in the US. Yesterday’s throw-away line about seven-digit office pool entries seems to have morphed into the hot rumour du jour, as Asia was rife with stories that the NFP would ring up the dreaded “million.”

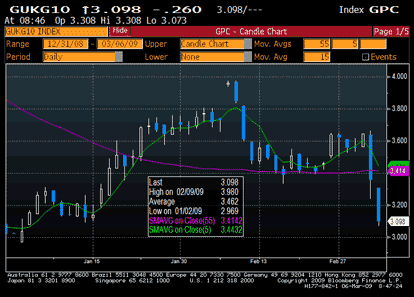

Frankly, Macro Man has no idea if it will or not (though he suspects not.) As always, the difficulty with the payroll number is discerning the signal (the shift in trend) from the noise (the 100k plus standard error around that trend.) That’s why he prefers to focus on the unemployment rate; it might lag a bit, but the serial correlation is high and the magnitude of monthly changes provides information about trend strength.

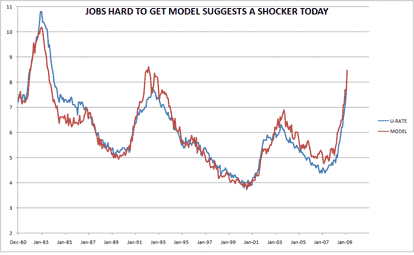

Regardless of what the payroll report shows, today’s U-rate should be a shocker; Macro Man’s model based on the jobs hard to get component of the consumer survey suggests a 0.8% rise in the unemployment rate. Ouch!

“Ouch” is also a pretty apt descriptor of the foreign exchange market these days. recently volatility in EUR/USD has been fairly extreme, with virtually no signal to show for it. Yesterday the interbank electronic broking system went offline for most of the afternoon; given that virtually all spot guys who used to trade by voice alone have either retired or (ugh!) become salesmen, the market had little idea of how to trade. Carnage ensued. And then this morning, Macro Man was awakened by the dulcet tones of a text message telling him that Voldemort was up to his old tricks again. And Mrs. Macro wonders where the gray hair comes from….

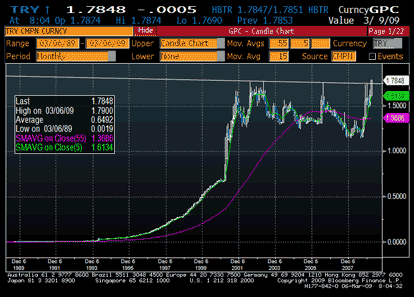

One market where there definitely does appear to be a singal is Turkey, where the lira is getting roasted (sorry!) against all comers. A tax amnesty has expired, thereby eliminating a key source of TRY demand, while Turkish banks are facing a reasonably significant amount of debt roll-overs over the next month or so. Both USD/TRY and EUR/TRY have made new all-time highs over the past 24 hours, so technically it might be time to cue up a little Sinatra and play “Fly Me to the Moon.”

Actually, finding out what spring is like on Jupiter and Mars doesn’t sound like such a bad idea. I wonder how their banks are doing?

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply