“We are not Greece”. Many government officials from different countries have been claiming that their fiscal problems are not as bad as those of Greece: Portugal, Spain, Ireland or the U.S.

Given the importance of credibility and “labels” in financial markets, many government are trying to distance themselves form the “Greek” label to ensure that their interest rate spreads remain under control.

It is hard to deny that the situation of the Greek government is one of the most difficult ones among advanced economies, but how bad is it compared to other countries? The most recent IMF analysis of fiscal policy provides a nice summary of the difficulties ahead.

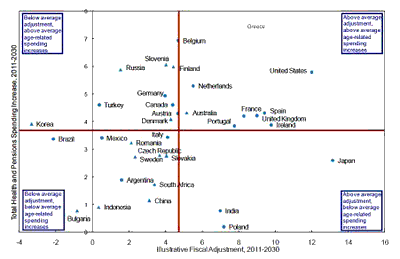

One way to summarize the many tables that the report contains is to look at Figure 14 (below). This figure looks at two dimensions of the necessary adjustment in economies around the world:

1. The effort in terms of adjustment to the government primary balance to maintain government debt levels at 60% of GDP in 2030. (see the full report for details, there are some technical assumptions that matter). This is measured in the horizontal axis.

2. The expected increase in Age-Related Spending during the 2011-2030 period. This is an important number because it informs us about the need to increase taxes (or reduce other components of spending) in order to achieve the necessary adjustment as calculated above in point #1. This is measured in the vertical axis.

The best place to be is on the bottom/left quadrant where the adjustment is small and the projected increased in spending is small. The worst place to be is the top/right quadrant where there is a need for a large adjustment and where age-related spending is likely to increase fast.

One clarification about this picture: Greece is not included in the IMF chart. The reason is that you need to use a starting point as a reference to calculate the necessary adjustment. Given the current turmoil and the constant change in budgetary plans, it is difficult to establish such a reference point in Greece. I have added Greece in the picture by using the information on the note that comes with the chart which states that Greece needs to adjust the budget balance by 9.2% after measures of 7.6% undertaken in 2010.

Greece is the country that requires the largest adjustment in the (primary) budget balance, even after the proposed adjustment for this year. Greece also expects a significant increase in age-related spending over the next two decades. although others are in a worse situation.

There is no country that looks exactly like Greece but there are a few that face a significant fiscal policy challenge.

The United States combines the need for a very large short-term adjustment with an increase in age-related spending that is only second to Japan. Spain and Ireland are also in need of large adjustment although they face significantly lower pressure when it comes to age-related spending.

There are many ways to look at fiscal policy statistics and future scenarios and there are some key assumptions that can dramatically change the position of each economy in this chart (assumptions on growth, interest rates,..). But looking at numbers rather than “labels” is always a good starting point.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply