China is thirsty for oil and has a fat wallet.

Just last month, China signed a $20 billion deal with Venezuela to finance more exploration and production in the country’s Orinoco Belt. It’s a win-win deal – Venezuela badly needs the capital to restore its depleting fields and China badly needs the resource.

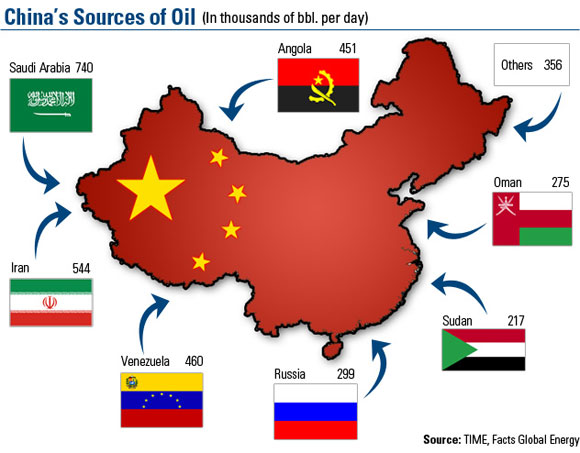

Counting this one, since 2005 China has made 27 international deals worth more than $60 billion involving 19 countries and every continent but Antarctica. The graphic below shows who China is dealing with and how much oil it is getting for its money.

China’s demand for oil already exceeds its domestic production, and the country’s rapid growth will only widen that gap. Over the past 20 years, China’s oil consumption has jumped more than 5 million barrels a day while production has only increased by a little more than 1 million.

This strong demand will likely withstand any economic slowdown. More than 1.2 million passenger cars were sold in China in March, up 63 percent from the previous year. The country is currently on pace to sell 14 million autos in 2010, which would be tops in the world for a second straight year.

The brisk pace of vehicle growth in China should ensure that the pace of oil deals also remains brisk.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply