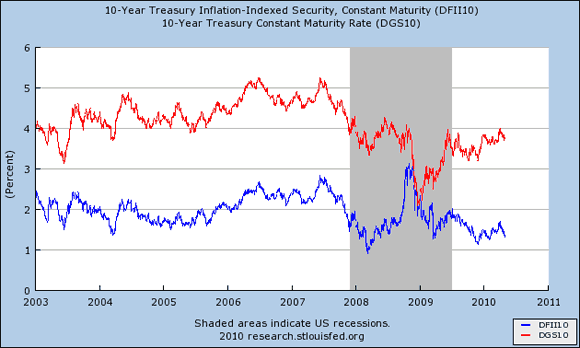

Karl Smith is thinking about inflation forecasts and directs us to the figure below. Here the daily nominal interest rate on 10 year treasury securities is graphed along with the daily real interest rate on 10-year Treasury inflation-protected securities (TIPS) :

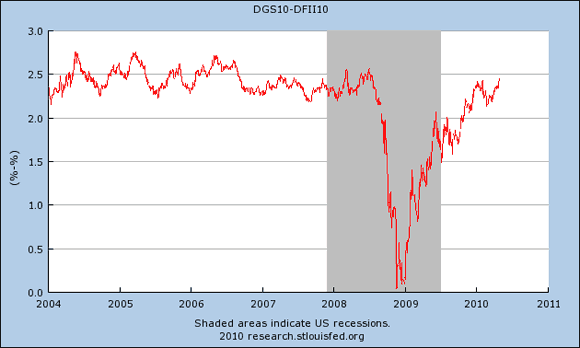

Karl notes the difference between the two series is the bond market’s 10-year forecast of inflation and currently it is about 2.5%. Interestingly, outside the financial crisis the forecast value is on average close to this 2.5% value. This can be seen more easily by plotting the difference between the two series as is done in this figure:

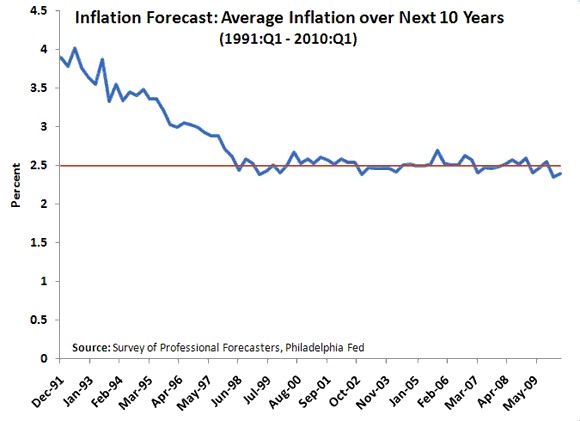

This caught my attention because if one goes and looks at the quarterly forecast for the average annual CPI inflation rate over the next 10 years in the Philadelphia Fed’s Survey of Professional Forecasters the value is also around 2.5%. Here is the forecast data:

The similarity of inflation forecasts from the bond market and the survey is remarkable.* Even more remarkable is that this long-run value of 2.5% has persisted since the late 1990s and has not been seriously affected by the crisis. It suggests that this value is the Fed’s long-run inflation target. As I have said before, the stability of this value attests to the Fed’s inflation-fighting credibility. Bond markets, apparently, see no unanchoring of inflation in the future. Of course, this stability of the long-run inflation target also lends support to the view that the Fed was been too tight with monetary policy over the last year and half or so. And on the flip side such a rigid long-run inflation target may also present problems when there are sustained productivity gains.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply