Macro Man is back in the saddle this morning and somewhat bemused to see that the world has gone China-recovery mad. Both the comment section of yesterday’s post and his email inbox this morning are crammed full of observations about the bottoming of Chinese equities and the manufacturing PMI.

While it factually true that both have bounced, Macro Man is withholding judgement. After all, the Shanghai composite is closer to its recent lows than the US homebuilders index, and he doesn’t see anyone falling overthemselves to call a recovery in that industry. More importantly, we should all remember that things don’t move in a straight line forever, and China has cranked up a large inrastructure stimulus. Indeed, there will be a period of improved growth in the US this year…just as there was last year.

Looking elsewhere, Macro Man sees little else but doom and gloom. Indeed, if he were the religious type, he might be worried about the impending approach of the Apocalypse.

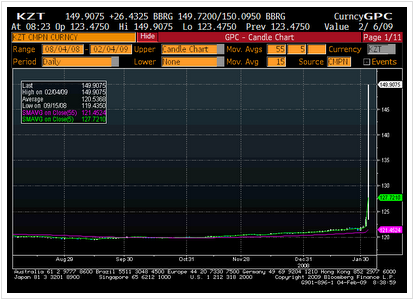

Yet another emerging market currency has been splattered today, as the Kazakh tenge has finally been devalued by 20% after months of pressure. The KZT was in vogue a couple of years ago as a sexy long….but another one of Macro Man’s rules of thumb is never to trade a currency named after a movie character (the KZT is known as the ‘Borat’.) The pressure on the KZT has been mirrored in “real” markets, where the CEE currencies such as HUF and PLN have been obliterated in the past few days, with market liquidity collapsing. So the Great Unwind has further to go.

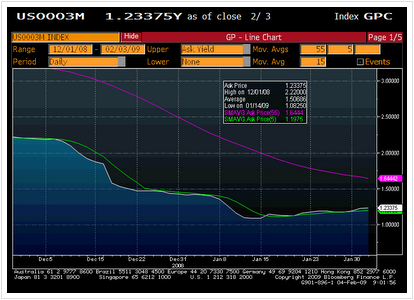

Indeed, somewhat ominously, LIBOR rates have started to tick up, with three month dollar cash fixing some 14 bps higher over the past couple of weeks. Perhaps this is an inoccuous development…but treating previous upticks as such has been a very dangerous (and costly) proposition.

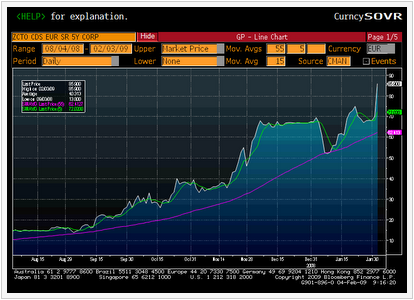

At the same time, US sovereign 5 year CDS surged 15 bps yesterday to 86 bps. To put that in perspective…..it’s where Citigroup CDS was trading exactly one year ago. Remarkably, Macro Man could only find two other countries with double-digit CDS ratings: Japan (58), Germany (59), and France (69). Was it really only a decade or so ago that Japan’s loss of a AAA rating amidst massive borrowing made waves? Now markets are essentially saying that the Japanese government (facing a massive demographic challenge) is the best creditor in the world.

Rumours that the devil is shopping for a mink winter parka are as yet uncofirmed.

More troubling is the prospect of a populist political backlash to the crsis. Populism is generally the enemy of sensible policymaking; in that vein, developments in Switzerland are troubling. We’ve had suggestions from the SNB that they might contemplate FX intervention as a tool in their policy arsenal; as currencies are a zero-sum game, that merely shifts pressure from the Swiss economy to someone else. But this weekend, the Swiss are voting on a proposed “economic freedom of movement” treaty with the EU. A certain cohort in Switzerland opposes allowing workers from some new “undesirable” EU countries into Der Schwiez. The imagery used in their campaign is truly scary, as to Macro Man’s eye it is not dissimilar to that used in early 30’s Germany.

Finally, there is a literally Biblical sign of the Apocalypse in Australia, as Queensland has been beset by floods of such magnitude that crocodiles are swimming in the streets. In typically Aussie fashion, however, afflicted citizens have homed in on the really apocalyptic aspect of the flooding: they’re running out of beer.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply