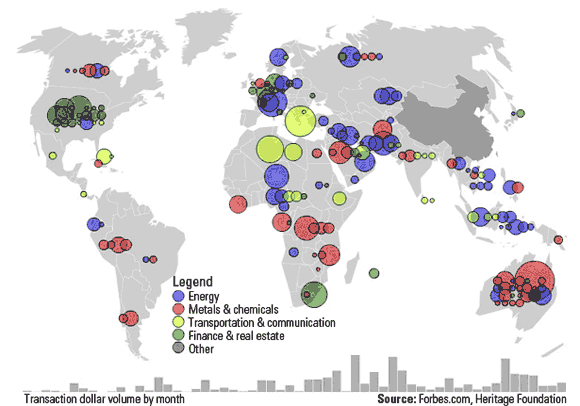

While the rest of the world suffered through its worst financial crisis in a half century, China went shopping. Since 2005, China has made 185 deals worth $100 million or more, totaling more than $222 billion.

The largest of these deals was the $12.8 billion joint venture between Chalco and Alcoa made to purchase 12 percent of Rio Tinto back in 2008. This deal was struck in Australia which has been China’s most popular destination both in terms of quantity and dollar amount.

Indicative of the large future the Chinese government has in store for its country, the most popular sectors for these deals have been metals and energy, respectively.

Forbes just published an interesting interactive map based on data from the Heritage Foundation detailing these transactions.

As you view the presentation, pay special attention to how the pace picks up. By the second half of 2009, China is averaging more than seven $100 million deals a month.

You can check out the full interactive version at Forbes.com

By clicking the image or link, you will be directed to Forbes.com. U.S. Global Investors does not endorse all the information supplied by this website and is not responsible for its content. None of U.S. Global Investors family of funds held any of the securities mentioned in this article as of 3/31/10.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply