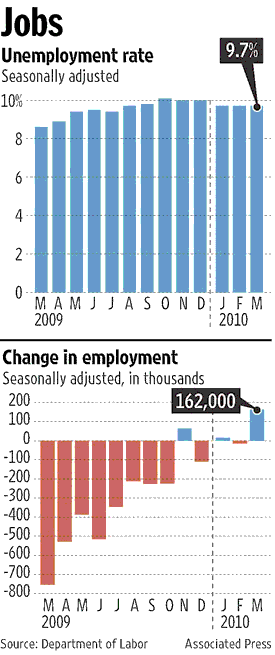

The unemployment numbers continue to suggest a peak in unemployment last Oct/Nov (see chart, from a veritable unemployment chartfest at The Big Picture). This points to the Fed raising rates in Q4. (History says the Fed tends to raise a year after unemployment peaks, or three years after a recession starts, which both put it in Q4.

The unemployment numbers continue to suggest a peak in unemployment last Oct/Nov (see chart, from a veritable unemployment chartfest at The Big Picture). This points to the Fed raising rates in Q4. (History says the Fed tends to raise a year after unemployment peaks, or three years after a recession starts, which both put it in Q4.

This timing for a rate increase should be bullish for stocks, in a Goldilock’s sense: it seems good enough to support he 2010 earnings expectations but not so strong as to pull forward a Fed rate increase. While markets were closed Friday, futures markets had a short opening, and stock futures went up a bit. The financial press pointed towards this and the unemployment report as signaling a recovery ahead. I will comment later this week on that, but for now I wouldn’t make too much of this report, since stocks seem to be fully-valued against expected 2010 earnings, and the small futures pop was largely technical (specifically, the S&P seems to have completed a triangle, which is typically followed by a sharp thrust, which we might see continue Monday morning).

The Fed called for an emergency meeting Monday morning, which likely means they will raise the Discount Rate a second time. They raised it on Feb 18, and the USD strengthened. Monday is a bank holiday in Europe. so reaction may be muted until they Euro banks wake up Tuesday am. (Also, the recent pattern of a Monday Pump up may be delayed to Tuesday, due to this holiday.)

I have seen it mentioned in the blogosphere that the Fed typically waits until the Discount Rate is 1% higher than the Fed Funds rate, or at 1.25%, before raising the Fed Funds rate. I expect a rise to 1% tomorrow, meaning more time until we hit 1.25%. Question is whether the rapidity of the recent rise of the Discount Rate suggests an earlier end than Q4 to holding the Fed Funds rate low? At six weeks betwixt & between raises, the next window is end of May for 1.25%, followed by mid-July for over 1.25% – both well before Q4.

Or is something else going on? After ObamaCare passed, the Fed had a hard time with auctioning off Treasuries, and has more to offload this week. Perhaps this emergency meeting will reconsider ending QE so the Fed can prop up the auctions.

Also, last week the Fed revealed that its Maiden Lane program (where it bought mortgage backed securities – the toxic waste of the housing bubble) has left it holding $2.4T of assets of questionable value. The Maiden Lane III portfolio is only worth 39c on the Dollar. This means the Fed has assumed an impaired balance sheet, and needs to fix it. One way to do this is to sell off or swap out the toxic debt, and buy Treasuries to slowly return to its historical quality of reserve assets. Thus rather than explicitly continue QE, it may begin a swap program.

Whichever, the Fed is in a bit of a pickle: it needs to successfully fund the huge deficits, and at the same time exit from extraordinary measures. More after the Fed’s meeting.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply