The signing of the health care bill yesterday puts me in mind of the saying on a ubiquitous poster from my youth: “Today is the first day of the rest of your life.” Part of what that life looks like in terms of the political process is already quite clear:

“House Democrats are pivoting to a jobs agenda hours after sending President Barack Obama landmark healthcare legislation.

“Democrats are planning votes as soon as Tuesday on an $18 billion bill that funds infrastructure projects and provides small-business tax breaks, as well as a disaster-relief measure that includes $600 million for a summer youth jobs program. …

“The $18 billion jobs bill includes $2 billion to exempt small businesses from the capital gains tax through 2011, a move Obama had called for in the [State of the Union] address.”

Anxiety about the state of small businesses has become a common theme. This report, from the Wall Street Journal, is typical:

“The U.S. Treasury Department is concerned the steady pace of bank failures could keep many small businesses from gaining access to new credit as the economy rebounds and companies seek to expand. …

” ‘We’ve been concerned that small businesses, which are particularly dependent on bank financing because they typically don’t access corporate bond markets, will face and have been facing difficulty getting credit,’ Treasury’s chief economist said.”

I, myself, have expressed similar concerns. It bears noting, however, that the story about jobs and small business is still somewhat murky. It is true, as we have noted, that at least the first year of the recession was characterized by disproportionate net job losses in the small business sector relative to the 2001 recession. In light of this, we have previously looked into the credit access issue among small businesses in the six states represented by the Atlanta Fed—Alabama, Florida, Georgia, Louisiana, Mississippi, and Tennessee—and to our surprise found little evidence of yet that financing problems represent a major constraining factor among most of these enterprises. In reporting the results of that research, we noted one problem with the information we collected:

“… the survey respondents represent established, relatively successful firms. We could not, with this effort, capture the experience of firms that have recently failed (perhaps for lack of credit). Nor can we ascertain the businesses that were never formed because they could not obtain start-up funding.”

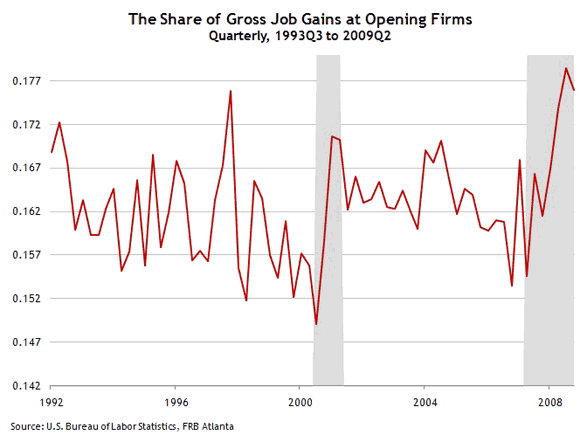

Those issues remain a problem, but an interesting bit of information about business start-ups has been lurking in the details of the U.S. Bureau of Labor Statistics’ Business Employment Dynamics data on gross job flows. If you look at the share of jobs created by opening businesses—as opposed to jobs created from expansions of existing businesses—that share has actually risen through the middle of 2009 (these data come with an excruciatingly long lag).

These opening businesses are weighted heavily toward smaller firms, with somewhere around three-fourths of these businesses being represented by firms with fewer than 10 employees.

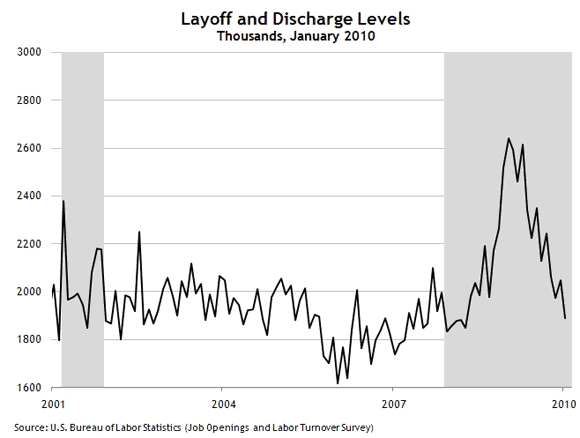

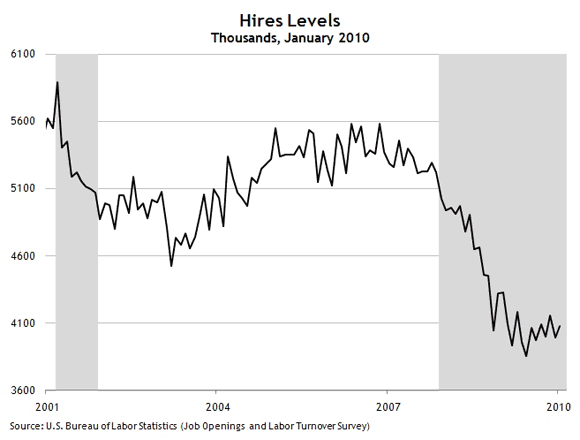

Of course, job creation has fallen a lot for both big and small businesses. As the Bureau of Labor Statistics’ data from the Job Openings, Layoffs, and Turnover Survey (JOLTS) indicates, the story going forward is not going to be about layoffs and discharges—which have been falling steadily since last spring—but instead job creation, which has bottomed out (though remaining well below prerecession levels):

Perhaps, then, there is some hopeful news in the fact that, up to now, small businesses have not been disproportionately poor sources of gross job creation.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply