Treasuries are the safest bonds in the world and not even the safest corporate bond can make that claim.

Treasuries are the safest bonds in the world and not even the safest corporate bond can make that claim.

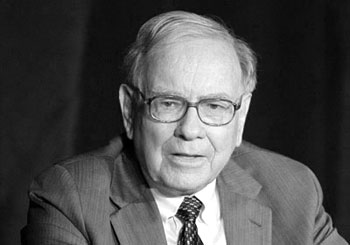

Well..while that assumption may be true, based on perception that risk of default on these fixed-income securities is almost nil, the market seems to be telling the experts that the U.S. is a riskier investment than Warren Buffett’s Berkshire Hathaway (BRK-A) (BRK-B).

According to data compiled by Bloomberg, two-year notes sold by billionaire’s Berkshire Hathaway in February yielded 3.5 basis points less than United States Treasuries. Procter & Gamble Co. (PG), Lowe’s Cos. (LOW) and Johnson & Johnson (JNJ) also traded at lower yields recently, which have been called an “exceedingly rare” event in the history of the bond market.

With the U.S. moving ‘substantially’ closer to losing its AAA credit ratings as the cost of servicing the debt continues to rise, Moody’s (MCO) warned last week that the country has a ‘debt reversibility’ problem, which implies that the government’s ability to reverse the debt trend is becoming increasingly more difficult.

Bloomberg: “It’s a slap upside the head of the government,” said Mitchell Stapley, the chief fixed-income officer in Grand Rapids, Michigan, at Fifth Third Asset Management, which oversees $22 billion. “It could be the moment where hopefully you realize that risk is beginning to creep into your credit profile and the costs associated with that can be pretty scary.”

The U.S. currently faces a $12.6 trillion national debt and $1.6 trillion national deficit.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply