The sugar high from the very positive ISM manufacturing report on Monday is fading fast. Blame it on the unemployment numbers.

The DOL report showed initial claims increasing by 8,000 to 480,000 and the four week moving average was back up to 468,750 an increase of 11,750. By the way, the four week average has increased in each of the last three weeks. Uh-oh.

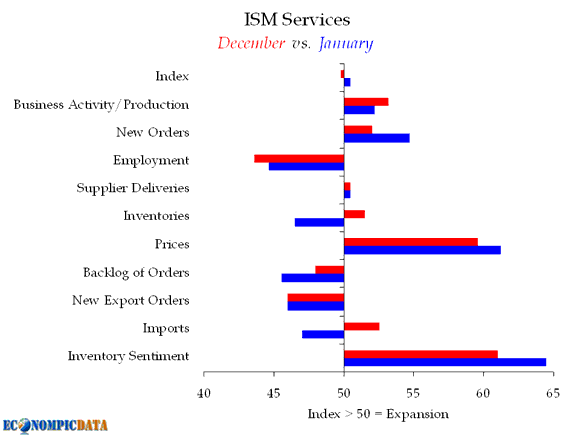

If you’re looking for some why’s here, look no further than the ISM report on the service sector which came out Wednesday. Sure, it showed a slight bump up overall — from 49.8% to 50.5% — but if you look at the components, one jumps out at you. You can see it here from Jake’s post at EconomPicData.com:

The employment component increased a percentage point to 44.6%. Remember, anything under 50 represents contraction. In other words, companies are still cutting. By the way, the service sector represents 70% or so of the economy.

I don’t know why the markets didn’t pick up on this on Wednesday, maybe they just needed the DOL report to confirm that all still isn’t well. At any rate, the message appears to be sinking in.

So, we apparently have a jobs situation that despite massive government stimulus and massive assistance from the Fed, is still in the process of going the wrong way. Much of that assistance is shortly going to end. Is it any wonder that the markets are tanking? Does this look like a recovery that is on the way to organically sustaining itself?

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply